Prices

November 14, 2013

Iron Ore and Scrap Futures

Written by John Packard

Iron Ore

Resilient is the word best used to describe this market with Iron Ore still $136.6/MT on the index. A third ISM number out of China above 50, this time for October, has some traders quite buoyed by the growth potential there. Growth out of China is as clear as mud as always, but for now it’s looking better and that’s all the traders really care about. Plenty of news around about China’s really really awful air quality, that just got a lot worse with winter approaching, and the efforts planned by the Chinese to shut down some old industrial capacity, i.e. old steel mills. Looks like they may be serious this time, and this could have an effect on demand for ore going forward as those effects are absorbed. We hear less imminent talk about prices dropping. Actually that is what’s needed if it is ever to happen. The market remains backwardated nonetheless. Let’s call Dec ’13 either side of $133.25/MT, Q1 ’14 either side of $130.35/MT, Q2 ’14 either side of $122.75/MT, Cal ’14 either side of $121.75/MT and Cal ’15 either side of $110.75/MT.

Scrap

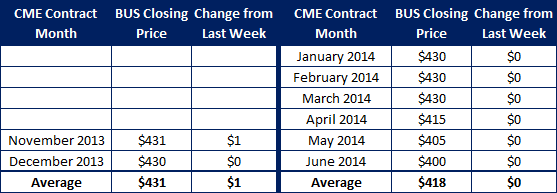

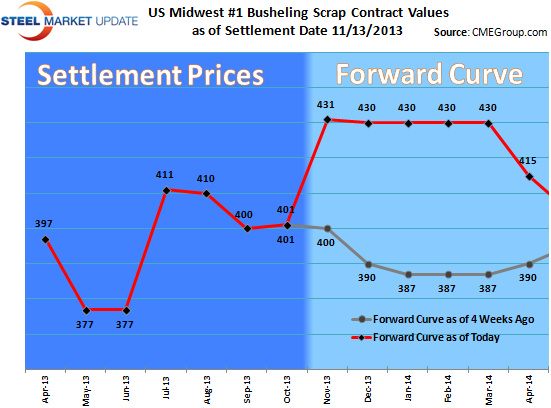

Well we’re up $30/gt plus for November for the MW Prime Index to $430/GT area. The opinions appear mixed from here as to whether Dec enjoys an increase as well. It appears flows are less robust in the East and more interesting in the Ohio valley, and mixed in the Mid West. On the futures side, we have increased interests looking for counters. We have buyers on Dec BUS, and sellers and buyers on Q1 and 1H. All either side of $430-440/GT. In the Turkish market, the last round of buying off our shores, which brought us up to the $395/MT area CFR, has since retraced a bit to $391/MT as the Turks have found more aggressive offers coming out of Europe. Expectations are that they still need to buy a number of cargoes before year end, and that Europe’s supply is not sufficient. We will have to see to what degree Turkish steel demand picture is intact enough to prove out that need for a lot more scrap. Time will tell, but East coast yards holding out for now.