Prices

March 13, 2014

First Projection of March 2014 Steel Imports

Written by John Packard

As our regular readers already know, Steel Market Update has begun to project steel imports for the current month based on U.S. Department of Commerce license data. We advise our readers to be familiar with the US DOC license program (called SIMA) and the nuances with the program which were addressed in an article by SMU contributing writer and former director of the American Institute for International Steel, David Phelps.

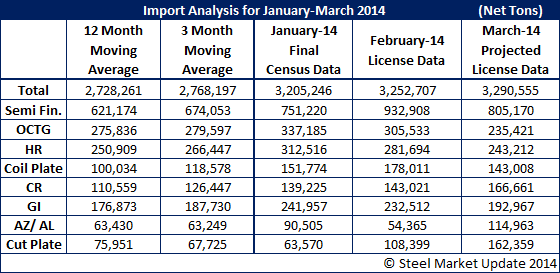

Final January imports came in at 3,205,246 net tons (we convert the US DOC metric calculations to net tons for our readers convenience). February imports (not final) are projected will be about the same as January at 3,252,707 net tons.

Based on license data through Tuesday, March 11 – Steel Market Update is forecasting March imports will be about the same as January and February at approximately 3.2 million net tons. We have broken out our projections by product which is shown below.

A note to our readers – you will notice that we have adjusted our table and added in coiled plate just below hot rolled. A number of our readers requested that we show coiled plate data as many of the larger companies combine the data with hot rolled since there is an overlap between the two products.

We have moved plate in sheets (cut plate) to the bottom of the group and will keep the sheet numbers separate from the coil numbers.