Prices

June 12, 2014

Foreign Steel Import Analysis: 2006 vs. 2014

Written by John Packard

As you could probably sense from our last issue of Steel Market Update, we are concerned about the amount of foreign steel imports related to the strength of the overall economy. It is one thing to see imports surging when the economy is hot and steel usage is high like we saw in 2004, 2006 and during the beginning of 2008.

However, with residential and commercial construction well below 2006 levels, and apparent steel supply lagging where we were during those busy years of 2004 and 2006, in particular, the domestic mills have to be surprised to see foreign imports approaching or exceeding the 4 million net ton mark which is what the import license data is pointing to for the month of May.

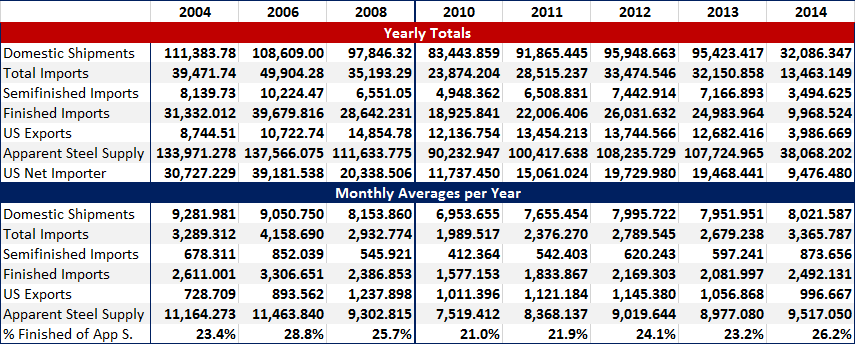

It is critical to understand that we are approaching foreign steel import levels that were reached previously only when the economy was much stronger and apparent steel supply exceeded the domestic mill’s capacity to produce enough steel to satisfy their domestic market (believed to be approximately 120 million tons). In 2004 apparent steel supply was 133.9 million tons, 2006 was 137.56 million tons and 2008, which was the year the recession hit, was 111.63 million tons and last year (2013) apparent steel supply was 107.72 million net tons.

If we get 6 percent growth during 2014 that would take us to a projected apparent steel supply of 114 million net tons, nowhere near the 2004 and 2006 levels exceeding 133 million net tons.

Getting back to the imports we are seeing now, Steel Market Update (SMU) reviewed a number of years of data to see when was the last time total steel imports exceeded 4,000,000 net tons in a single month. What we found led us to the year 2006.

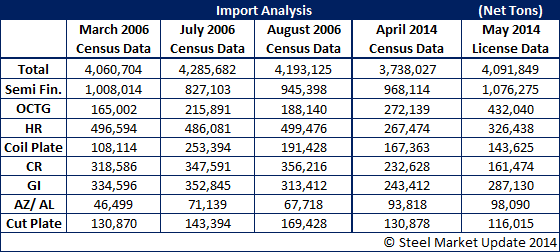

We used the months of March, July and August 2006 and compared the imports to that of April and projected May 2014 imports by product. The table below provides the details (all in net tons).

A couple of interesting observations, slab imports are at approximately the same levels as seen in 2006 only the U.S. has added a major consumer of slab, the AM/NS Calvert operation (formerly ThyssenKrupp).

Oil country tubular goods (OCTG) imports were relatively modest compared to today’s levels.

Hot rolled imports are lower and more representative of the economy. Cold rolled and coated have not yet reached the levels seen in 2006. Galvalume (AZ) and aluminized (AL), with most being Galvalume, imports are much higher than what was seen during the boom year of 2006.

We will let our readers reach their own conclusions, with apparent steel supply at 137.56 million tons during 2006 and this year it is expected to be approximately 114 million net tons, or 25.56 million tons less…

Note: Total steel imports (including slabs) were 49.9 million net tons during the calendar year 2006. Of the total 10.2 million net tons were semi-finished (mostly slabs). Import penetration was at an all time high that year at 28.8 percent. In 2013 the rate was 23.2 percent. April 2014 imports accounted for 27.9 percent of apparent steel supply (slabs are taken out of the number since they are rolled and counted as domestic shipments).

In the table below we are showing apparent steel supply for the years 2004, 2006, 2008, 2010, 2011, 2012, 2013 and the 2014 data is through the month of April (1/3 of the year). Figures are in thousands of net tons.