Prices

May 27, 2014

April Steel Imports Break Through 3.7 Million Ton Level

Written by John Packard

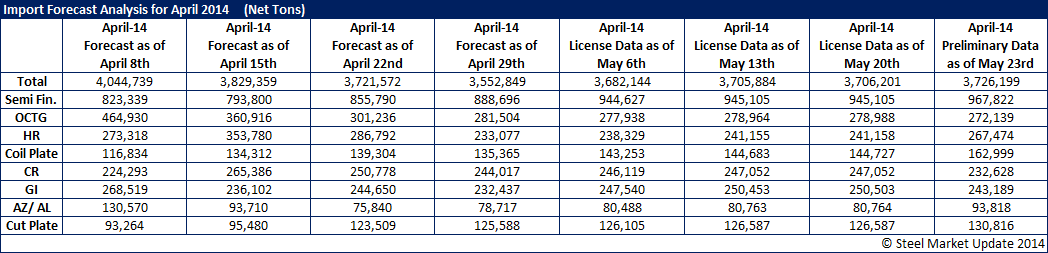

The U.S. Department of Commerce released Preliminary Census Data on steel imports into the United States for the month of April on Friday. As expected steel imports jumped by 20 percent compared to the previous month and by 36 percent year-over-year (days adjusted basis) to 3,726,199 net tons (3.4 million+ metric tons). This is for all steel products combined.

When looking at flat rolled imports rose by 8 percent month/month on a days-adjusted basis. Cold rolled imports rose by 32 percent month-over-month with China surging to 105,225 net tons three times more than any other single month over the past twelve (in March China exported 31,087 net tons to USA). The next closest exporting country was Canada at 40,725 net tons.

Semi-Finished imports (Slabs & Billets – most being slabs) also saw a jump compared to the prior month with latest data pointing to semi’s being just shy 1 million net tons at 967,822 net tons. This is above our estimates made during the month of April and into early May (see table below). This means that 25 percent of all foreign steel imported into the USA are semi-finished slabs (or billets) destined for the U.S. producing mills. When you add in hot rolled coil destined for USS/Posco and Steelscape on the west coast and CSN in Terre Haute, Indiana you could have the domestic mills responsible for 30 percent of all imported steel into the U.S.

South Korea, which still has the threat of anti-dumping of OCTG pending the final ITC determination later this summer, exported and landed 94,795 net tons of OCTG products during the month of April. The next closest countries were Canada (36,401 net tons) and Mexico (23,768 net tons).

![]() Coiled plate came in above April and early May estimates at 162,000 net tons. The largest supplier was Russia with 42,163 net tons followed by Canada at 41,851 net tons and then South Korea with 24,145 net tons.

Coiled plate came in above April and early May estimates at 162,000 net tons. The largest supplier was Russia with 42,163 net tons followed by Canada at 41,851 net tons and then South Korea with 24,145 net tons.

Galvalume imports were at 93,818 net tons. China is a growing supplier of Galvalume with 17,207 net tons coming from that country. The biggest supplier was Taiwan with 30,397 net tons followed by South Korea with 21,422 net tons.

Galvanized was 243,189 net tons with China essentially doubling their March number and at least tripling their prior 12 month average at 68,287 net tons. The largest exporting country was Canada with 79,956 net tons.

Hot rolled imports were actually down month over month but higher compared to last year. The U.S. received 267,474 net tons of hot rolled product in April. South Korea led the way with 43,386 net tons, followed by Japan (40,143 net tons) and Canada (39,194 net tons). Australia popped up with 22,280 net tons and already has 50,916 net tons of import license requests for the month of May. For the first three months 2014 Australia hasn’t exported a pound to the U.S. according to the US DOC data.

Here is a SMU table showing the weekly forecasts based on license data and the newest number based on Preliminary Census data (you can click the image to enlarge it):