Prices

January 21, 2014

Revised Import License Data Still Forecasting January at 3.2 Million Tons

Written by John Packard

Every Tuesday the U.S. Department of Commerce releases their latest steel import licensing data for the current month. Based on data collected through the 21st of January (today) total steel imports (all products) are forecast to be 3.2 million net tons for the month of January. This is slightly lower than the 3.3 million tons we forecast last week based on the numbers provided at that time but, well above both the 3 month and 12 month moving averages.

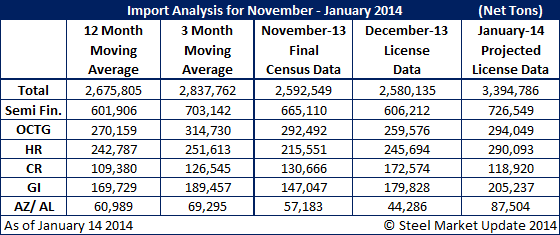

Here is our original forecast from last week based on import license data through the first 14 days of January:

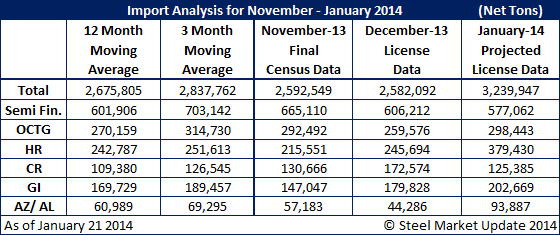

Based on the data released today which now has 21 days of license information our revised January import projection looks like this:

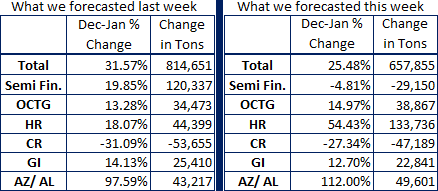

The projected increases in tonnage from December to January are shown below. First, we show the changes projected last week (left) and then we show the adjustments made based on another week’s worth of data (right). As you can see total tonnage is now projected to be 657,855 tons higher in January than December. Items showing the most growth are hot rolled at +54.43 percent and Galvalume/Aluminized at +112 percent.

In the first two tables shown above we show the 12 month and 3 month moving averages for the total and by product. When looking at flat rolled by product our newly adjusted data (second table) shows:

Hot rolled is well above both the 12MMA and 3MMA. In doing a quick review of hot rolled since 2008 the largest one month total for hot rolled imports was July 2011 at 323,538 net tons.

Cold rolled is within the 3MMA and slightly above the 12MMA.

Galvanized (GI) is above both the 12MMA and 3MMA.

Galvalume/Aluminized is well above both the 12MMA and 3MMA.

Every single flat rolled item is trending higher (3MMA is larger than 12MMA) which has to be of concern to the domestic steel mills.

SMU Note: Import License Data is not reliable and we remind our readers to review the recent article by David Phelps on how the import licensing system works and why the data can only be used as an indicator and not reality until the census data is released.