Market Data

January 4, 2014

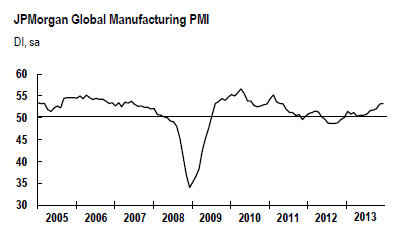

Global Manufacturing PMI Accelerating

Written by Sandy Williams

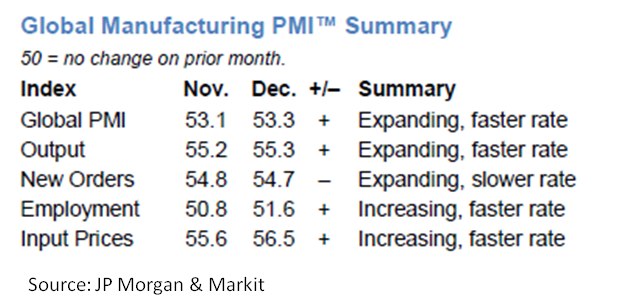

The JP Morgan Global Manufacturing PMI rose to 53.3 in December from 53.1 in November, expanding for the twelfth consecutive month.

Manufacturing production increased at its fastest pace since Feb. 2011, with growth rate of new orders holding steady at November’s rate. Exports rose for the sixth consecutive month. The US, Japan, Germany, the UK and Italy led output growth for the month. France continued to contract while a Canada recorded a sharp slowdown.

In emerging nations production growth was modest other than in Taiwan which reached a 32-month high.

Manufacturing employment had a modest increase in December for the majority of nations in the survey. Job losses were reported in China, France, Spain, Brazil, Russia, Austria and Greece.

Input price inflation was slightly above the survey average and accelerated to a 20 month peak in December. Output price inflation was near a two and half year peak as higher input costs were passed on to customers.

“The global manufacturing sector ended 2013 on a positive note. According to the global PMI, output was rising at the fastest pace in almost three years,” said David Hensley, Director of Global Economics Coordination at JP Morgan. “Both final demand and inventory dynamics are supporting production. In addition, near-term dynamics appear to remain favorable, based on the elevated level of the global new orders PMI.”

Eurozone

The Markit Eurozone Manufacturing PMI reached a 31 month high recording 52.7 in December, up from 51.6 in November. Growth has accelerated in the second half of 2013 with the fourth quarter showing the best performance in two and a half years. Production output, new orders and backlogs rose in December stabilizing employment levels for the month. Purchasing activity growth was at its highest level since May 2011. Input prices were up for the fourth month but inflation was subdued on a historical survey basis. Selling prices increased as higher input costs were passed onto clients. Charge inflation hit a 21 month high.

Chris Williamson, Chief Economist at Market predicts further growth in the manufacturing sector during 2014 will drive modest recovery in the Eurozone economy. France continues to see contraction, recording a PMI of 47 for December for a seven month low and a 22nd month of contraction. Widening export losses indicate a lack of manufacturing competitiveness with its Eurozone peers.

China

Chinese manufacturing slowed in December with the HSBC PMI posting at 50.5, slipping slightly from 50.8 in November. Manufacturing output and new orders increased but at a slower rate last month. New export orders were down, albeit marginally, for the first time since August. Inventories of pre-production goods dipped slightly from the preceding month. Input costs increased in December but at a weaker rate while selling prices declined slightly for the first time in five months.

“The recovering momentum since August 2013 is continuing into 2014, in our view,” said Hongbin Qu, Chief Economist, China & Co-head of Asian Economic Research at HSBC. “With inflation still benign, we expect the current monetary and fiscal policy to remain in place to support growth.”

Japan

Manufacturing activity in Japan has been above the 50.0 PMI no growth mark for the past ten months. The Markit/JMMA PMI posted 55.2 in December, up from 55.1 in November. The output and new order growth rate eased in December but was still well above trend. Higher raw material costs and foreign exchange rates were passed on to customers as higher output prices. Purchasing activity increased in response to higher volume of orders. Export orders rose for the fourth month with demand strongest from Myanmar, Thailand and North America.

Brazil

Stronger production growth and an increase in new orders brought Brazil back into the positive growth range at 50.5 in December, up from 49.7 in November. Input and output price inflation increased in December but at a softer rate. New export orders were flat for the month. Employment levels fell for the ninth month in a row.

Mexico

The Mexico PMI rose to 52.6 in December from 51.9 in November for a ten month high. New orders growth was solid and supported higher production in December. Input and output inventories both rose during the month. Input costs rose but at the weakest rate since June while average selling prices remained unchanged from November. Employment levels increased slightly for the month.

Canada

Manufacturing conditions in Canada continue to show growth but the PMI fell to a four month low of 53.5 in December from 55.3 in November. Output and new order growth slowed from recent two and half year peaks. Strong demand was reported by manufacturers, both domestically and in key export markets like the U.S. Higher raw material costs were passed on to clients through increased selling prices. Unfavorable foreign exchange prices also drove up the cost of imports. Employment rose at a rate weaker than the series average.