Market Data

January 18, 2014

Service Center Inventories: SMU Projections

Written by John Packard

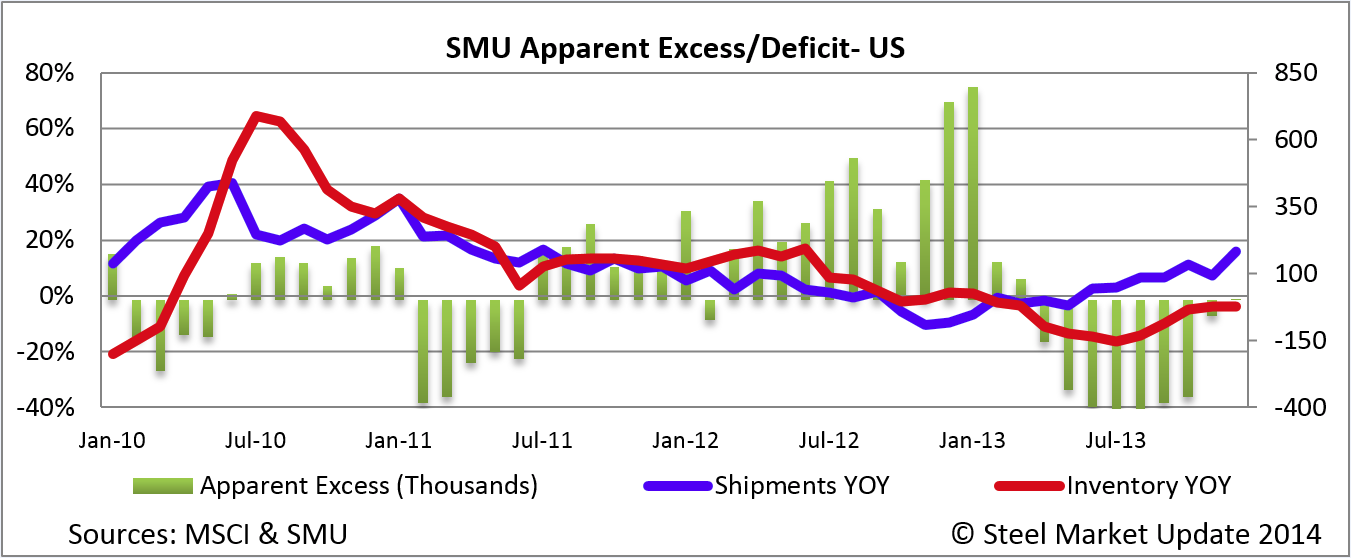

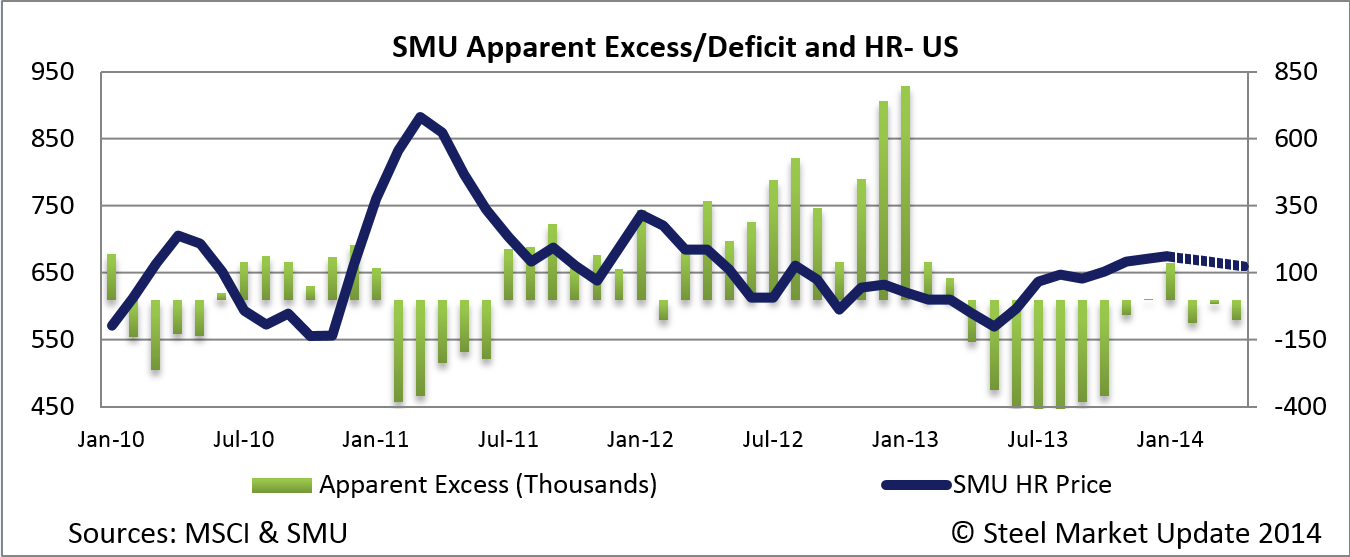

The Metal Service Center Institute (MSCI) produced their analysis of service center shipments and inventories as of the end of December 2013. According to the MSCI flat rolled inventories stood at 4,981,400 tons which represented a 2.6 month’s supply on a non-seasonally adjusted basis and 2.1 months supply based on seasonally adjusted data. Steel Market Update (SMU) produces an analysis of the service center data for our Premium Level members. The resulting Service Center Apparent Excess/Deficit analysis and forecast is a leading indicator as to new mill order patterns from the service center group which are critical to lead times and thus the ability of the domestic mills to keep prices from falling.

Our Apparent Excess/Deficit analysis of the December distributor data resulted in service center inventories being balanced at +2,000 tons. This was due to an increase in flat rolled inventories of 337,300 tons over the prior month. Inventories are also very close to the 5,181,000 tons reported by the MSCI at the end of December 2012. Shipments increased in December year-over-year and were very close to the November 2013 levels.

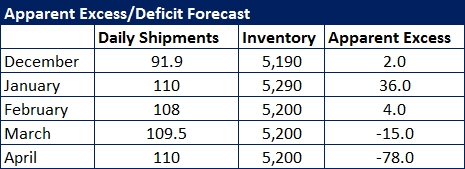

For Premium Level members, Steel Market Update is producing forecasts based on our estimates as to where we believe shipments and inventories will end up at the end of the next four months. We are then able to project our Apparent Excess/Deficit based on those numbers using our formula. Here is what we think the next four months will look like:

After forecasting service center inventories, shipments and the Apparent Excess or Deficit which will exist at that point in time we then can forecast price movements. Here is how our steel price forecast looks for the next four months:

As we continue to work with our model one item which could play havoc is the amount of foreign flat rolled due into the United States over the next four months. If flat rolled imports surge this would impact inventory levels and the domestic mill order books and thus our price forecasts. We are continuing to work on our models which we will share with our Premium Level members.

A note to our Premium Level members – November imports by product, port and country are available on the website. This includes hot rolled, cold rolled, galvanized and other metallic (Galvalume and aluminized – most of which is Galvalume).

Premium Level membership cost $1995 for one person for one year.

Executive Level memberships cost $995 for one person for one year.

Monthly memberships cost $300 per person for one year.

Steel Market Update also has a wide variety of corporate memberships which you can review on our website.

You are welcome to register for a free trial which allows you Executive Level access to our website and you will receive the Executive newsletter three times per week for two weeks.