Market Segment

March 18, 2014

Canadian Service Center Shipments Down 10.5%

Written by Brett Linton

Canadian steel service center shipments for all steel products were reported at 448,500 net tons (NT) in February, down 9.4 percent over January figures and down 3.2 percent from February 2013 shipments. With 20 shipping days in February, daily shipments are calculated to have been 22,400 tons per day, down from 22,500 tons per day the previous month. Inventory shrunk in February to 1,395,400 NT, down 1.1 percent from the previous month and down 21.2 percent from February 2013 tonnage. Total steel receipts fell 107,100 NT month-over-month to 433,600 NT, with an average daily receipt rate of 21,755 NT, down from 24,482 NT the previous month. Months supply stood at 2.5 months on an unadjusted and seasonally adjusted basis, with the unadjusted figure up from 2.3 months in January and the seasonally adjusted figure unchanged over the previous month.

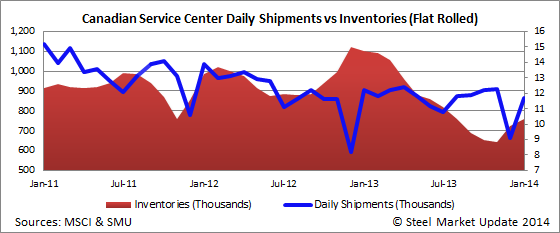

Flat Rolled

Flat rolled shipments were reported at 231,200 NT in February, down 10.5 percent over January figures and down 1.7 percent from February 2013 shipments. Daily shipments are calculated to have been 11,600 tons per day, down from 11,700 tons per day the previous month. Inventory remained steady in February at 756,800 NT, unchanged from the previous month but down 30.7 percent from February 2013 tonnage. Flat rolled receipts decreased to 231,100 NT, with an average daily receipt rate of 11,595 NT, down from 13,249 NT the previous month. Months supply was at 2.4 months unadjusted (up from 2.2 the previous month) and 2.3 months on a seasonally adjusted basis (unchanged over January).

Plate

Steel plate shipments were reported at 86,400 NT in February, down 6.0 percent over January figures and down 5.8 percent from February 2013 shipments. Daily shipments are calculated to have been 4,300 tons per day, up from 4,200 tons per day the previous month. Inventory fell in February to 260,300 NT, down 4.5 percent from the previous month and down 11.0 percent from February 2013 tonnage. Plate receipts decreased to 74,100 NT, with an average daily receipt rate of 3,718 NT, down from 4,777 NT the previous month. Months supply was at 2.9 months unadjusted (up from 2.7 the previous month) and 2.8 months on a seasonally adjusted basis (down from 2.9 the previous month).

Pipe and Tube

Shipments of pipe and tube products were reported at 48,000 NT in February, down 11.4 percent over January figures and down 5.5 percent from February 2013 shipments. Daily shipments are calculated to have been 2,400 tons per day, down from 2,500 tons per day the previous month. Inventory was slightly down in February to 132,200 NT, down 0.2 percent from the previous month and down 2.5 percent from February 2013 tonnage. Pipe and tube receipts increased to 47,700 NT, with an average daily receipt rate of 2,393 NT, up from 2,056 NT the previous month. Months supply was at 3.1 months unadjusted (up from 2.8 the previous month) and 3.0 months on a seasonally adjusted basis (down from 3.1 in January).