Prices

March 20, 2014

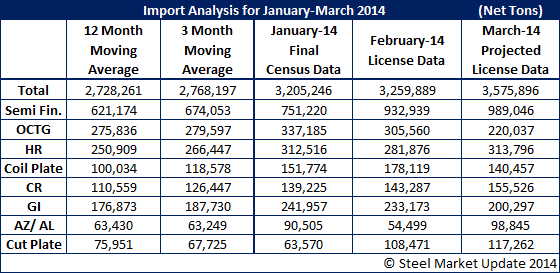

Projected March Imports Rise to 3.5 Million Tons

Written by John Packard

As our regular readers know, Steel Market Update projects imports of foreign flat rolled sheet, plate and oil country tubular goods (OCTG) as well as semi-finished (mostly slabs) steels for the month in progress. The projection is based on U.S. Department of Commerce license data which can be misleading and our projection should also be used as an indicator not a firm or real number.

This is the second projection for SMU since the month began. Our first projection was based on license data for the first 11 days of the month. Today’s number is based on license data collected through the 18th of March.

Total steel imports are projected to total approximately 3.5 million net tons. If correct, this would represent an approximately 300,000 net ton increase over the current projections we have for the month of February as well as the final census data for the month of January.

We are seeing increases on almost every item we monitor for this report. Semi-finished, which technically stands for blooms, billets and slabs – although the vast majority of the tons are slabs, are projected to reach close to 1 million net tons. As you can see by the table below the 12 month moving average (which does not include March projected numbers) is 621,174 tons. The 3MMA is a little higher at 674,053 tons and final numbers for January were 751,220 tons. The February number is still based on license data and stands at 932,939 tons.

Based on March 18th numbers we see probable increases over both the 3 month and 12 month moving averages on hot rolled, coiled plate, cold rolled, galvanized, Galvalume (which also includes aluminized) and cut plate. The only reduction we see at this moment is on oil country tubular goods (OCTG).