Prices

November 7, 2013

Iron Ore & Scrap Futures Firming

Written by John Packard

TSI Iron Ore: Market Remains Firm

Iron ore prices have continued to be strong as Rebar futures have bounced off recent months lows last week and spot steel in China continues to go higher. Over the past couple of weeks iron ore prices have pushed up around $5/ton down the curve with Q1 trading around $130, Q2 $122 and the cal 14 at $121. Volumes remain very strong both in the physical market as well as the futures market as ore record level of ore has moved out of Australia’s Port Hedland in October. There is still some wariness in the market as to whether prices can top $140 this year before retreating. As always time will tell…

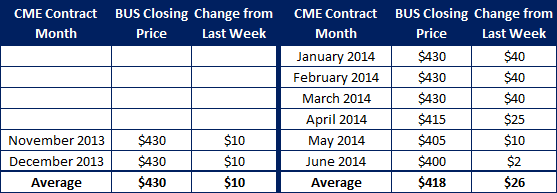

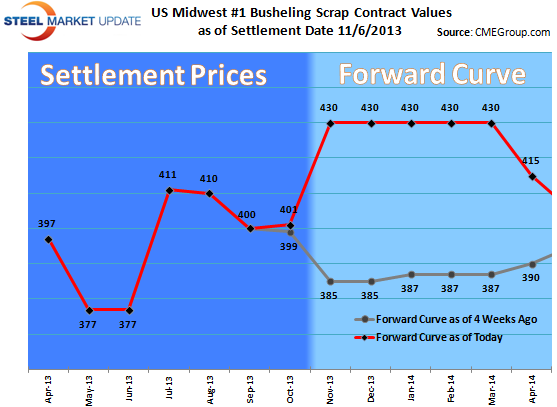

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Prices Continue to Firm

The busheling futures market continues to go from strength to strength this past week as prices have continued their upward trend. The Nov and Dec have been bid as high as $450 / ton last week before pulling back to around $430. Dec and March traded small volume yesterday at $430 per ton, registering the first cleared trade in months which hopefully is a sign of good things to come as volatility looks to re-enter the physical market. Indications are that the market will settle up at least $30 dollars to $430 in November and possibly up again in December . The continued strength in finished steel prices plus the historically strong winter periods for scrap pricing have coincided to push prices higher.

Again, there have been no reported trades this past week.