Prices

October 30, 2013

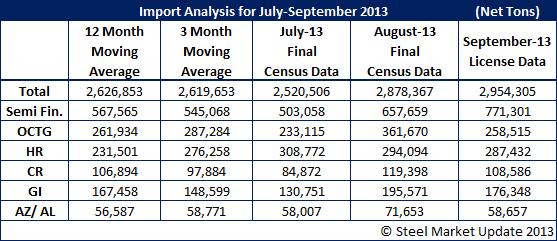

August Imports Surge by 368,000 Tons Due to Slabs & OCTG

Written by John Packard

The U.S. Department of Commerce released final August import numbers late last week. August steel imports rose by 368,606 net tons to 2,878,367 net tons due to higher slab, OCTG, cold rolled and hot-dipped galvanized imports. Slab imports were up by 140,252 tons over the prior month to 657,659 tons total. However, this was expected as ThyssenKrupp Steel USA continues to build back their inventories. Brazil, which is where the ThyssenKrupp CSA slab mill is located, shipped 374,322 tons of slabs during August which was an increase of 74,802 tons above their July numbers. We also saw increases in slab shipments out of Russia and Mexico.

Also of significance was oil country tubular goods (OCTG) which saw August tonnage increase to 361,670 net tons or 128,555 tons more than the previous month. This was also the highest level of OCTG imports since May 2012 when 379,862 net tons were brought into the United States. The largest exporting country continues to be Korea which evidently is not concerned about the dumping suits filed against the country by a number of domestic tubular mills.

Based on preliminary license data, Korean OCTG imports will reach 116,194 net tons during the month of September. Korean OCTG imports during the month of July totaled 60,111 net tons.

Cold rolled imports rose to 119,397 net tons during August but are forecast to drop slightly during the month of September to 108,586 net tons.

Hot dipped galvanized imports rose from 130,750 net tons in July to 195,570 net tons in August. This is the highest level of HDG imports during the past 12 months. September HDG imports are forecast to be down slightly to 176,347 net tons.

Other metallic imports (vast majority of which are Galvalume) rose to the highest levels of the year reaching 71,653 net tons. This is up 13,647 tons over the 58,006 tons imported into the U.S. during the month of July.