Market Data

February 23, 2014

SMU Survey Results: Demand, Inventory Levels, Spot Price Support, Foreign Steel

Written by John Packard

Steel Market Update (SMU) conducted our mid-February flat rolled steel market survey this past week. Our surveys are by invitation only and our current invitee list consist of 586 companies. The vast majority of the individuals or companies associated with our survey have been vetted by SMU management to insure that we are working from a pool of reliable and informed participants.

In our most recent survey, which concluded on Thursday afternoon, February 20th, 49 percent of the respondents were from manufacturing companies, 37 percent were service centers/wholesalers, 6 percent trading companies, 4 percent steel mills, 3 percent toll processors and 1 percent suppliers to the industry (such as paint or chemical companies).

A portion of our survey is presented to the entire community of participants before being broken out by market segment. This provides us with a general understanding on topics such as demand before honing in on each group for a more detailed analysis.

Our Premium Level members are able to view a power point presentation of a majority of the results on our website under the Analysis tab.

Even though our SMU Steel Buyers Sentiment Index continues to be at very optimistic levels we found a bump in the road as we pressed for more information regarding demand. When asking the entire response population we found the percentage of respondents reporting demand as improving had shrunk from 32 percent at the beginning of this month to 23 percent this past week. On the flip side, those reporting demand as declining increased from 7 percent to 14 percent. We will have to watch this closely in the coming weeks to see if this is but a blip on the radar screen or the beginning of a trend.

When looking at the detail by market segment we found the manufacturers as being the group pushing the demand statistics. Manufacturers reporting demand as decreasing marginally rose from 7 percent to 14 percent. Even so, the vast majority of manufacturing companies responding in last week’s survey reported demand as either increasing marginally (50 percent) or substantially (6 percent) far outweighing those who felt demand was remaining the same (30 percent) or in decline (14 percent).

Our Premium Level members can get more detail on service center responses regarding demand as well as how both groups were handling inventory buys this past week compared to previous surveys.

Service centers reported in our survey that the average inventory level stood at 2.31 months as of this past week. This is essentially the same as the 2.30 months the MSCI reported on a seasonally adjusted basis at the end of January (2.2 months unadjusted).

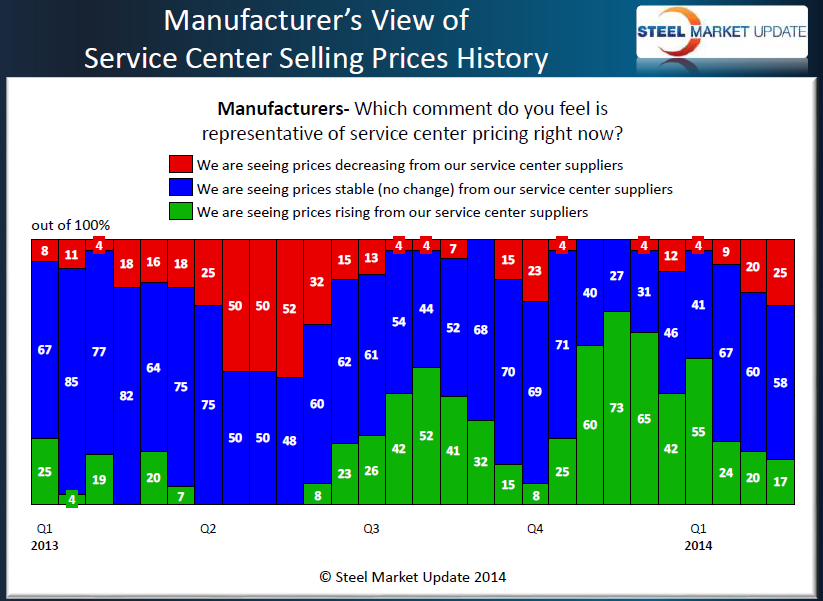

Pricing and price support is an important part of our twice monthly flat rolled steel market surveys. Manufacturers reported service centers as beginning to break ranks by offering lower spot prices back in the middle of January 2014. Since then the percentages of manufacturing companies (and service centers) reporting lower spot prices have grown. As you can see by the graphic below 25 percent of the manufacturing companies responding to last week’s survey report lower spot prices.

The service centers themselves have 30 percent of their respondents reporting that the distributors/wholesalers are indeed lowering spot prices to their customers. At the beginning of January 2014 zero percent of the service centers reported spot prices as falling.

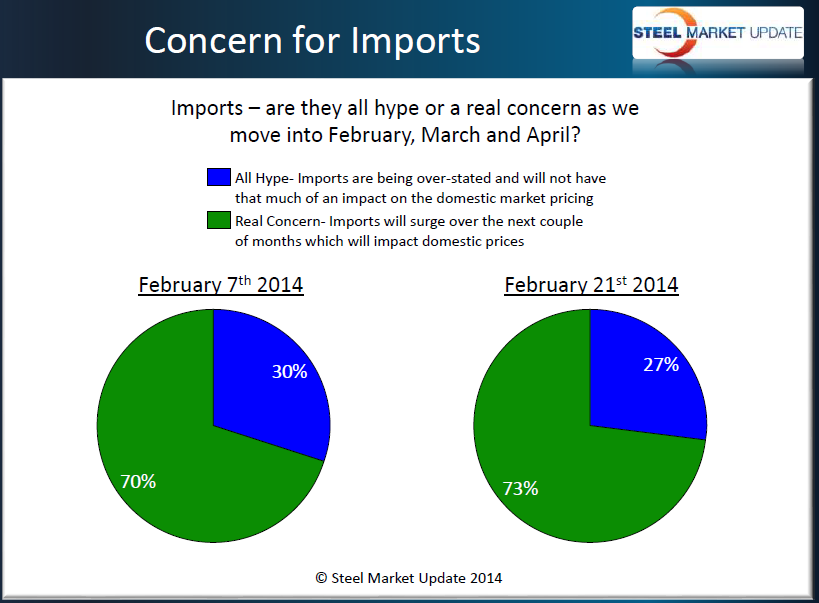

One of the areas of interest has been foreign imports and pricing. Each survey we try to determine if the price spreads between domestic and foreign steel justifies manufacturing or service center segments buying foreign steel. Going back to early 4th Quarter both manufacturing companies and distributors have been advising through our surveys that the spreads were such that they would consider buying more foreign steel (and that they were indeed placing more foreign orders). As a group both distributors and manufacturing companies are quite concerned about the potential impact of the imports expected to arrive on U.S. shores in the coming months.