Prices

March 25, 2014

February Imports Exceed 3.2 Million Tons

Written by John Packard

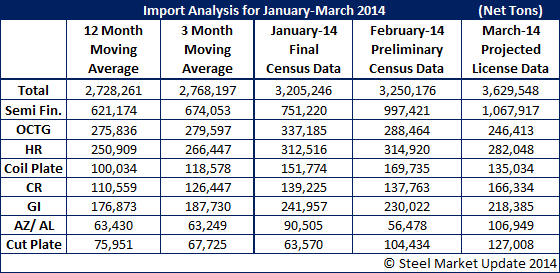

The U.S. Department of Commerce reported Preliminary Census Data for February 2014 steel imports into the United States. Total steel imports (all products) were reported to be 3,250,176 net tons which is an increase of 30 percent year over year and well above both the 12 month and 3 month moving average.

As you can see by the table below we saw increases in semi-finished steels (most of which are slabs), cold rolled, cut plate and Galvalume (other metallic which also includes aluminized).

We found Brazil imports of semi-finished (slabs) rising to 459,993 net tons. The second largest supplier was Russia with 302,074 net tons. Out of the blue we saw semi-finished imports out of the United Kingdom (England) with 118,585 net tons.

Hot rolled imports grew out of South Korea, Russia, France and the Netherlands while shrinking slightly out of Canada.

Cold rolled exports increased out of China (30,532 net tons) and India (12,136 net tons) as well as Sweden (8,751 net tons). Canada was the second largest exporter behind China with 30,161 net tons.

The largest exporters of galvanized steel were Canada, India, China, Korea and Taiwan. India was higher than normal at 63,984 net tons. Canadian exports of GI were down slightly from the previous month.

Plate in coils saw India come out of nowhere, having exported 1,746 tons over the last 12 months in total prior to the 50,310 net tons shipped to the U.S. during February.

Here is how our week by week forecast for the month of February looked vs. the Preliminary Census Data just reported today: