Prices

March 11, 2014

January Steel Exports Up 11% Over December

Written by Brett Linton

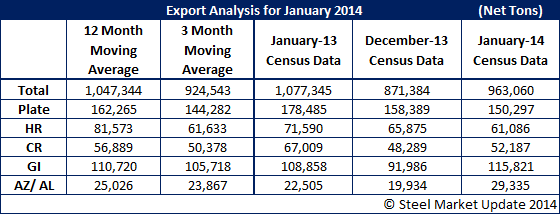

Total January 2014 US steel exports were 963,060 net tons (NT), a 10.5 percent increase over December 2013 figures but down 10.6 percent compared to January 2013. Total exports in January were above the three month moving average but below the twelve month moving average. The top countries receiving US exports were Canada at 54.8 percent, Mexico at 34.7 percent (for a NAFTA export total of 89.5 percent), the Dominican Republic at 0.9 percent, China at 0.9 percent, and India at 0.7 percent. All other countries were less than 0.5 percent of the total tonnage.

Top products exported in January were galvanized sheet at 115,821 NT or 12.0 percent of the total, plates cut lengths at 108,273 NT or 11.2 percent, heavy structural shapes at 90,795 NT or 9.4 percent, hot rolled sheet at 61,086 NT or 6.3 percent, hot rolled bars at 54,025 NT or 5.6 percent, and cold rolled sheet at 52,187 NT or 5.4 percent.

AIIS Executive Director Richard Chriss had the following comment on January exports: “The stronger showing in January over December is due to improved export tonnages to our NAFTA partners. With the exception of exports to the EU, the other smaller export markets posted another negative month. While the improvement in exports in January is a positive sign, the comparison with January 2013 is not encouraging — exports declined to all our regional markets, including NAFTA. With the U.S. steel market starting 2014 on a stronger note compared to 2013, the condition of the international markets early in 2014 appears not to be as positive, at least at this point in time. Some of the decline compared to 2013 could have been due to weather-related logistics difficulties.”

Key points from the January export figures:

– US exports to Mexico and Canada, as a percentage of total exports, are at the highest levels in over a year.

– Tonnage wise, total exports as well as exports to NAFTA countries were higher than the previous two months.

– Galvanized exports are up 25.9 percent over the previous month and up 6.4 percent over January 2013.

– Exports of plates cut lengths were down 10.5 percent over January 2013.

The table below shows steel export data for January 2014 including a comparison to both the previous month and to one year ago and also the 3 and 12 month moving averages.

If you are reading this article on the Steel Market Update website, you can view and adjust interactive graphic below that shows a history for total steel exports along with 6 select products. If you need help with your log-in information feel free to email us at info@SteelMarketUpdate.com or call our office at (800) 432 3475.

{amchart id=”107″ Total Exports- All Products, Monthly, Net tons}