Prices

October 25, 2013

September Raw Steel Production Down

Written by Brett Linton

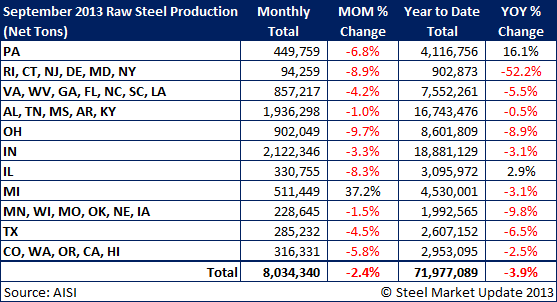

The American Iron & Steel Institute (AISI) reported their final raw steel production numbers for the month of September 2013. This estimation is different than the weekly raw steel production as it is based on 75 percent of the domestic mills reporting vs. 50 percent for the weekly estimates.

Total raw steel production for the month of September was reported to be 8,034,340 net tons with 4,854,926 NT being produced by electric arc furnaces (EAF) and 3,179,414 NT produced by blast furnaces. September raw steel production was reported by the AISI to have been 2.4 percent lower than the previous month.

Total raw steel production in 2013 throughout September is now 71,977,089 NT which is 3.9 percent below that of 2012 through the same time period. The capacity utilization rate for the month of September was reported to be 78.3 percent and 77.0 percent in average for 2013 so far. (Source: AISI)

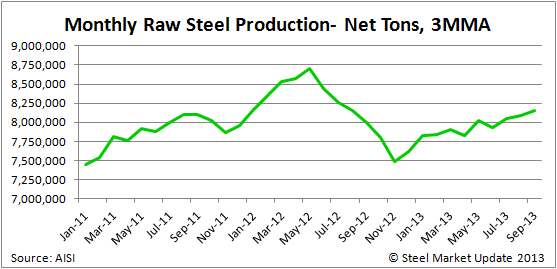

Below is a chart showing the monthly production figures in a 3-month moving average.