Overseas

November 24, 2013

Foreign Steel Import Spreads Widen with Orders Following

Written by John Packard

One of the questions we hear on a continuous basis is, how much foreign flat rolled steel import is really coming and what impact will it have on domestic steel prices (and when)?

Steel Market Update conducted our most recent analysis of the flat rolled steel market over this past week. Based on the responses to our questionnaire we learned the following.

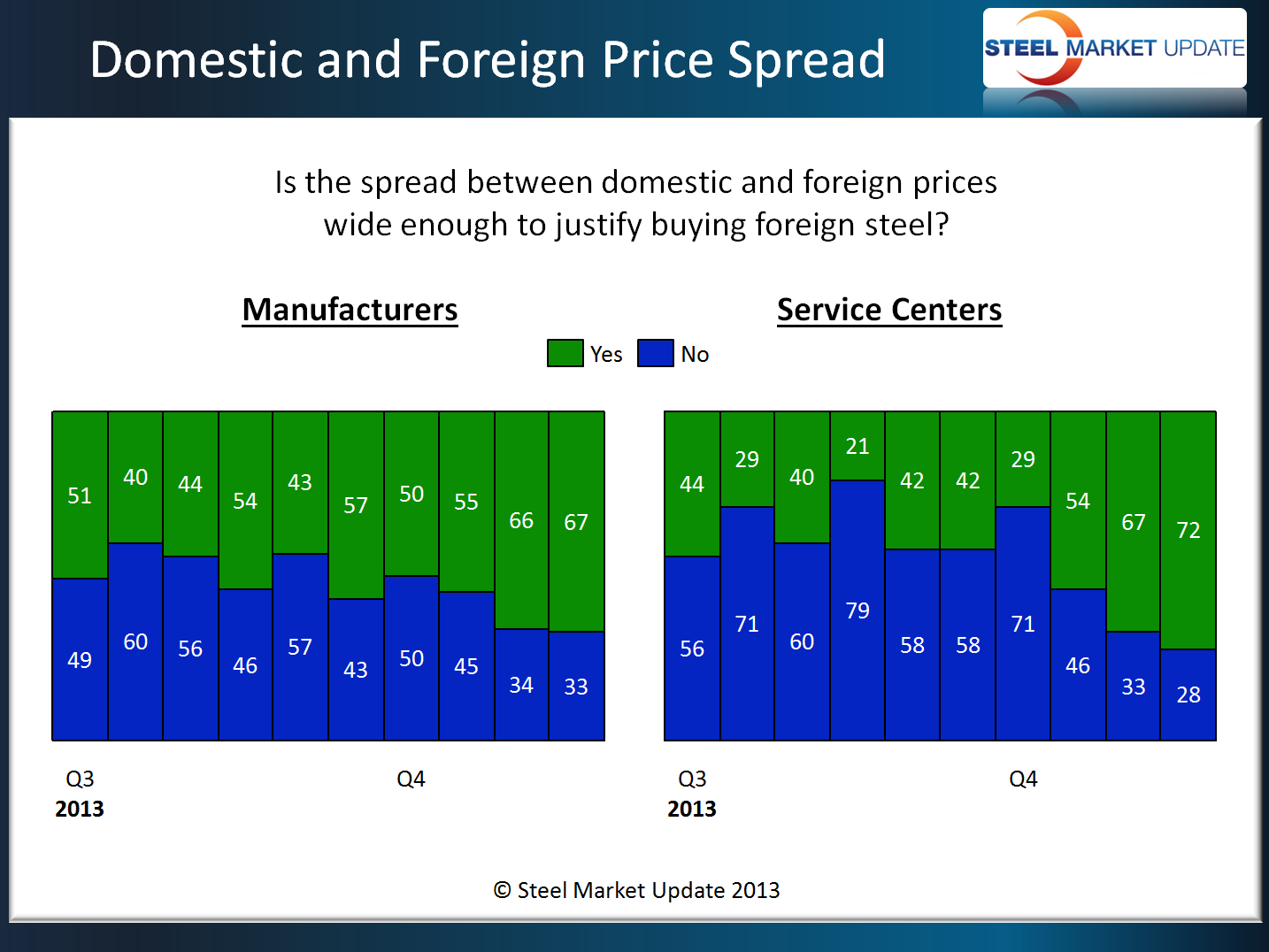

We have been watching the spread between domestic and foreign steel for quite some time. We have found a growing disparity between what the domestic mills want for their flat rolled products and those of their foreign competition. SMU inquires about whether that spread is wide enough to justify purchasing material from outside the United States. As you can see by the graph below the trend has been for a widening gap and more interest in foreign steel by both manufacturing companies and service centers.

What everyone really wants to know is, does this growing spread translate into more foreign orders?

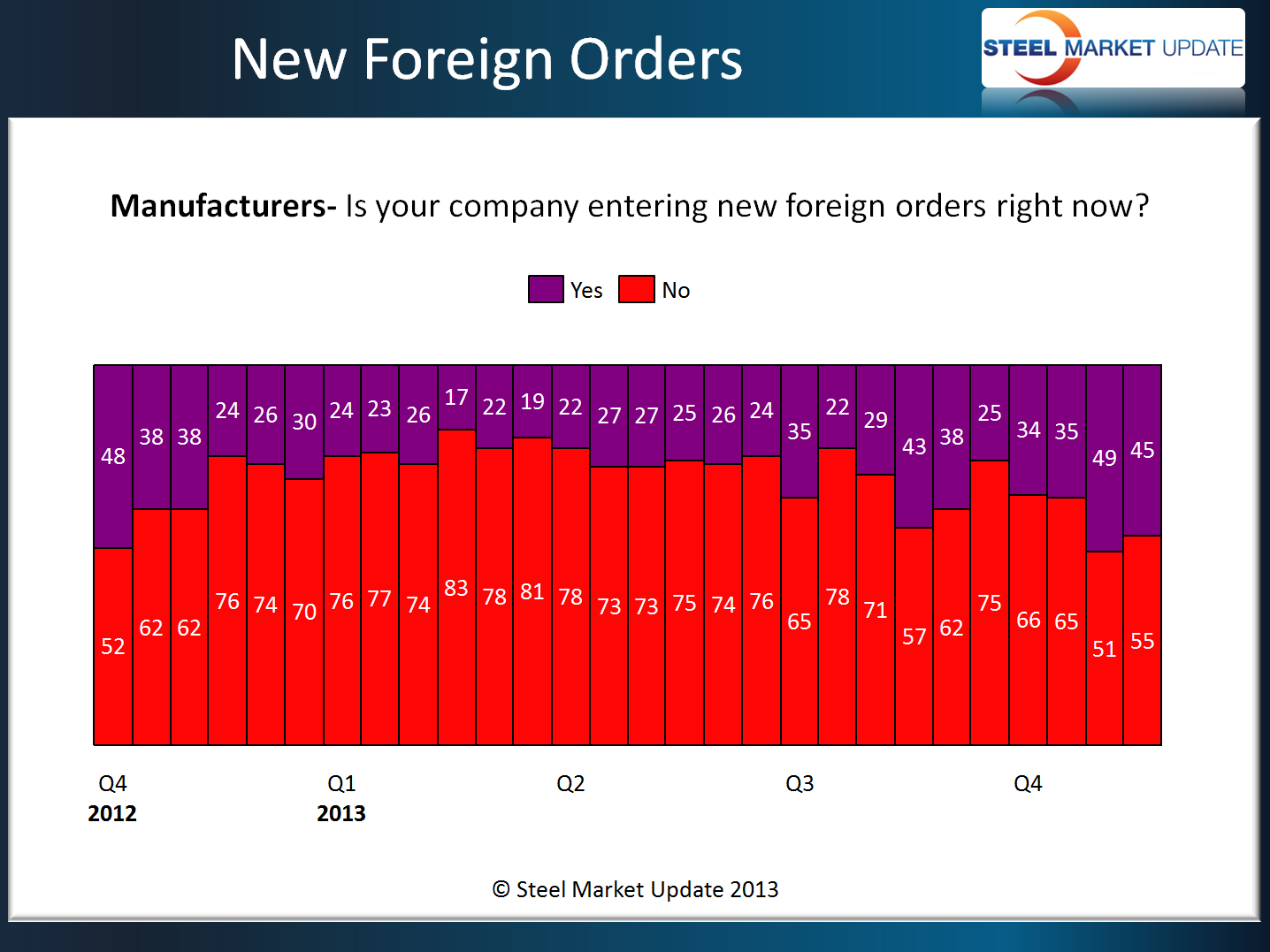

We thought it would be a good idea to produce our response in the context: What was happening at this time last year and has the trend varied from 2012 to 2013. As you can see by our first graph below the manufacturing segment of the industry was actually lessening their exposure to foreign steel as we progressed into 4th Quarter 2012. This year the percentage of manufacturers reporting to SMU that they are buying foreign steel has increased to 45 percent (down from 49 percent at the beginning of November) and almost double the 24 percent reported at the same time last year.

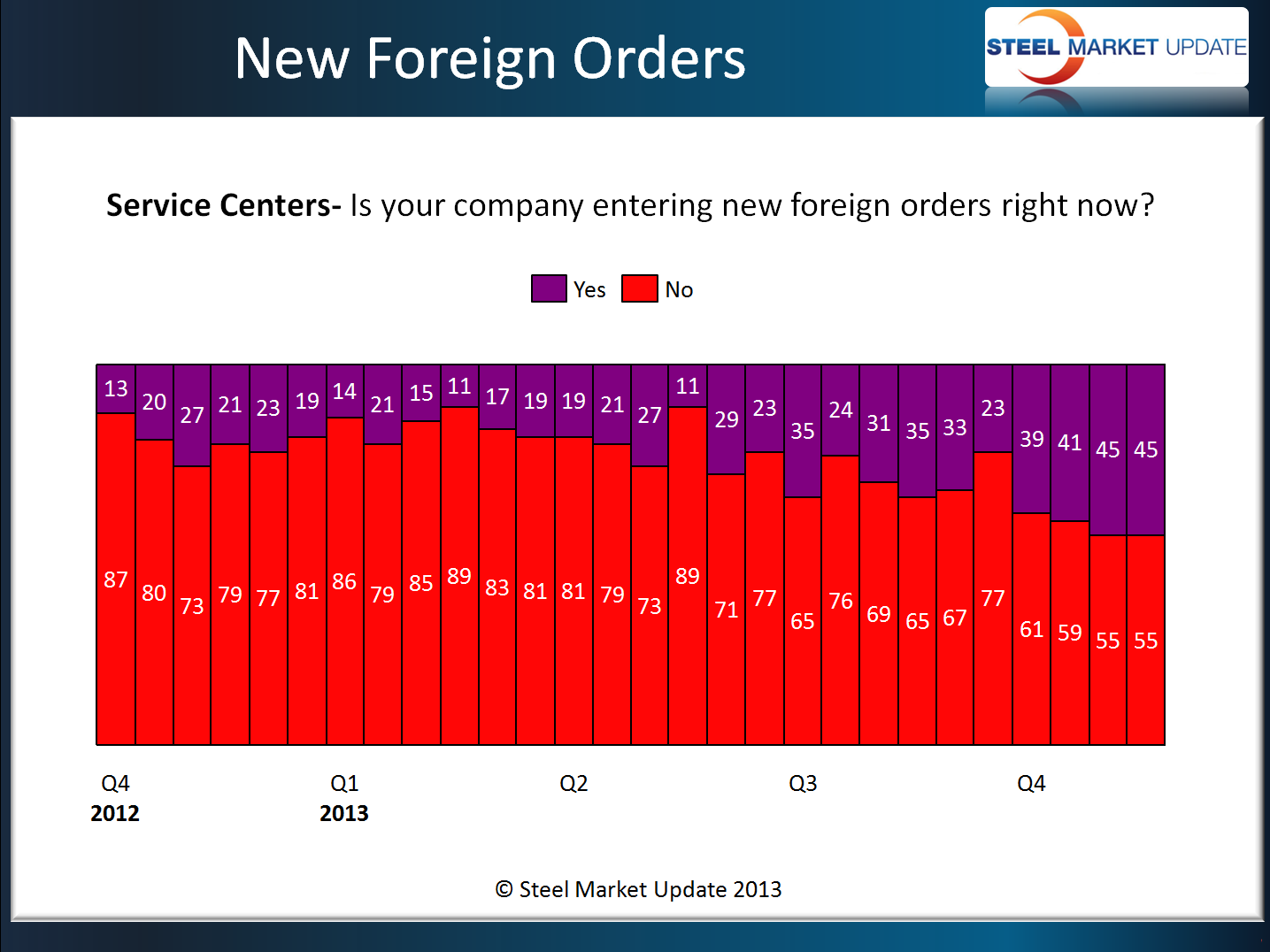

The service center data we have been collecting was even more dramatic than that of the manufacturers. We have seen a clear and growing trend toward placing foreign orders. During the 4th Quarter 2012 the percentage of distributors reporting to SMU that their company was placing foreign orders was 21 percent. The trend continued, with high teens to low 20’s percent levels being reported until we reached late second quarter 2013. From that point the percentages have been steadily increasing, with the last two surveys indicating 45 percent of the service centers reporting they were placing at least some tons in the foreign market.

Steel Market Update traded emails with a trading company this afternoon (Sunday). The trader captured the essence of the existing market as follows: “Domestic pricing puts steel buyers (East Coast especially) in a ‘must buy import’ mode.” He went on to place imported cold rolled at $715-$725 per metric ton, CFR East Coast port. This equates to $643-$658 per net ton well below the $780 per net ton most indices are reporting as average spot prices, fob domestic mill.

SMU believes that a number of the domestic mills are reluctant to push prices higher without commodity prices moving first (such as higher scrap prices). The domestic mills need the gap between their prices and that of foreign to shrink below $100 per ton. If they do not, we believe the percentage of foreign imports hitting U.S. shores will exceed 28 percent and, conceivably, could go over 30 percent of apparent steel supply.