Analysis

January 23, 2014

NAFTA Vehicle Production through December

Written by Peter Wright

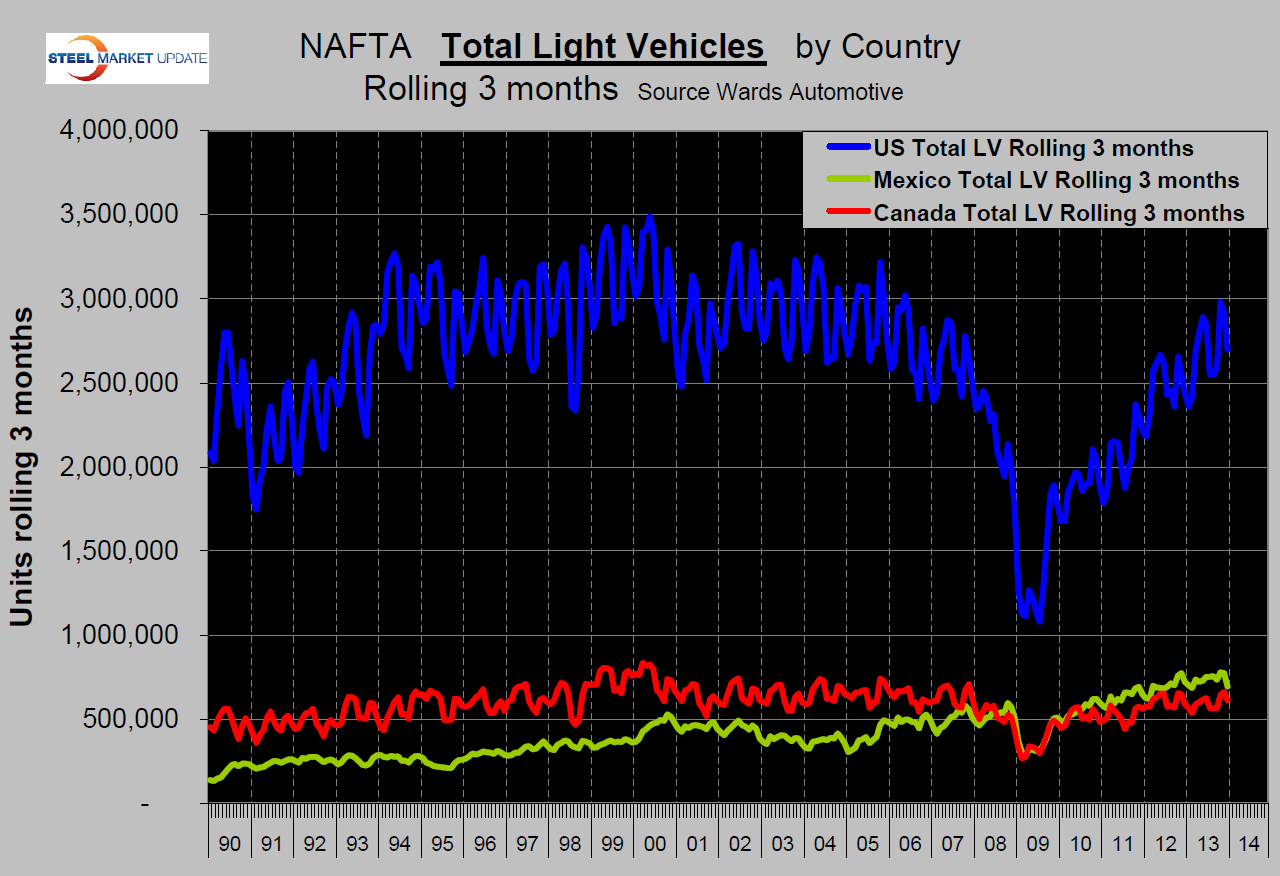

Light vehicle production in NAFTA in 2013 totaled, 16,141,347 units, the best year since 2002 and an increase of 6.0 percent on 2012 (Source Wards Automotive.). In 3 months through December production was up by 6.9 percent year over year. Light trucks which include crossovers are surging faster than cars, the year over year growth rates were 11.8 percent and 1.0 percent respectively.

Total production in 2013 breaks down to 7,133,422 and 9,007,925 for cars and light trucks respectively. In three months through December, growth rates of total light vehicles year over year were, US 7.0 percent, Canada 4.4 percent Mexico negative 3.5 percent. The US continues to be the success story of NAFTA auto production (Figure 1), though it must be said that the US had the more ground to make up from the recession. More good news for US light vehicle production, according to AMM, is that through August capital expenditure announcements were US $3.902 billion, Mexico $1.020 billion and Canada $0.250 billion. The growth of medium and heavy truck production has stalled overall and had negative growth of 3.8 percent in NAFTA as a whole in Q4 (Figure 2).

Total production in 2013 breaks down to 7,133,422 and 9,007,925 for cars and light trucks respectively. In three months through December, growth rates of total light vehicles year over year were, US 7.0 percent, Canada 4.4 percent Mexico negative 3.5 percent. The US continues to be the success story of NAFTA auto production (Figure 1), though it must be said that the US had the more ground to make up from the recession. More good news for US light vehicle production, according to AMM, is that through August capital expenditure announcements were US $3.902 billion, Mexico $1.020 billion and Canada $0.250 billion. The growth of medium and heavy truck production has stalled overall and had negative growth of 3.8 percent in NAFTA as a whole in Q4 (Figure 2).

The 2015 Ford F150 pickup truck revealed last week will have a steel frame but the full cab and bed are high-strength, heavy-gauge aluminum alloys that Ford engineers insist are tougher and more dent-resistant than the steel body panels Ford that has used for decades. The current F-150 uses aluminum only for the hood. “I think it’s a gutsy move,” said former Chrysler CEO Tom LaSorda. “It is a trade-off: higher-cost materials for fuel efficiency to meet CAFE.” Aluminum costs 50 percent more than steel, but Ford appears prepared to absorb the additional $1,000 per vehicle. That is on top of a premium of $1,000 or more when the buyer opts for an EcoBoost engine. Production of the 2015 F-150 will begin in Dearborn in the fourth quarter of 2014 to be followed by Kansas City in 2015.

Economy.com reported that US sales of light vehicles are on track for a 15.5 million unit year equally split between cars and trucks. Sales continued their post-recession rebound and gained 7 percent in 2013 to reach 15.6 million units (SAAR). This marks a 50 percent increase from the recession’s trough of just 10.4 million units in 2009. As a result, the rebound in vehicle sales has most definitely been V-shaped, as opposed to the much feared U-shaped, or even worse, L-shaped pattern. All three U.S. automakers have shared in the recovery’s gains, but Chrysler has posted the most impressive results; sales have increased a resounding 87 percent since the 2009 trough. Ford’s increase was a bit more modest at nearly 52 percent, and GM’s was nearly 35 percent. The fundamentals indicate the auto industry will continue to improve, as job growth is accelerating, access to credit for less than prime consumers has broadened, consumer confidence is generally rising, and the wealth effect has kicked in thanks to rising equity and house prices. In addition, pent-up demand continues to power sales as consumers replace their decade-old vehicles. Sales are expected to strengthen further as the economy gains momentum in 2014 and 2015. Sales will reach 16.7 million units and 16.6 million respectively.

Economy.com reported that US sales of light vehicles are on track for a 15.5 million unit year equally split between cars and trucks. Sales continued their post-recession rebound and gained 7 percent in 2013 to reach 15.6 million units (SAAR). This marks a 50 percent increase from the recession’s trough of just 10.4 million units in 2009. As a result, the rebound in vehicle sales has most definitely been V-shaped, as opposed to the much feared U-shaped, or even worse, L-shaped pattern. All three U.S. automakers have shared in the recovery’s gains, but Chrysler has posted the most impressive results; sales have increased a resounding 87 percent since the 2009 trough. Ford’s increase was a bit more modest at nearly 52 percent, and GM’s was nearly 35 percent. The fundamentals indicate the auto industry will continue to improve, as job growth is accelerating, access to credit for less than prime consumers has broadened, consumer confidence is generally rising, and the wealth effect has kicked in thanks to rising equity and house prices. In addition, pent-up demand continues to power sales as consumers replace their decade-old vehicles. Sales are expected to strengthen further as the economy gains momentum in 2014 and 2015. Sales will reach 16.7 million units and 16.6 million respectively.

Last month Stratfor reported as follows in their piece on “NAFTA, the Future of Canada, Mexico and the United States.” “Today, Mexico exports about $1 billion worth of goods per day to the United States, making it the United States’ single-largest source of imports and its third-largest trading partner.” Issues do remain, particularly over the question of immigration, legal or otherwise, with both countries trying to find a balance between competitive growth and stable domestic markets. From aerospace engineering in Queretaro to footwear assembly in Guanajuato, Mexico is shaping up to be a competitive and flexible manufacturer. Mexico’s geographic proximity to the United States and high levels of internal wage and skill disparity made its manufacturing sector more competitive than China’s after 2012. Yet Mexico also seems to have found a way to avoid the Chinese curse of depending on low-cost manufacturing. High-tech exports accounted for 17 percent of Mexican gross domestic product in 2012, while cars amounted to a quarter of all Mexican exports that same year. The high tariffs on high-tech products manufactured outside of NAFTA give Mexico a notable advantage. Particularly noteworthy is Mexico’s booming aerospace industry. This sector has received the most foreign direct investment in the global industry for the past four years thanks in great part to the construction of a massive manufacturing plant by the Canadian company Bombardier in the central highlands of Mexico. Challenges do remain for Mexico. Income disparity is a double-edged sword, and while the middle class grows at a slow pace, the country’s poor education system continues to create a shortage of skilled labor for high value-added manufacturers considering a shift to Mexico. Organized crime continues to be a high-visibility issue that slows foreign investment, even as the current Mexican administration seems to have toned down some of its predecessor’s more aggressive policies.

Still, progress seems to be on the horizon. In a rare display of political unity, the Mexican government passed a host of constitutional reforms in 2013 that may begin to address some of the country’s systemic issues, particularly those in the education, fiscal and energy sectors.

The importance of the last one cannot be overstated: Since the nationalization of oil in 1938, Mexico has been blighted by a steadily ossifying energy sector. The Mexican Constitution made it nearly impossible for foreign companies to participate in any part of the country’s energy supply chain, leading to technological stagnation and decreasing production and efficiency levels. The constitutional reforms passed in late 2013 are one of the first concrete signs that Mexico may be on the eve of a much-needed revitalization of its hydrocarbon sector — boosting the country’s competitiveness in the global arena. U.S. companies are likely to be deeply involved in this process, especially since they command the best technical expertise for the deep-water offshore and unconventional onshore production that Mexico will need most — yet again reinforcing formal and informal ties between the two countries. The true bonds between the three countries are their aligned and complementary interests born of their shared geopolitical fate. Though the future of the United States, Mexico and Canada is by no means set in stone, there are strong indicators that the triad has what it takes to be both a stable and dynamic geopolitical grouping in the long term — something that currently seems out of reach anywhere else in the world.

Read more: NAFTA and the Future of Canada, Mexico and the United States | Stratfor