Prices

May 6, 2014

Foreign Steel Penetration into Domestic Steel Market

Written by John Packard

When Nucor announced their earnings on April 24th they held a conference call with analysts to discuss their business and to make statements about their company, the markets they serve and about the economy in general. John Ferriola, Nucor’s Chairman, CEO and President, provided an opening statement during which he made the following remarks regarding imports of foreign steel into the United States:

“Imports have significantly increased their share of the U.S. market during the current downturn. Imported steel share of U.S. market increased from 25% in 2009 to 30% in 2013. And over the first two months of 2014, their share has increased to an alarming 36%. Given the indisputable fact that mills in the United States are among the lowest cost producers of steel in the world, this makes no sound economic sense. They come here not because of demand, but in many cases, because of foreign producers’ excess capacity, unfairly traded pricing, and illegal subsidies they enjoy from their governments.

“We should also understand that the damage done by dumped steel impacts the entire U.S. economy. The illegally-traded steel and steel products destroy jobs, the type of middle-class jobs that our economy desperately needs to get back to healthy and sustainable long-term growth. Nucor’s working hard to bring attention to the need for our government to enforce rules-based trade. Several current trade case filings underway are of critical importance to Nucor, our customers, and other U.S. steel producers. They include rebar, pipe and tube products, and wire rod. 22,000-plus members of the Nucor team urge both the U.S. Department of Commerce and the U.S. International Trade Commission to closely examine the evidence as they prepare their final determinations on potential duties for these cases.”

Nucor was not alone in singling out foreign steel as having a negative impact on the U.S. steel industry. US Steel and others have also pointed at imported steel – especially unfairly traded imported steel as something which needs to be prevented.

At Steel Market Update we watch imports and import penetration because we also believe they can have a major impact on the workings and pricing of flat rolled steel products in North America. We do not closely follow long products such as the rebar and wire rod products mentioned in Mr. Ferriola’s statement. But we do follow pipe & tube, much of which has a major impact on the hot rolled steel market.

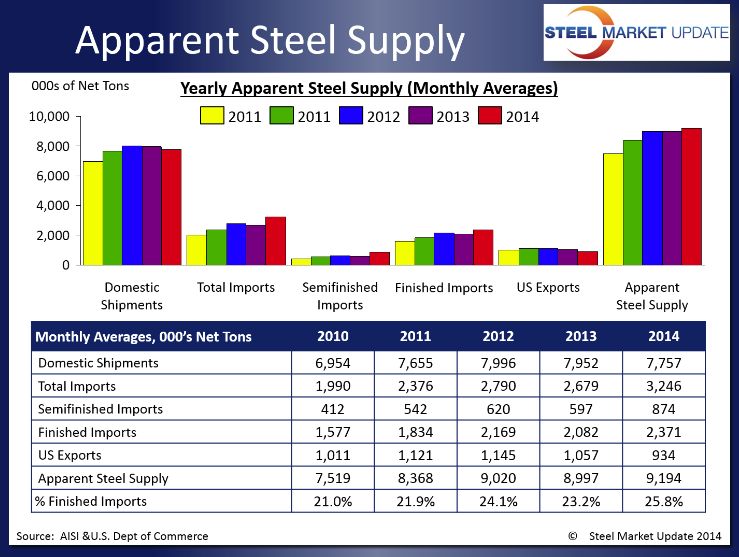

The key differences in the way SMU looks at the import numbers is 1) We look at the monthly average for the year and compare it against the year-to-date average for 2014 and, 2) We don’t consider semi-finished steels in the final percentages since semis are purchased by the domestic steel mills themselves, rolled and then sold under their domestic mill names.

As you can see by the graphic below, the percentage of finished imports (all products) grew from 2010 to 2011 and again from 2011 to 2012. In 2013 the percentage of finished steel penetration into the domestic U.S. market actually shrunk from 24.1 percent to 23.2 percent. Since then there has been a major jump in imports with the first three months penetration calculated to be 25.8 percent of the apparent steel supply so far this year. A 2.6 percent increase in the monthly average is quite alarming but can be explained by the widening of the spread between domestic and world export prices.

When looking at the reasons for the increase the first number that sticks out is the 49 percent jump in semi-finished steels (from 597,000 net tons average per month in 2013 to 874,000 net tons so far this year). We have also seen increases in another item purchased by domestic mills (such as USS/Posco) which is hot rolled steel.

However, the increases in semi-finished (slabs) imports should not come as a surprise as the AM/NS Calvert operation continues to expand their operations and business conditions improve around the country which benefits California Steel, NLMK USA and AK Steel, all relying upon imported slabs to run their operations at their desired capacities.