Market Data

October 31, 2013

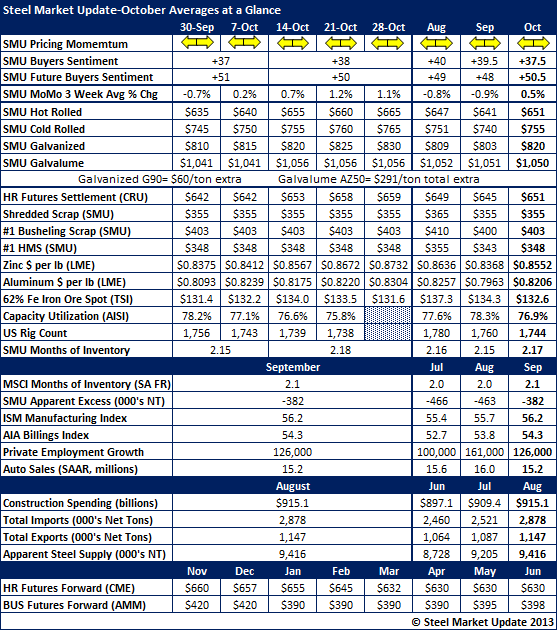

SMU End of Month Data – October

Written by John Packard

It has now been three consecutive months that the SMU Price Momentum Indicator has been at Neutral. Flat rolled steel prices have broken out of the $640 per ton doldrums with benchmark hot rolled coil haven risen to $665 as of earlier this week.

The monthly average for benchmark hot rolled is $651 per ton which happens to be the same as the CRU hot rolled coil settlement number for HRC Futures trading.

SMU Steel Buyers Sentiment Index averaged +37.5 for the month. Sentiment has been dropping over the past three months. However, Future Sentiment – which measures how buyers and sellers feel about their company’s ability to be successful 3 to 6 months in the future continues to be high at +50.5.

SMU MoMo (price momentum measured on a scale) broke out of negative territory during October as prices began to move higher.

MSCI flat rolled inventory levels came in at 2.1 months while SMU inventory levels were measured at 2.17 months (average of the two surveys taken during the month of October).

SMU Service Center Apparent Inventory Deficit at the end of September was -382,000 tons down from 463,000 tons at the end of August.

Imports are much higher and exports (report below) were also higher during the month of August (last month data has been completed).