Prices

October 24, 2013

Hot Rolled Futures Wobble as Price Seemed to Have Peaked…

Written by Bradley Clark

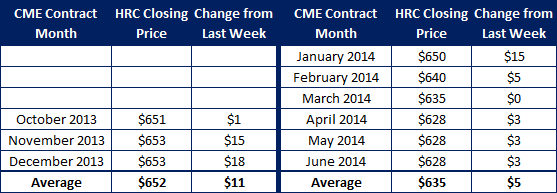

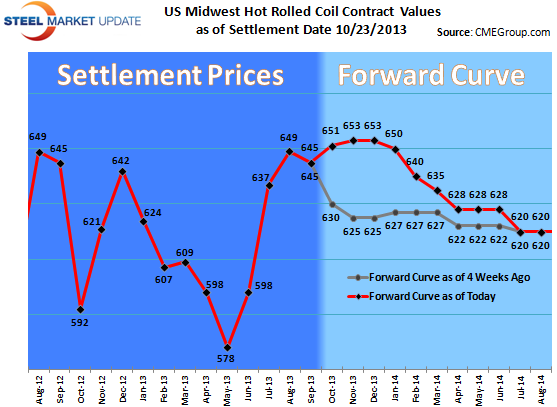

The recent strength in the physical market has sent futures prices up over the past month. This week, however, prices have begun to soften as most market participants feel the market has reached a top. Talk of revived imports coming in as well as some domestic mills offering deals a bit below published prices has given ammunition for sellers to start attacking bids down the curve. While so far a big move has not been made, weakness down the curve prevails. After peaking around $660 last week November and December futures periods have traded down to $653 today. The back end of the curve remains at a fairly steep discount to the spot with the calendar ‘14 value around $630 and Q1 trading around $645 and Q2 $625.

It seems too early to call whether this recent weakness will be justified as mill for the most part continue to hold a firm line on prices, the question remains that in a fundamentally oversupplied market and with the US domestic market being the strongest destination for steel, how long can prices remain high. Scrap will be up at least $20 for prime in November which should give the finished products some support in the short term. As we approach the end of the year it will be interesting to see who wins this grand game of chicken between bears and bulls.

Volumes have been excellent over the past week with over 50,000 tons trading.