Market Segment

March 13, 2014

Domestic Steel Mills Considering Dumping Suits on Coated Steel?

Written by John Packard

Steel Market Update has been aware for awhile that at least one, and probably more than one, domestic steel mill has been trying to convince the rest of the industry to support dumping suits on coated products. This would most likely include galvanized and Galvalume steels. The countries being mentioned include China, India, Taiwan and South Korea. So what does this mean to those buying and selling steel right now?

What Steel Market Update would like to do is to evaluate how much coated steel is arriving on the U.S. shores, what countries are the largest exporters and what kind of products are coming. Our Premium members can take the exercise even further by reviewing what ports are being used which helps identify specific domestic mills which may be hurt (or not hurt) by the imported products.

One of the misconceptions behind any suit is the assumption that the domestic mills actually want the business that the foreign mills are supplying. An excellent example is .012” galvanized material which is used in the HVAC and construction industries for furnace pipe, suspended ceilings, corner beads and expanded metal for air conditioning filters and many more products.

Thinner steels are difficult for many mills to run and most don’t like to run the product due to the loss of productivity (tons per hour) when running ultra light gauge products.

SMU believes an across the board suit like the one filed on oil country tubular goods may well backfire on the domestic mills.

We are not alone in our thinking. A manufacturing company spoke to SMU about the potential for dumping suits and what the rumor mill has been hearing over the past couple of months, “we’ve heard that Nucor is going after OCTG and CR. Conversely, USS is going after Galvanized and Galvalume. If all is lumped, there will be problems proving anything. We believe this is a lot of smoke and a veiled attempt to stem import for a period in order to gain control over the market.”

A trader of foreign steel gave us a similar outlook regarding the potential for suits and what may happen (as everything is conjecture until the suit(s) are filed), “…the light gauge Indian mills have far less to be concerned with since they’re fairly specialized, and the lack of US producers in that end of the spectrum. I would assume China would be the target since their numbers are pretty damn low most of the time however, then you have the political stance the US has with all things China. Would the DOC be enthused to press an issue with an already prickly major trading partner?”

The same trader then went on to tell SMU, “…well then you have to look at which countries would be their biggest irritants, and which coated products. Unless they take a shotgun approach, name everybody, then ask for a preliminary ruling to stop imports immediately before the actual investigative process takes place. I think the DOC would be unlikely to do that.”

So, what are we talking about here?

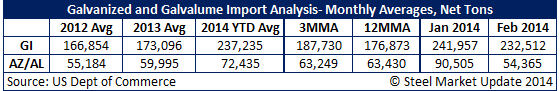

As you can see by the table provided below, the U.S. in 2012 and 2013 imported on an average 166,000-173,000 net tons per month of galvanized and 60,000-72,000 tons per month of Galvalume. This includes both bare and prepainted products.

So far this year, the monthly average for January and February is 237,235 tons of galvanized and 72,435 tons of Galvalume. This represents an increase in galvanized tonnage of +37 percent above the 2013 annual average and +42 percent over 2012. Galvalume has increased by +21 percent 2014 YTD versus 2012 annual average and +31 percent over 2012.

One steel mill told SMU this afternoon that the targeted countries are going to be the “Asian 4” (China, South Korea, Taiwan and India) and they went on to say, “…Their January increase to U.S. really pissed off the mills. February not quite as high, but March and April gonna be very, very big….”

Galvanized

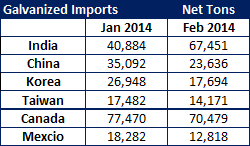

Let’s take a look at galvanized imports during January and February to see what countries have upset the domestic steel mills:

The largest exporting country for galvanized is Canada at 70,000+ tons for both January and February. The next largest exporting country was India. Most traders know that the biggest items of export out of India go into the furnace pipe and construction industries and are ultra light gauge products which many mills do not want to produce. After India comes China with South Korea and Taiwan not too far behind.

Galvalume

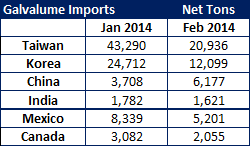

When looking at the Galvalume tonnages one must remember that the product is much smaller than galvanized. Most of the Galvalume is used for metal buildings, sidings, roof and architectural panels (construction). So, the tonnage may be less than galvanized but the impact on the U.S. Galvalume producing mills is much greater as a percentage of the total pie available to the industry.

Mexico, India and Canada have not been major exporters of the product during the first two months 2014. The largest exporter is Taiwan at 21,000 to 43,000 tons per month with China following well behind with 3,000-7,000 tons.

As one end user told us late today, “Let the games begin….”

Well, actually the games can’t begin until the dumping suit(s) are filed.