Market Segment

April 25, 2014

Correction: NLMK USA Slab Receipts and Flat Rolled Sales

Written by Brett Linton

Earlier this week Steel Market Update published slab receipts and flat rolled sales for Novolipetsk (NLMK). We inadvertently used the Russian flat rolled figures in our comparison rather than the US data. Below is a correction to the article and table. We apologize for our error.

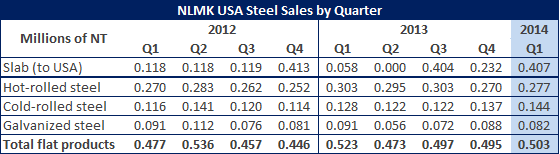

Hot rolled steel tonnage sold by NLMK USA during the first quarter 2014 was 277,000 tons (net tons). Cold rolled sales totaled 144,000 tons and galvanized 82,000 tons. The NLMK USA division sold a total of 503,000 tons of flat rolled during the first quarter 2014.

This is a slight decrease from the 523,000 tons in flat rolled sales during the first quarter of 2013, but it is an increase over Q4 2014 and Q1 2012.

There were a large number of slabs shipped from Russia to NLMK USA during the first quarter 2014. NLMK USA received 407,000 tons during the first quarter. Compare that number against the 58,000 tons received during Q1 2013 and 118,000 tons during Q1 2012.

According to US Department of Commerce data, the United States received a total of 960,986 net tons of Russian slabs during the first quarter 2014 (March is preliminary census data, not final data quite yet).