Prices

March 13, 2014

Apparent Supply of Sheet and Strip Products through January

Written by Peter Wright

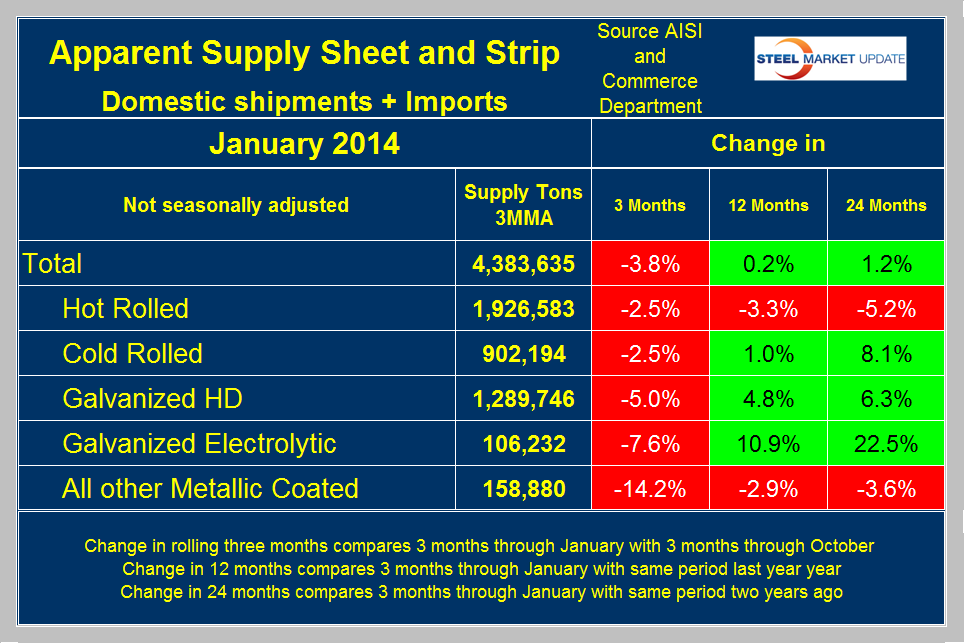

Apparent supply is defined as domestic mill shipments to domestic locations plus imports. The three month moving average of the total tonnage of sheet and strip supply was 4,383,635 tons per month in the period November through January. This was down by 3.8 percent from the August through October period and up by 0.2 percent from one year ago. Table 1 shows the performance by product over three, twelve and twenty four month periods. All products had negative growth in the three months through January led by other metallic coated, down by 14.2 percent. On a comparison against both one and two years ago only hot rolled and other metallic coated had negative growth.

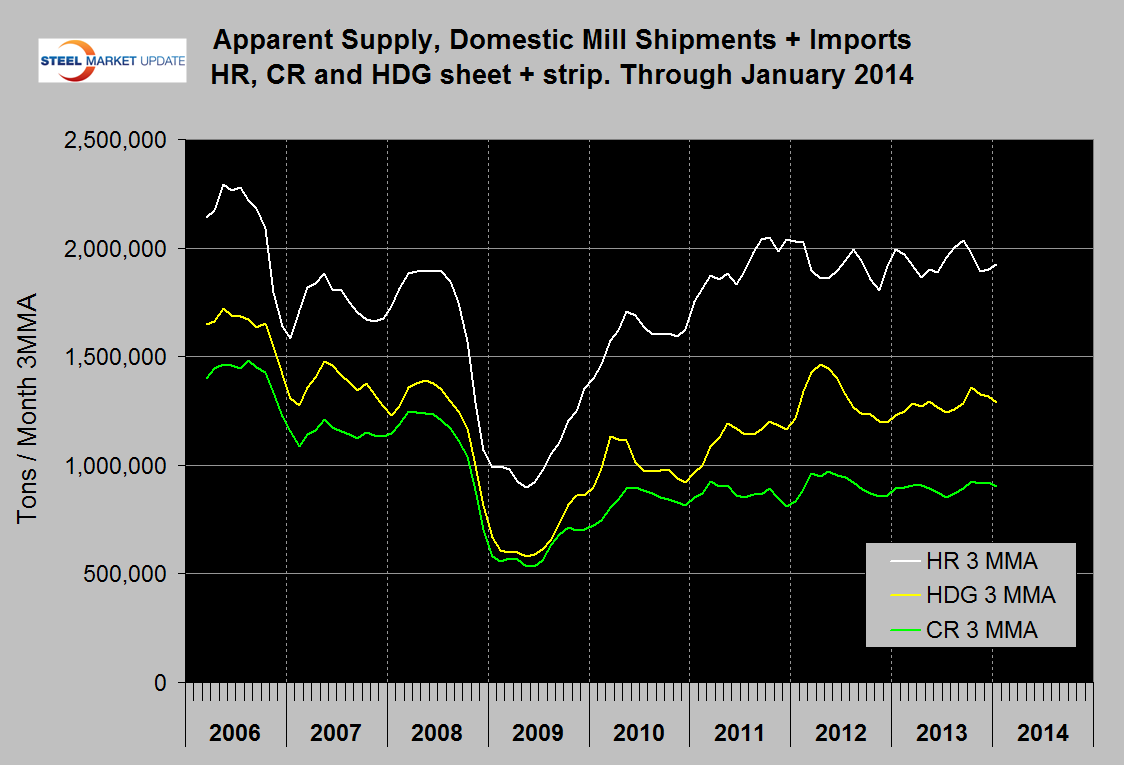

Figure 1 shows the long term supply picture for the three major sheet and strip products, HR, CR and HDG since January 2006. Hot rolled has been erratic and stuck in the range 2.083 million tons in October 2011 to 1.739 million tons in Sept 2012 for almost two and a half years. The three months through January averaged 1.977 million tons per month. Cold rolled has been fairly flat for over 3 and a half years living in the range 701 thousand tons per month in November 2010 to 970 tons per month in May 2012. Three months through January averaged 902 thousand tons per month. HDG had a strong bump in H1 2012, declined in H2 2012, and has been gradually improving for the past 13 months. The three months for HDG through January averaged 1.290 million tons per month.

Source: AISI and US Department of Commerce