Market Segment

February 23, 2014

Natural Gas Price Rise Good News for Steel Mills

Written by Peter Wright

The US is experiencing a revolution in the oil and gas markets. The spot price of natural gas delivered to the Henry Hub in Louisiana has risen by 50 percent since January 10th and was $6.55 per million British thermal units (MMBtu) on Wednesday, February 19. This is the highest spot price in over five years. At the New York Mercantile Exchange (NYMEX), the March 2014 futures price increased from $4.822/MMBtu last Wednesday to $6.149/MMBtu yesterday, the highest front-month contract price in more than four years.

Working natural gas in storage decreased to 1,443 Bcf as of Friday, February 14, according to the U.S. Energy Information Administration (EIA) Weekly Natural Gas Storage Report. A net storage withdrawal of 250 Bcf for the week resulted in storage levels 40 percent below year-ago levels and 34 percent below the 5-year average.

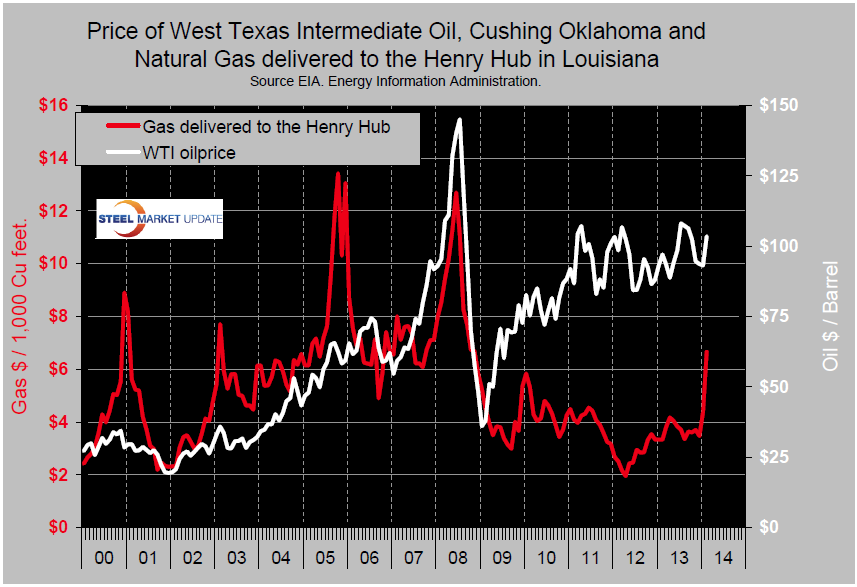

Figure 1 shows historical gas and oil prices since January 2000. The price of oil has been fairly stable by historical standards for over three years though in the second half of that time frame has been drifting up. West Texas Intermediate closed at 103.46 on February 19th. The EIA (US Energy Information Administration) reported as follows on January 10th, “Rising crude oil production in the United States contributed to relatively stable global crude oil prices in 2013, at around the same annual average levels of the previous two years. West Texas Intermediate (WTI) spot prices averaged $98 per barrel (bbl) in 2013, up 4% from 2012 and the highest annual average since 2008.”

New pipeline and railroad infrastructure alleviated transportation constraints that had put downward pressure on WTI prices. The North Sea Brent spot price averaged $109/bbl, down 3 percent from 2012. Brent prices came under downward pressure as rising U.S. light sweet crude oil production reduced the need for U.S. imports, thereby increasing supplies of Brent-quality crude oil available to the global market. In 2013 domestic crude oil production increased 1.0 million bbl/d—rising more than the combined increases in the rest of the world—to reach its highest level in 24 years. This increase marked the largest observed annual increase in U.S. history. Production exceeded imports during several weeks for the first time in nearly two decades.

Transportation infrastructure improvements enabled crude oil from Cushing, Oklahoma, and the Bakken, Permian, and Eagle Ford tight oil formations, to better reach refineries, reducing the need for foreign crude oil. On the Global scene, China accounted for almost one-third of growth in global demand and surpassed the United States to become the world’s largest importer of crude oil.

EIA estimates that global unplanned supply disruptions averaged 2.6 million bbl/d in 2013, 0.7 million bbl/d higher than the previous year. OPEC (Organization of the Petroleum Exporting Countries) producers had the largest volume outages at 1.8 million bbl/d. Despite significant production disruptions, international crude oil prices were relatively stable last year because higher U.S. production and seasonally elevated Saudi Arabian production (Saudi Arabia maintained peak summer production levels into the fall) offset outages elsewhere. Total liquid fuels production from members of OPEC fell by 0.9 million bbl/d in 2013. Non-OPEC liquid fuels production, concentrated in the United States, grew by more than 1.4 million bbl/d in 2013, more than offsetting the decline in OPEC production.

The evolution of the North American energy market is good news for future steel demand. The rising price of natural gas has not yet manifested as an increase in exploration but it will if the current price holds up through the spring warming trend.