Analysis

June 22, 2014

NAFTA May Light Vehicle Production 18 Million SAAR

Written by Peter Wright

U.S. light vehicle sales increased in May to nearly 16.8 million units at a seasonally adjusted annual rate, (SAAR) up from an average of 15.8 million units in the first five months of 2014 and the strongest rate since February 2007. Light vehicles are autos and light trucks (GVW Classes 1-3, under 14,001 lbs.).

Automotive sales increased from 7.5 million to 8.1 million units SAAR, while light-truck sales rose from 8.5 million to 8.7 million units SAAR. Crossovers are classified as light trucks which considerably swells that sectors sales and production numbers.

Comparing y/y sales growth by manufacturer, Chrysler, Toyota and Nissan were up by close to 20 percent, GM was up by 12 percent as Honda, Hyundai and Ford saw only single-digit gains. Volkswagen was down by 5 percent y/y and Volvo down by 20 percent. Imports took a 22 percent market share in May. Import market share has been declining as more foreign owned companies expand in the US.

From ARMADA Executive Intelligence brief: Analysts expected May auto sales to be good – but not this good. The only big thing that was a shocker to most of us was the F150 performance. The F150 has been one of the strongest performers in the automotive sector and a reliable driver of growth for Ford. Sales were down by 4.3 percent in May. The reason why this is so important is that many analysts believe that the F150 is almost a proxy for construction and farming trends. When the farming and construction sectors are strong and those who work in those industries feel good about their futures – sales seem to do well. So, was this a Ford issue, or an undercurrent in the economy? Something is going on. (SMU comment; maybe consumers think the aluminum switch has already happened!!!!) Analysts think that the 10,000 Baby Boomers reaching age 65 daily are helping to push light vehicle sales (getting a strong, new vehicle prior to retirement) and trends that make it easy to get credit for an auto purchase (and difficulty in getting a home loan) are helping to push sales. Lastly, new models bring new interest. And, there are lots of new models of vehicles on the market to choose from. People are upgrading their vehicles – and it’s a trend that many economists believe will continue in the near future.

Total light vehicle production in NAFTA in May was at an annual rate of 18,063,324 units, up from 16,966,644 units in April. Medium and heavy truck production was at an annual rate of 446,520 units up from 445,236 units in April.

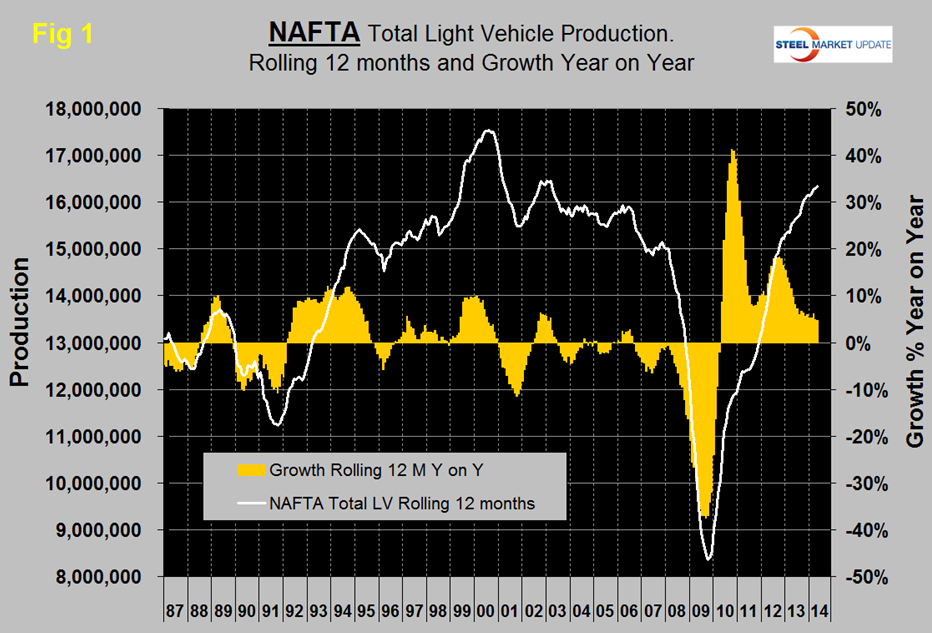

On a rolling 12 months basis y / y light vehicle production in NAFTA increased by 4.8 percent and is now well above the pre-recession peak, (Figure 1).

On this basis the US is up by 6.6 percent, Canada is down by 0.9 percent and Mexico is up by 3.2 percent, (Table 1).

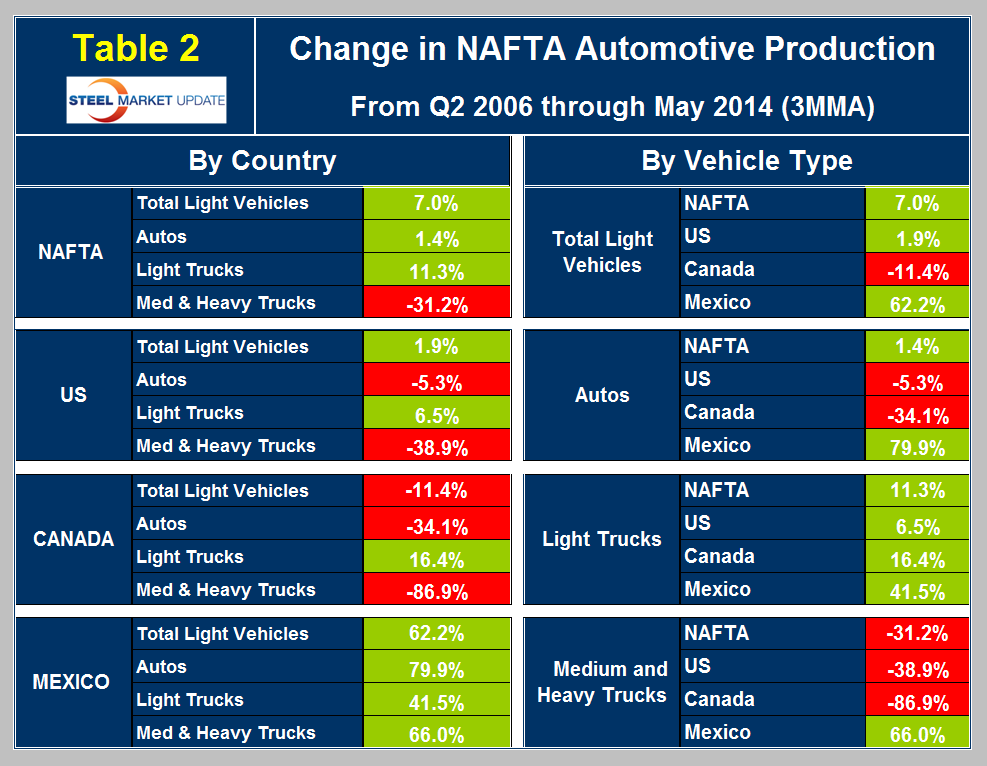

The growth of light truck production continues to outpace cars in the US and Mexico but in Canada the opposite is happening. Medium and heavy truck production in NAFTA as a whole was down by 2.7 percent y / y with a decline in all three nations. In the last three months there was a turnaround in M&HT production in the US and Canada but not in Mexico. Total light vehicle production in NAFTA on a three month moving average basis is now 7.0 percent higher than it was in the pre-recessionary peak of Q2 2006, however there is a big difference between the recoveries of the three nations, (Table 2).

The US is up by 1.9 percent, Canada is down by 11.4 percent and Mexico is up by 62.2 percent. These numbers overstate the performance of Mexico who had a very rapid surge in late 2010 but who has since slowed to a rate half that of the US on a rolling 12 month basis y / y. The same is the case with M&HT where in 3 months through May on a y / y basis the US is up by 0.4 percent and Mexico is down by 6.3 percent.

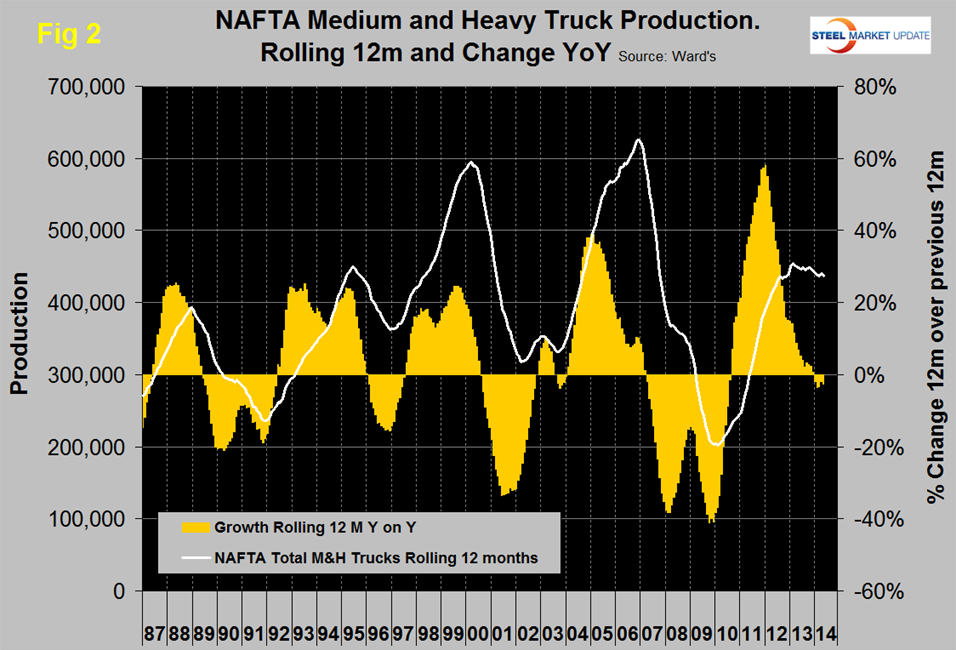

For NAFTA as a whole the 12 month rolling production of medium and heavy trucks has had a negative growth rate every month this year, (Figure 2).

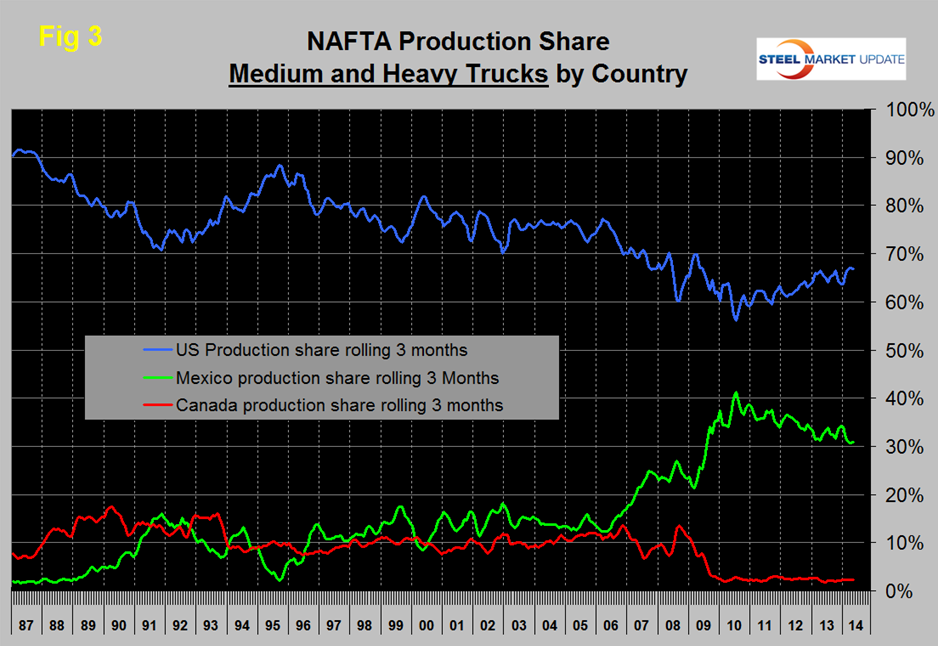

We have reported in the SMU in earlier months that the production share of light vehicles in NAFTA has been trending in favor of the US since Mid-2011. In that time frame the US has gained 4.9 percent as Mexico has lost 4.2 percent. This trend is also very strong for medium and heavy trucks for which the US has gained 10.8 percent share and Mexico has lost 10.3 percent share in the last four years, (Figure 3).

It looks as though Canada, with a production share of only 2.3 percent of medium and heavy trucks has been more or less written off by the OEMs as an assembly region.

Ward’s Automotive reported last week that light vehicle inventories declined by 9 days of supply in May to 60 days. Inventories of the Detroit 3 also declined by 9 from 81 days at the end of April to 72 days at the end of May.