Market Data

January 2, 2014

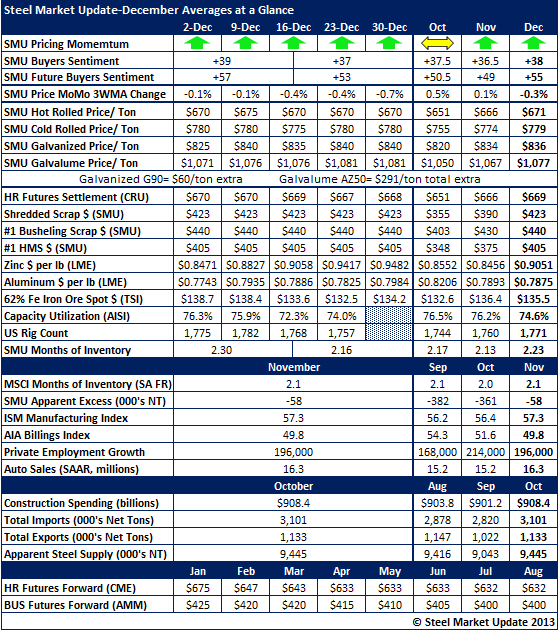

A Look Back at December by the Numbers

Written by John Packard

SMU Price Momentum Indicator ended the month of December where it began, indicating higher flat rolled steel prices over the next 30 days. The domestic steel mills did not disappoint as they raised base price levels to $35.00/cwt on hot rolled and $40.50/cwt on cold rolled and coated (plus extras, FOB mill) for the mills east of the Rockies.

On the West Coast, California Steel Industries (CSI) and USS-POSCO Industries (UPI) came out with price announcements as well. The UPI announcement calls for hot rolled base price levels at $35.75/cwt, cold rolled at $40.00/cwt and galvanized at $42.50/cwt for March production.

Our SMU Steel Buyers Sentiment Index moved higher with an average of +38 for December.

SMU hot rolled prices averaged $671 per ton ($669 at CRU), cold rolled $779 per ton, benchmark .060” G90 galvanized $836 per ton and benchmark .0142” AZ50, Grade 80 Galvalume at $1077 per ton.

Zinc pricing on the LME rose for the first time in quite awhile averaging $.9051 but actually ended the month at $.9482. Galvanized buyers will need to keep an eye on zinc pricing over the next few months to see if this is a new trend or just a blip on the radar screen.

SMU Apparent Deficit on service center inventories (more details available to Premium Level members) dropped from -361,000 tons to -58,000 tons.

Construction spending is growing as are imports of foreign steel and exports of domestic steel. Apparent steel supply for October (last month will full data) was 9,445,000.