Market Data

May 2, 2014

Gross Domestic Product- Q1 2014 First Estimate

Written by Peter Wright

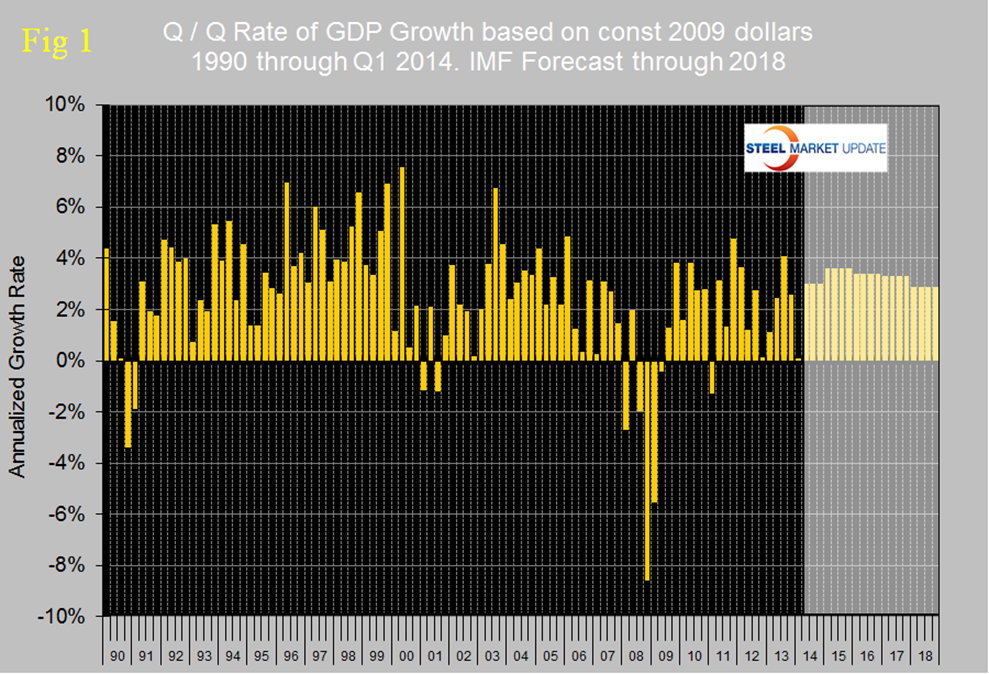

The Bureau of Economic Analysis (BEA) released their first estimate of real GDP today, (April 30th) for Q1 2014. GDP rose in the fourth quarter by 2.6 percent but declined to 0.1 percent in the first estimate for Q1 2014. Figure 1 shows quarterly results since 1990 with the IMF forecast through 2018. The Q1 result was far worse than most economist’s expectations which had been for a gain of 1.1 percent. Results are reported at a seasonally adjusted annual rate.

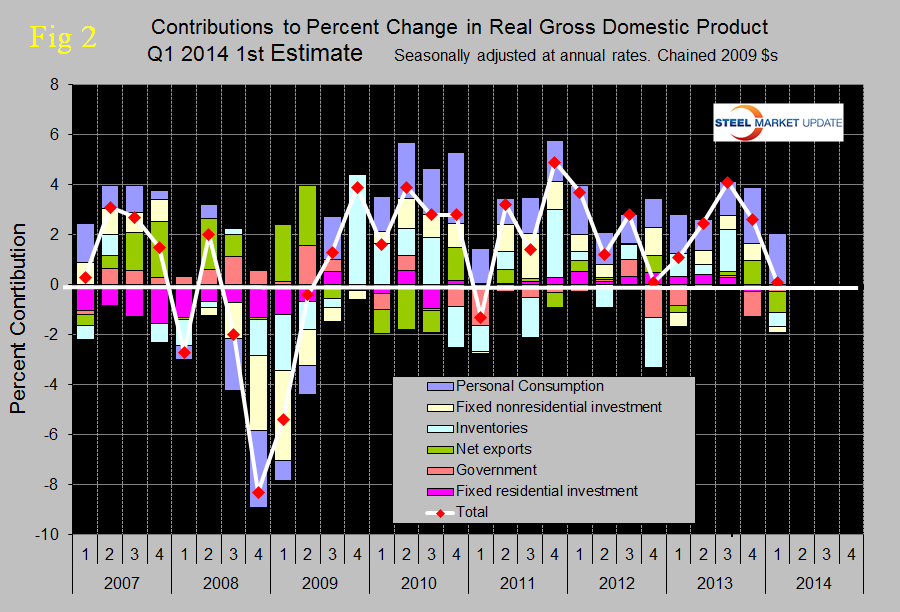

Figure 2 shows the contribution, (or lack of) for the major components. Personal consumption held up quite well and contributed 2.04 percent. All other components at this drill down level were negative including both the residential and non-residential measures of construction. Net exports had the largest negative contribution followed by inventories which when they decline in volume detract from GDP.

Moody’s economy.com summarized as follows: “GDP growth was weak in early 2014. However, much of the weakness was concentrated in the first two months of the year when the weather was particularly severe. Vehicle sales, industrial activity and, most importantly, the job market, rebounded in March. Employment is again increasing at rate of about 200,000 jobs per month, and the length of the average workweek has risen close to its recovery high. In addition, some of the weakness came from a reduction in the accumulation of farm inventories, a necessary correction, but not one which hurts the outlook. The rebound in growth that is already under way will be sustained. The economy’s fundamentals are strong. Credit is beginning to flow more freely, especially to businesses, but not exclusively. Businesses are profitable and competitive. Household debt loads are low and credit conditions are strengthening. Banks are well-capitalized and liquid. The fiscal health of government at all levels is much improved. Financial tumult, issues in Europe, and weaker growth in emerging economies could be problems, but so far the fallout from these issues on the U.S. and the rest of the global economy has been marginal. Further, there are also potential upside surprises. There is significant pent-up demand for housing and housing-related goods because more than 1 million more twenty-somethings are living with their parents today than just before the recession because they can’t find jobs, according to the Census Bureau. Arguably, demand for business investment is pent up as well. Real GDP is still on track to expand near 3 percent this year. Given that GDP likely rose slowly in the first quarter because of the bad weather, growth should reach a stronger pace,

Highlights from today’s BEA report read as follows:

Real gross domestic product — the output of goods and services produced by labor and property located in the United States — increased at an annual rate of 0.1 percent in the first quarter (that is, from the fourth quarter of 2013 to the first quarter of 2014), according to the “advance” estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 2.6 percent. The Bureau emphasized that the first-quarter advance estimate released today is based on source data that are incomplete or subject to further revision by the source agency. The “second” estimate for the first quarter, based on more complete data, will be released on May 29, 2014.

The increase in real GDP in the first quarter primarily reflected a positive contribution from personal consumption expenditures (PCE) that was partly offset by negative contributions from exports, private inventory investment, nonresidential fixed investment, residential fixed investment, and state and local government spending. Imports, which are a subtraction in the calculation of GDP, decreased. The deceleration in real GDP growth in the first quarter primarily reflected downturns in exports and in nonresidential fixed investment, a larger decrease in private inventory investment, a deceleration in PCE, and a downturn in state and local government spending that were partly offset by an upturn in federal government spending and a downturn in imports.

Personal consumption expenditures increased 3.0 percent in the first quarter, compared with an increase of 3.3 percent in the fourth. Durable goods increased 0.8 percent, compared with an increase of 2.8 percent.

Non-durable goods increased 0.1 percent, down from 2.9 percent.

Services increased 4.4 percent, compared with an increase of 3.5 percent in Q4.

Real nonresidential fixed investment decreased 2.1 percent in the first quarter, in contrast to an increase of 5.7 percent in the fourth.

Nonresidential structures increased 0.2 percent, in contrast to a decrease of 1.8 percent.

Real residential fixed investment decreased 5.7 percent, compared with a decrease of 7.9 percent.

Real exports of goods and services decreased 7.6 percent in the first quarter, in contrast to an increase of 9.5 percent in the fourth.

Real imports of goods and services decreased 1.4 percent, in contrast to an increase of 1.5 percent.

Real federal government consumption expenditures and gross investment increased 0.7 percent in the first quarter, in contrast to a decrease of 12.8 percent in the fourth. National defense decreased 2.4 percent, compared with a decrease of 14.4 percent. Non-defense increased 5.9 percent, in contrast to a decrease of 10.0 percent.

Real state and local government consumption expenditures and gross investment decreased 1.3 percent; it was unchanged in the fourth quarter.

The change in real private inventories subtracted 0.57 percentage point from the first-quarter change in real GDP after subtracting 0.02 percentage point from the fourth-quarter change.

Private businesses increased inventories $87.4 billion in the first quarter, following increases of $111.7 billion in the fourth quarter and $115.7 billion in the third.

Real final sales of domestic product — GDP less change in private inventories — increased 0.7 percent in the first quarter, compared with an increase of 2.7 percent in the fourth.