Market Data

November 22, 2013

Steel Buyers Basics: Mill Coating Extras

Written by Mario Briccetti

Last week I discussed how Steel Mills calculate thickness and width extras. This week we will look at Mill coating extras for Galvanized and Galvalume coated steel coil. I am going to refer again to US Steel’s published list of price extras which you can find on their website. Other mills tend to have similar extras but it is important to compare as there can be variations which can be significant depending on the product and thickness.

The US Steel’s pricing extras for Hot Dipped Galvanized/Galvannealed coil chart (HDG) begins on page 23. The base price of HDG coil tends to be about $100 to $120 per ton higher than hot rolled coil so I will use a base price of $38.00/cwt. (SMU latest hot rolled average is $33.25/cwt but for ease of use and example purposes we will use a $38.00/cwt base for coated products.)

For HDG coil there is a thickness and width extra chart and an additional extra chart related to the coating weight of Zinc being put on the substrate. The first chart is similar to what we have seen before – extras based on the thickness/width of the coil. For instance for US Steel’s Fairfield Mill the width/thickness extra for 0.015” min x 40” coil is $3.50/cwt.

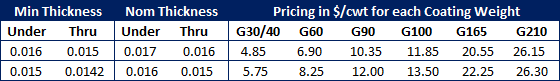

However, the second chart for coating extras we have not seen before. Here is an example based on coil thickness (note that width is not relevant for coating weight extras):

If your coil specification is 0.015” min G90 then your coating weight adder (extra) is $10.35/cwt using the first line of the table referenced above. It would be unwise to specify 0.0149” min thickness since that increases the extra cost for G90 from $10.35/cwt to $12.00/cwt. The extra footage gained would not justify the extra cost.

Hot Dipped Galvanized, just like Hot Rolled and Cold Rolled coil, has a series of other extras related to steel grade and processing.

In the US Steel price book, following the HDG extras section, the Galvalume and Electrolytic Galvanized pricing extras are shown. The pricing in that section is different than Galvanized but is presented in the same fashion as shown above.

Next time a shift of gears to a more general point of view on purchasing.