Market Data

June 1, 2014

May 2014 – The Month That Was…

Written by John Packard

As usual we will spend a few moments taking a look at the month of May in our rear view mirror to see what transpired.

SMU Price Momentum Indicator was adjusted during the month from Higher to Neutral as we detected a change in the supply/demand dynamics with the return to full production at US Steel Gary Works and US Steel Great Lakes. We also learned that AK Steel had apparently caught up its hot rolled and cold rolled order book (still extended on coated) which in the past has put them into the spot market. The other big issue is foreign steel imports which the US Department of Commerce (US DOC) has pegged April Preliminary Census data at 3.7 million net tons up from 3.2 million tons in January, February and March. Even more disturbing is our forecast based on US DOC license data that May steel imports could well exceed the 3.7 million net tons and could end up as high as 4.0 million net tons.

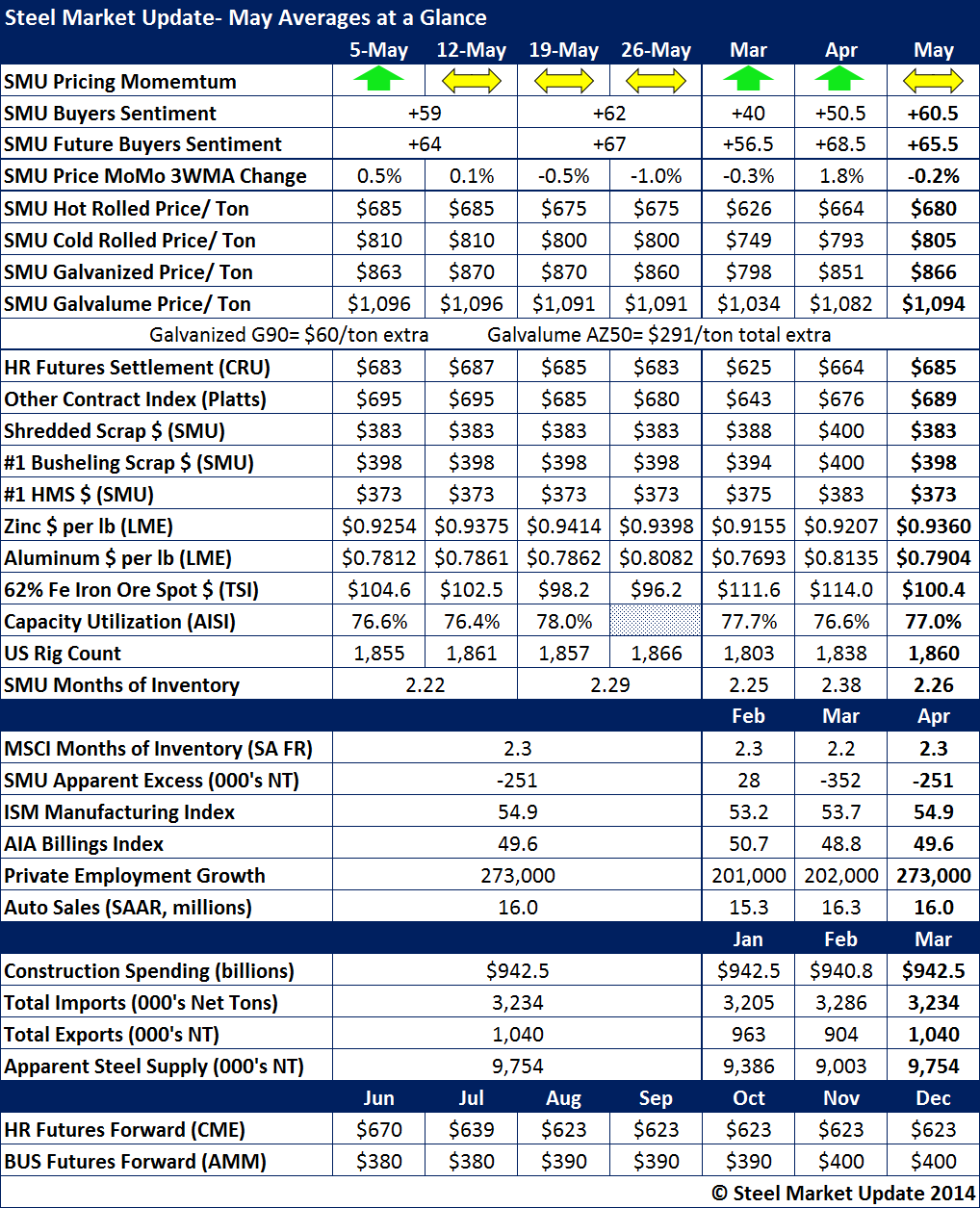

SMU Buyers Sentiment Index set two record highs during the month of May (+59 and then +62) meaning flat rolled steel buyers and sellers are quite optimistic about their company’s ability to be successful in the current economic environment.

Benchmark hot rolled prices averaged $680 per ton according to our SMU price index. The CRU average was $685 while Platts came in at $689 for the month. We will let you decide which was more accurate. The CRU number is used to settle HRC Futures contracts on the CME.

An item to watch when reviewing the economic data is the AIA Billings Index which has slipped below 50.0 for the second month in a row. A number below 50.0 indicates a shrinking construction market. Not shown in the numbers in the table below is new home sales/building permits which are at disappointing levels now seven years after the beginning of the housing recession which began in 2007.

Apparent steel supply rose dramatically in March to 9.754 million net tons. February was impacted by severe weather across the country and it came in at 9.003 million net tons.

Below is our end of the month table for the month of May 2014: