Prices

May 9, 2014

Apparent Supply of Sheet and Strip Products through March 2014

Written by Peter Wright

Apparent supply is defined as domestic mill shipments to domestic locations plus imports. Sources are the American Iron and Steel Institute and the Department of Commerce.

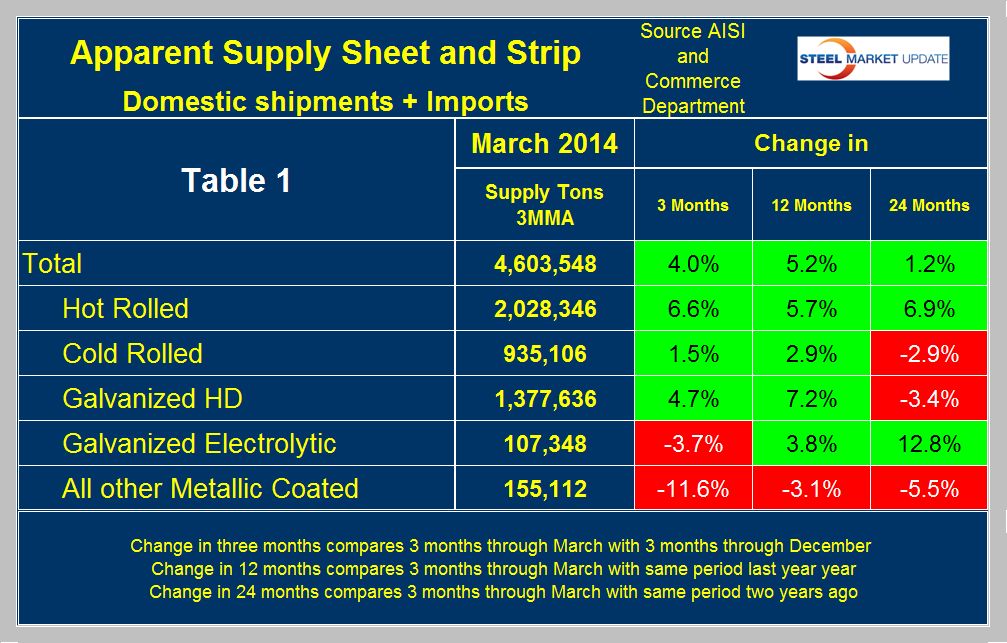

The three month moving average of the total tonnage of sheet and strip supply in the 1st quarter was 4,603,548 tons, up from 4,426,649 tons per month in Q4 2013, an increase of 4.0 percent. Compared to Q1 2013 and Q1 2012 supply was higher by 5.2 percent and 1.2 percent respectively. Table 1 shows the performance by product over three, twelve and twenty four month periods. The only products having negative growth in Q1 14 / Q4 13 were electro-galvanized and other metallic coated (mainly Galvalume.) Year over year hot band grew by 5.7 percent, cold rolled by 2.9 percent and HGD by 7.2 percent.

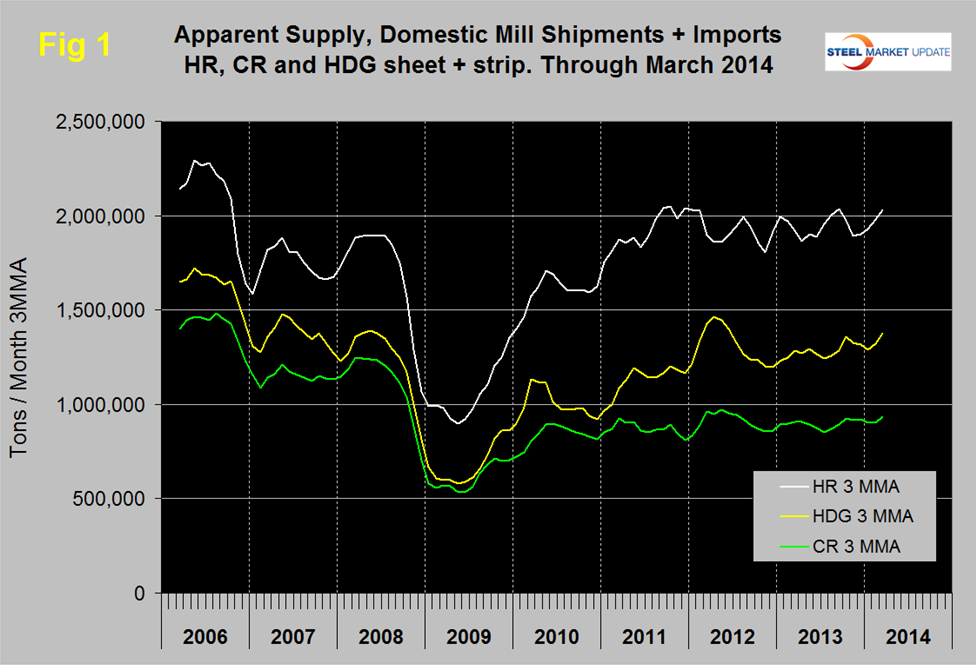

Figure 1 shows the long term supply picture for the three major sheet and strip products, HR, CR and HDG since January 2006. No distinctive trends are evident in the last 18 months. Hot rolled has been erratic and stuck in the range 2.083 million tons (Oct 2011) to 1.739 million tons (Sept 2012) for almost 2.5 years. The three months through March averaged 2.028 million tons / month. Cold rolled has been fairly flat for over 3.5 years living in the range 701 thousand tons / month, (Nov 2010) to 970 tons / month, (May 2012). Three months through March averaged 935 thousand tons / month. HDG had a strong bump in H1 2012, declined in H2 2012 and has been gradually improving for 14 months. HDG in three months through March averaged 1.378 million tons / month.

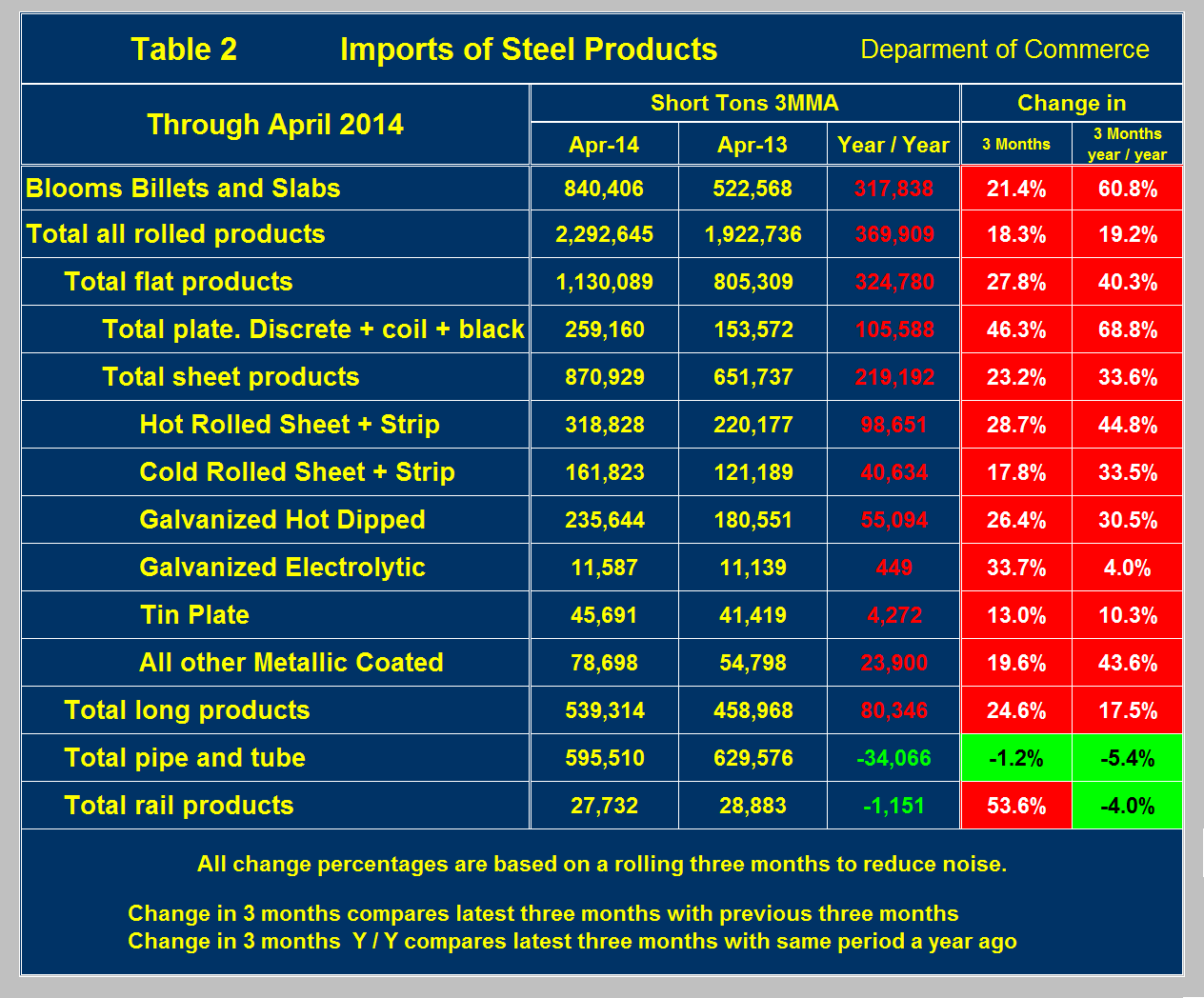

Supply is both domestic shipments plus imports. The supply of sheet and strip products was up by 5.2 percent in Q1 year / year as mentioned above but mill shipments were actually down by 0.5 percent in the same time frame. We now have import data through April and the total tonnage of sheet and strip imports in three months through April was up by 33.6 percent year over year therefore absorbed all the supply growth and then some. Imports of the three major products, hot band, cold rolled and HDG in three months through April y / y were up by 44.8 percent, 33.5 percent and 30.5 percent, respectively (Table 2).