Prices

December 9, 2013

Net Imports of Rolled Products in October 2013

Written by Peter Wright

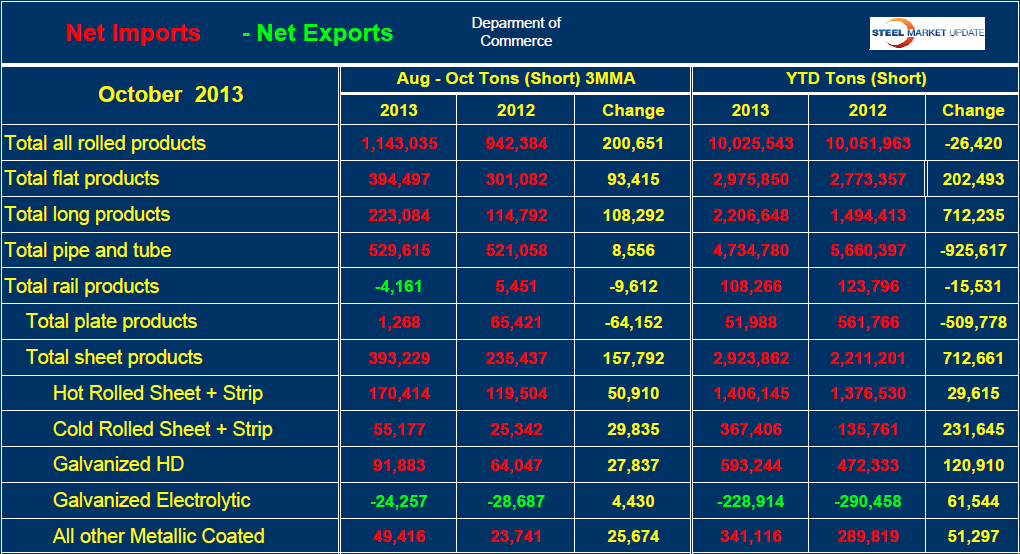

Year to date net imports of all hot worked products combined was 10,025,543 tons, down by 26,420 tons from the first ten months of 2012. This reduction was entirely driven by tubulars and plate. Pipe and tube had a decline in net imports of 925,617 tons and plate a decline of 509,778 tons. All other products except rail had an increase in net imports this year (Table 1).

Long products fared much worse than flat rolled in the first ten months of 2013. Net long imports up by 712,235 tons, net flat up by 202,493 tons. After declining for the first six months of this year, net sheet imports changed direction and increased for the next four months through October (Figure 1). Net long products did almost exactly the opposite (Figure 2). In both cases it was the import side of the equation that caused the change in net.

Table 1 also compares the periods August through October for 2013 and 2012. Electro-galvanized and rail products had net exports this year, (shown in green,) Hot worked products in total had an increase of 200,651 in net imports this year split almost 50:50 between flat rolled and long products. .