Prices

May 15, 2014

Surging Steel Imports Put Jobs at Risk

Written by Sandy Williams

The Economic Policy Institute (EPI) and the law firm of Stewart and Stewart recently released its publication “Surging Steel Imports Put Up to Half a Million U.S. Jobs at Risk.” The publication was released in support of the domestic steel industry and their unions and contends that unfairly traded imports are costing the U.S. jobs and revenues. Steel Market Update is providing the following review to our readers as this report is actively circulating in the media and financial communities.

According to the report 583,600 American steel-related jobs are at risk if the U.S. does not fully enforce trade laws. The report claims surging imports of unfairly traded steel have led to depressed domestic steel production and revenues, sharp declines in net income in the U.S. steel industry, layoff of workers and reduced wages.

Excess Capacity

According to the EPI report, current global excess steel capacity stands at more than half a billion metric tons (500,000 metric tons = 551,000 net tons). If the capacity were to remain flat, which is unlikely, it would take 3-5 years for global consumption to catch up. EPI says high fixed costs and the capital intensiveness of steelmaking operations makes it difficult for mills to adjust to drops in demands. The result is continued excess production and export of surplus steel at below market rates—a trend that is encouraged by countries with state supported and/or state-owned steel industries.

China is the largest contributor to excess capacity, responsible for nearly one third of global excess. Oversupply is being exacerbated by increases in capacity in India and South Korea despite stagnant demand. According to the report “major producers in India expect to add an additional 24 million metric tons of capacity by 2017-2018, and India’s overall capacity is projected to more than double to reach 200 million metric tons by 2020.”

South Korean expansion has outstripped demand and oversupply is especially evident in oil country tubular goods (OCTG), a product that is not used domestically in Korea and is produced solely for export. According to the EPI report, “Korean OCTG capacity grew by 21.1 percent from 2010-23012, enabling a 47.4 percent increase in Korean exports, over 90 percent of which were designed for the United States.”

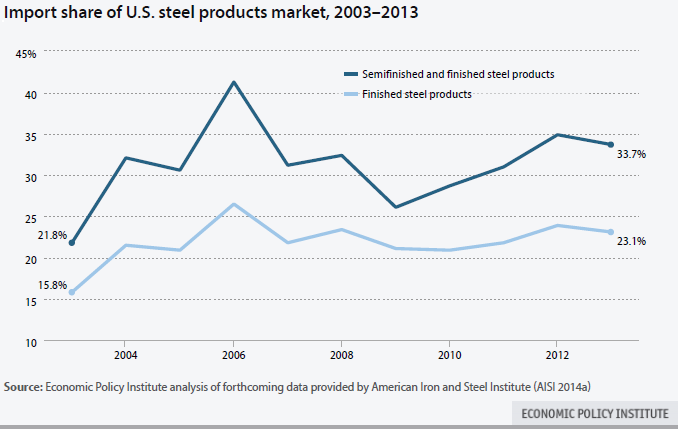

Spike in Imports

Indirect imports to the U.S. from have recently come under fire by critics. According to the EPI report, “U.S. imports of unfairly traded steel products are increasing as countries such as China and others sell dumped and subsidized “upstream” (basic) steel products to other countries, which use these inputs in the “downstream” (finished) products, like pipes, that they sell to the U.S.”

Domestic prices undercut

The average price of imported steel declined by $259/ton (23.1 percent) between 2000 and early 2014. Average price dropped 12 percent the first two months of 2014, falling by an average $118 per ton compared to Jan/Feb 2013. The EPI reports states that “surging imports of unfairly traded steel are a clear and present threat to the health of the domestic steel industry.”

Jobs at Risk

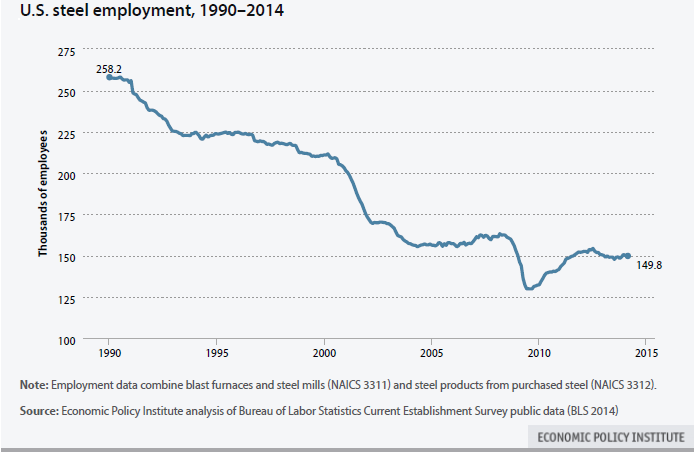

According to Bureau of Labor Statistics data, 55,000, or 26 percent, of steelworker jobs were lost between January 1999 and December 2004 as a result of the steel crisis and subsequent restructuring, During the recession from 2007 to 2009, 30,000 steel industry jobs were lost and mostly recovered, but employment levels have trended downwards since then. According to the EPI report, “Surging imports of unfairly traded steel products have contributed to the loss of nearly 1,000 jobs in the U.S. steel industry in the first three months of 2014 alone.”

An analysis of 2012 data shows 583,600 American jobs are supported by steel production. Most of these are in manufacturing in the durable goods industry (255,500), but also substantial numbers in transportation and warehousing, minerals and ores, and waste management. The EPI report claims these jobs “are clearly at risk if surging imports of unfairly traded steel are allowed to supplant or replace domestic steel production.”

The top ten states at risk for job loss were Texas (59,800 jobs supported), California (52,300 jobs), Pennsylvania (35,300 jobs), Ohio (33,900 jobs), Illinois (28,400 jobs), Indiana (26,000 jobs), New York (25,100 jobs), Florida (23,200 jobs), Michigan (20,100 jobs), and Wisconsin (15,700 jobs). Significant losses are also anticipated in southern and border states that produce oil and natural gas.

The EPI report urges the government to take action to ensure that the U.S. steel industry can remain competitive and its workers secure.

“In short, trade remedies have been critical to the survival of the steel industry and the more than half-million workers who depend on that industry, particularly when the industry faces the kind of crisis that threatens it today. Policymakers should ensure that trade remedies are effectively enforced, that enforcement discretion is exercised consistent with the remedial goals of the statute (the Tariff Act of 1930, as amended), and that the remedies do in fact fully redress the unfair trade practices distorting the U.S. market.”