Analysis

February 7, 2014

Construction Expenditures in December 2013

Written by Peter Wright

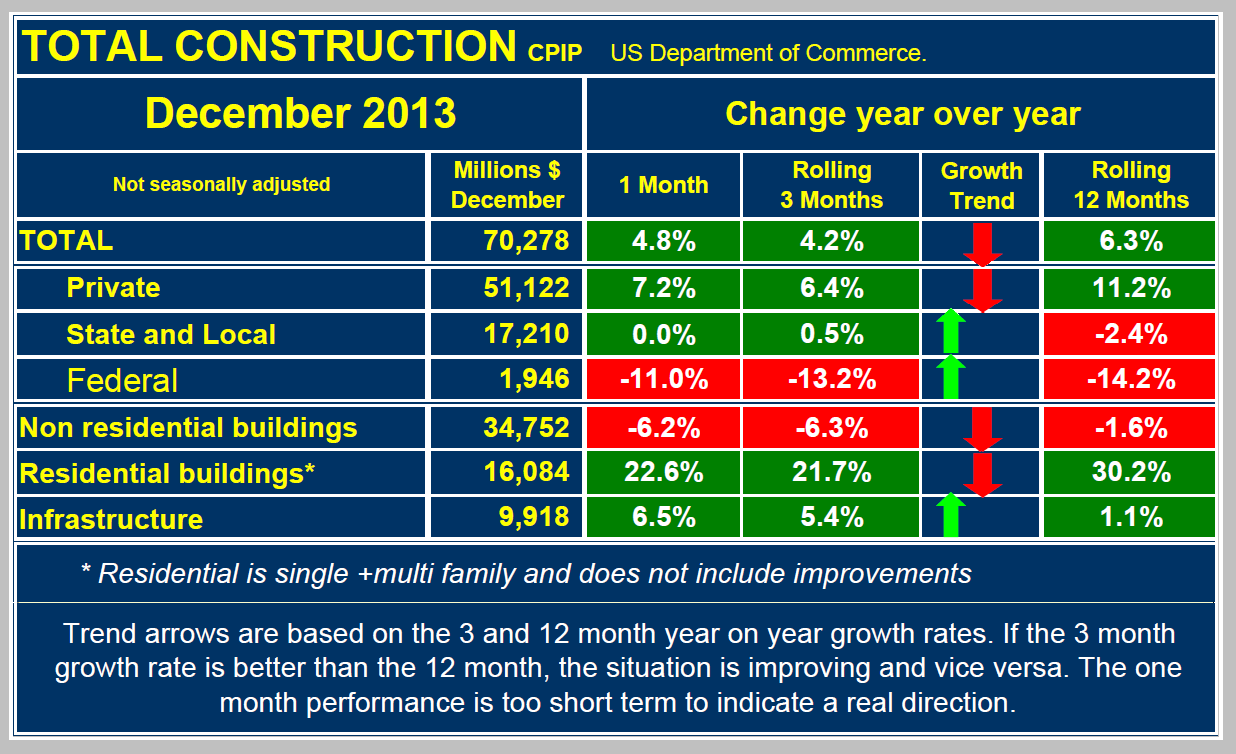

Total construction expenditures in December were $70.278 billion, up by 4.8 percent from December 2012. Fourth quarter expenditures were up by 4.2 percent year over year (y/y) and 2013, as a whole, was up by 6.3 percent from 2012. Private construction continues to be the driver, up by 6.4 percent in Q4 y/y but state and locally financed work also achieved a small gain of 0.5 percent. Federally financed construction is not much of a factor in the big picture and it continues to decline sharply, down 13.3 percent in Q4 y/y (Table 1). Residential building construction is still growing rapidly although the pace is slowing. Non residential buildings have slipped back into contraction as measured both quarterly and annually y/y. Infrastructure expenditures expanded by 5.4 percent in Q4 y/y.

According to Ken Simonson, chief economist of the Associated General Contractors of America, the shrunken pool of skilled construction workers, a legacy of the Great Recession and its aftermath, looms as a problem around the country as the economy slowly recovers and construction picks up. The findings of the association’s annual outlook survey of contractors nationwide shows 62 percent are already encountering difficulty filling key professional and craft positions. Just over half said they continue to see employees leave for other construction firms or other professions. Optimism among contractors nationwide is at its highest point since 2008, but nevertheless remains pretty subdued. The national trend in construction is that more companies expect to add workers this year and fewer companies expect layoffs.

From The Hill Transportation Blog January February 6th, by Sen. Mark Warner (D-Va.). The primary source of all road and highway funding in this country, the Highway Trust Fund, is projected to run dry by the end of September. The American Society of Civil Engineers estimated last year that to get our infrastructure into shape, we would need to invest $3.6 trillion by 2020. For roads, bridges and transit, that represents a $112 billion annual discrepancy between what we are currently spending and what we should be. In addition, as fuel efficiency increases our funding for roads goes down because our main funding source, the gas tax, has not been increased in more than 20 years. “I was proud to recently stand with Sen. Roy Blunt (R-Mo.) to lead a group of 10 senators, five Democrats and five Republicans, in introducing legislation that will help address our growing U.S. infrastructure crisis. The BRIDGE Act will establish a new infrastructure financing authority that complements existing programs currently scattered across several agencies. The legislation will allow us to consolidate expertise and talent in infrastructure financing and program management. The BRIDGE Act would provide $10 billion to create the financing authority to provide loans and loan guarantees to projects in the transportation, water and energy sectors. Experts say this modest initial investment ultimately could unlock $300 billion or more in total infrastructure investment in the first 10 years. The Financing Authority is structured to be self-sufficient over time, continuing its infrastructure investments over decades to come, but without requiring additional federal money. This bipartisan legislation does not create a silver bullet to magically fix America’s infrastructure gap. Instead, our proposal creates a targeted new tool to help states and localities access billions of additional dollars in private-sector capital that remains parked on the financial sidelines despite today’s extremely favorable interest rates.”

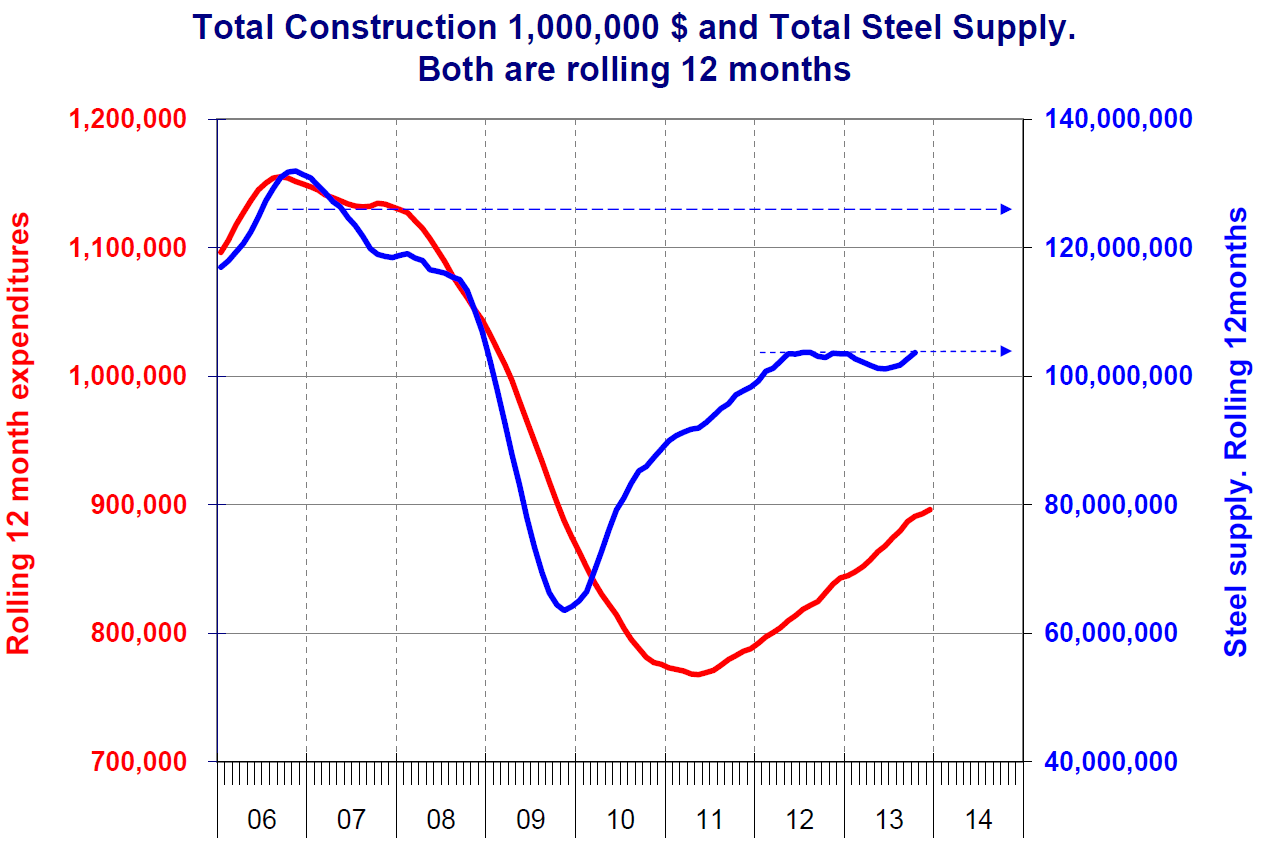

Figure 1 shows the relationship between total steel supply (domestic + imports) and total construction expenditures. It suggests that the upside potential for steel demand is about 20 million tons per year as construction recovers to its pre-recessionary peak. At the current rate of growth this will not occur until the end of 2017. (Source: US Commerce Department)