Market Data

February 1, 2014

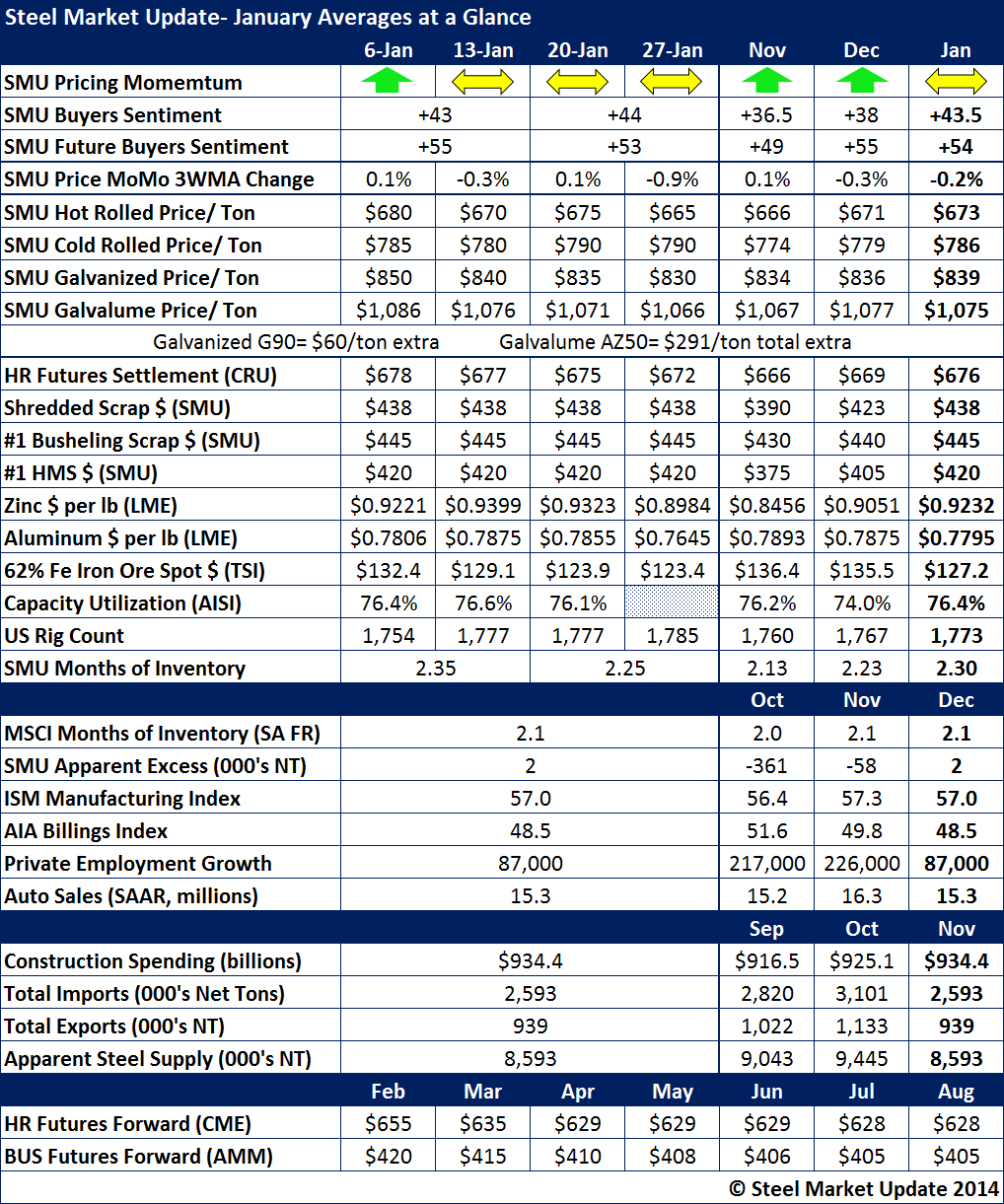

January at a Glance

Written by John Packard

During the month of January Steel Market Update (SMU) adjusted our Price Momentum Indicator from Higher to Neutral. Benchmark hot rolled prices averaged $673 per ton ($33.65/cwt) according to the Steel Market Update index. CRU posted their monthly average at $676 per ton ($33.80/cwt).

You can find the balance of our weekly and monthly averages on cold rolled, galvanized, Galvalume as well as #1 HMS, Shredded and #1 Busheling scrap in the table below.

Zinc prices retreated during the last week of the month to $.8984 per pound (zinc is used to make galvanized and Galvalume steels). Aluminum prices also dropped during the last week of the month to $.7645 per pound (aluminum is used to produce Galvalume, aluminized, Galfan, etc.).

Iron ore spot prices (TSI) out of China dropped from $132.4/dmt to $123.4/dmt during the course of the month. China is now closed for their New Year Holiday.

Both the HRC and BUS Futures forward curve are in backwardation meaning the current prices are higher than the futures values associated with each product.