Prices

February 14, 2014

SMU First Import Forecast for February 2014

Written by John Packard

During the month of January, Steel Market Update provided steel import forecasts for the month of January based on the weekly license data provided by the U.S. Department of Commerce. As we have explained previously, license data can be quite misleading compared to the final Census numbers. However, we did receive a number of emails liking the forecasts which included a breakdown of hot rolled, cold rolled, galvanized, Galvalume, slabs and OCTG and our analysis of each product so we are continuing the practice.

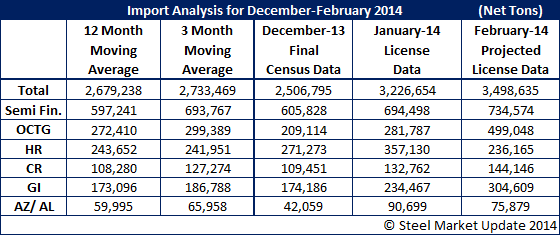

The initial forecast for the month of February are based on license data through Tuesday, February 11th. Our initial forecast is calling for total imports to be 3.5 million net tons. Out of the total slabs are forecast to be 734,574 net tons, OCTG 499,048 net tons, Hot Rolled 236,165 net tons, Cold Rolled 144,146 net tons, Galvanized 304,609 net tons and Galvalume 75,879 net tons.

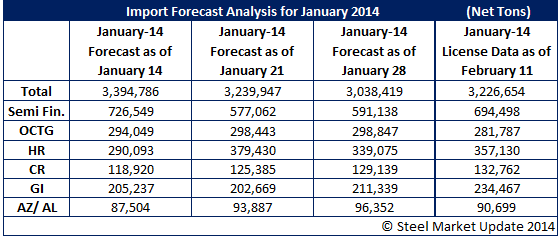

To put these numbers into perspective, below is a table with the various forecasts we made during the month of January which you can then compare against the week by week forecast for the prior month. As of the 14th of January we forecasted total imports to be 3,394,786 net tons. The first February forecast is for imports to be slightly higher than January by approximately 100,000 net tons. As you can see by the numbers provided in our first February forecast, increases are projected for slabs, oil country tubular goods, cold rolled and galvanized. However, these are very early numbers and we need to wait another week to see if the trend continues or if the license data backs off.