Market Segment

May 16, 2014

Canadian Service Center Shipments and Inventories Down in April

Written by Brett Linton

Canadian steel service center shipments for all steel products during the month of April were 496,300 net tons, a decrease of 0.7 percent from the month before, and a decrease of 5.6 percent from April 2013. Inventories at the end of the month stood at 1,431,800 tons, a decrease of 2.7 percent from last month, and a decrease of 11.7 percent from the same month one year ago. The daily average receipt rate for April was 21,682 tons (21 day month), down from 27,404 tons the prior month (21 day month as well). Total April receipts were 120,400 tons lower than March. According to the Metal Service Center Institute, total months on hand stood at 2.9 months unadjusted or 3.1 months on a seasonally adjusted (SA) basis.

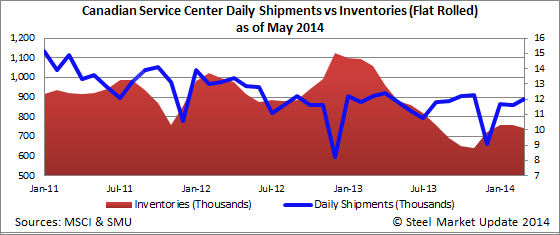

Flat Rolled

Canadian shipments of flat rolled products for the month of April were 265,000 tons, an increase of 5.0 percent from the month before, but a decrease of 2.9 percent from the same month one year ago. Inventories at the end of the month were 747,000 tons, an increase of 0.9 percent from last month, but a decrease of 22.2 percent from the same month one year ago. The daily receipt rate for April was 12,914 tons, up from 11,220 tons the month before. Total tonnage received was 271,600, up from 236,000 the month before. Flat rolled inventories stood at 2.8 months unadjusted or 3.0 months on a SA basis.

Plate

Canadian shipments for plate products in the month of April were 85,200 tons, a decrease of 15.1 percent from the month before, and a decrease of 13.7 percent from April 2013. Inventories at the end of the month were 266,600 tons, a decrease of 15.6 percent from last month, and a decrease of 4.1 percent from the same month one year ago. The daily average receipt rate for April was 1,716 tons, down significantly from 7,403 tons the month before. Plate inventories stood at 3.1 months unadjusted or 3.2 months on a SA basis.

Pipe and Tube

Canadian shipments for pipe and tube products in the month of April were 53,200 tons, an increase of 1.3 percent from the month before, but a decrease of 9.1 percent from the same month last year. Inventories at the end of the month were 140,600 tons, an increase of 3.1 percent from last month, and an increase of 8.4 percent from the same month one year ago. The daily average receipt rate for April was 2,729 tons, up from 2,696 tons the month before. Pipe and tube inventories stood at 2.6 months unadjusted or 2.8 months on a SA basis.