Prices

May 13, 2014

Foreign Orders Expected to Continue at High Levels

Written by John Packard

There will be a lot of news in the media today and tomorrow regarding foreign steel imports and their damage to the U.S. economy. We are seeing demonstrations across the country by union workers trying to influence policy and, particularly, the final determination of the OCTG dumping suits. Politicians are involved with Senator Sherrod Brown (D-OH) on Tuesday touting the newest report calling for protectionism for the domestic steel industry and its workers. We are covering the issues from a number of perspectives and we will let our readers determine where the happy medium needs to be.

SMU watches steel imports and import data very closely and we also have a number of questions in our flat rolled market analysis on the subject. We conducted a survey this past week and we continue to see very high response rates for those companies who are admitting that they are buying foreign steel.

The issue of imports is connected to the spread between domestic (USA) and foreign import prices. US mill production and supply issues, a weaker than normal global steel industry needing to export, and fairly stable world export prices have resulted in an influx of less expensive foreign steel as both manufacturing and service centers take advantage of foreign offers.

We are sharing a couple of graphics with you which are part of our Power Point presentation to our Premium Level members twice per month. The graphics are to the left and they consist of the following:

We are sharing a couple of graphics with you which are part of our Power Point presentation to our Premium Level members twice per month. The graphics are to the left and they consist of the following:

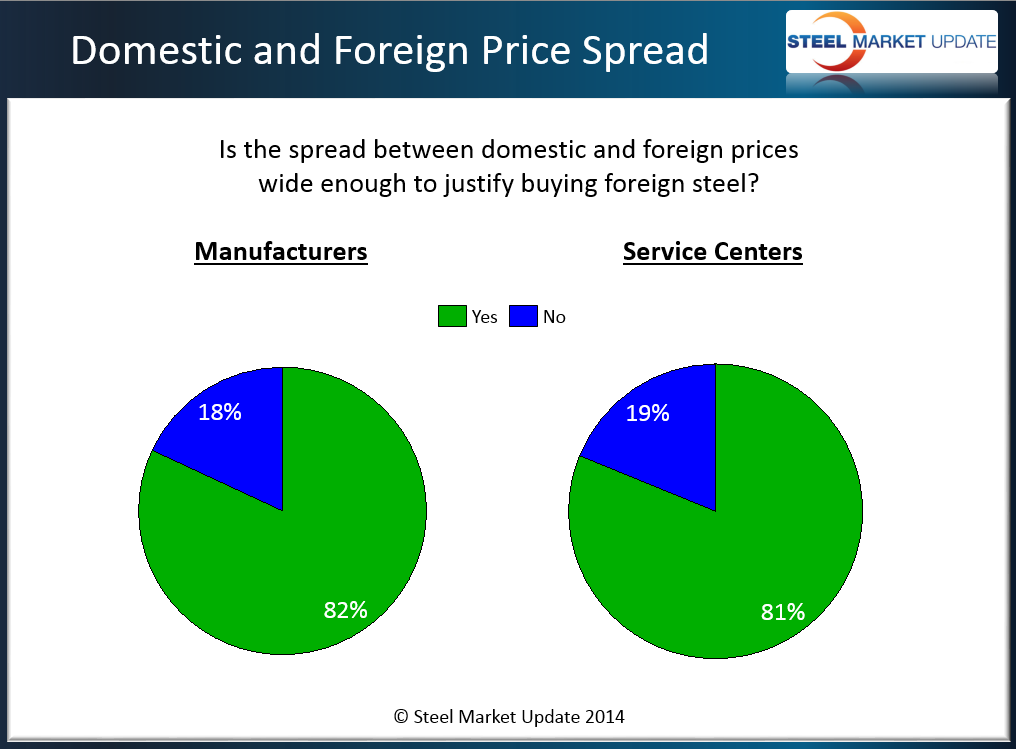

Domestic and foreign price spread: Broken out by market segment (manufacturing or distribution) and what percentage of each views the spread between foreign and domestic as being wide enough that they are attracted to and potentially buyers of foreign steel.

The next graphic puts this into historical perspective using the data from our manufacturing segment respondents (the service center data looks very similar and our Premium Level members can review the data for both in the Survey Results under the Analysis tab on our website). We have seen a strong influx of foreign steel since the beginning of the year. With most foreign carrying 3 to 5 month lead times you can go back and see how the spread has expanded and the attractiveness of foreign steel has become more interesting to steel buyers in both market segments.

The next graphic puts this into historical perspective using the data from our manufacturing segment respondents (the service center data looks very similar and our Premium Level members can review the data for both in the Survey Results under the Analysis tab on our website). We have seen a strong influx of foreign steel since the beginning of the year. With most foreign carrying 3 to 5 month lead times you can go back and see how the spread has expanded and the attractiveness of foreign steel has become more interesting to steel buyers in both market segments.

The percentages that we are seeing in both manufacturing and service centers is quite high – the highest we have collected going back to our early market analysis conducted in 2008 and 2009.

The net result is our survey data has 44 percent of the service centers and 50 percent of the manufacturing companies reporting that they are buying foreign steel right now for future delivery.

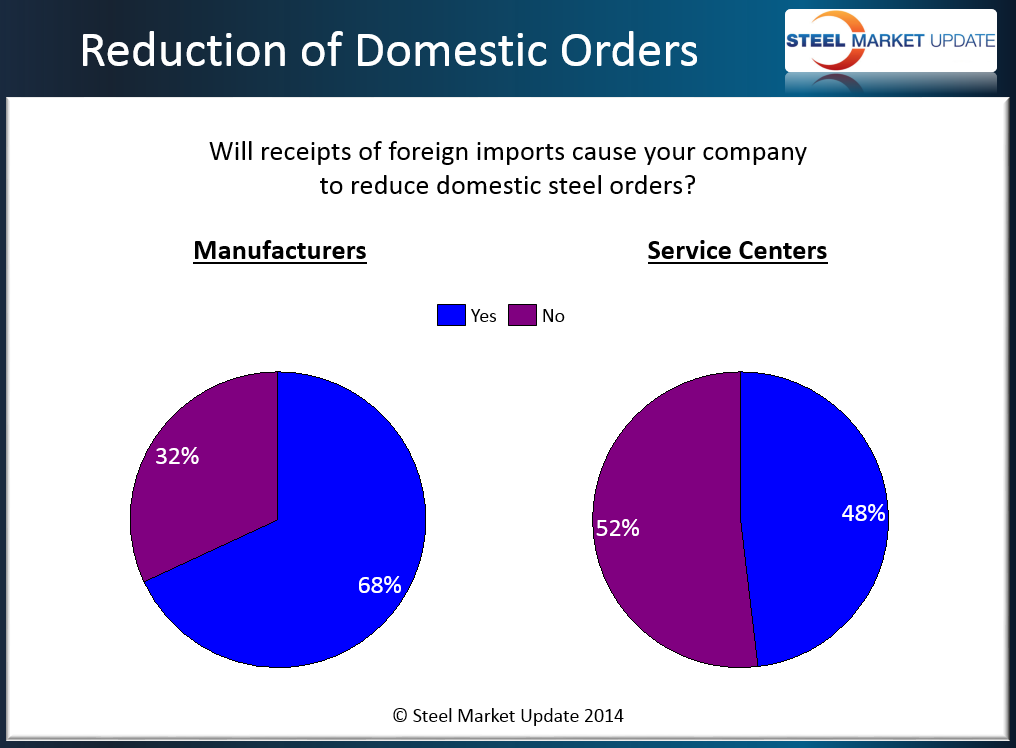

Perhaps more important to the domestic steel mills – and the main reason why you are going to be inundated with news articles about the “dumping” of foreign steel into the United States – is the percentage of manufacturing companies and distributors who are reporting to SMU that their foreign orders will impact their domestic order book. In other words they will reduce or eliminate orders with U.S. and Canadian mills due to the inventory positions taken utilizing foreign steel (see below). We believe it is the combination of the price spread between domestic and foreign prices coupled with a reduction in the volume of domestic steel orders due to the large influx of foreign steel, which is influencing pricing decisions as the domestic steel mills.