Prices

November 7, 2013

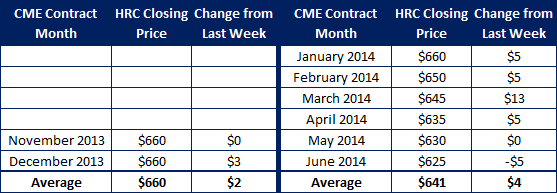

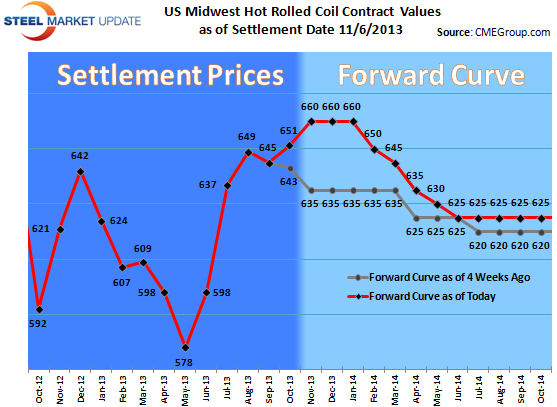

Hot Rolled Coil Futures Ascend Amidst Mill Price Hikes…

Written by John Packard

As expected a couple of mills have announced hot rolled coil price increases today, with more expected to follow in the coming days. These hikes have been anticipated by most in the physical market but appear to have caught a few in the paper market off guard as bids quickly entered the market at extremely high levels for the Dec contract at $674 and $660 for Jan. As it stands now the paper market looks to be in a full upswing as offers have left the market and bids have become more aggressive. With scrap prices settling around $30 higher the market looks to remain firm for the next few weeks.

The futures market has seen a definite uptick in volumes over the past couple of weeks that coincides with a renewed belief that the physical market will move higher as we get closer to the end of the year. A mixture of short covering and new longs coming into the market have spooked sellers. As for now it looks like the direction is only one way. To play devil’s advocate, the threat of imports and the actual imports coming into the market in q1 may damper sentiment but it appears that for now it is all go go go….

Volumes have surged over the past week with over 60,000 tons trading.