Prices

October 18, 2013

Hot Rolled Futures: Active Again

Written by John Packard

Financial Markets:

Okay now that that mess is over with, the S+P 500 and other U.S markets can get back to the business of what they do best – Go Up! In fact we, have already reached all time highs (again) today with the S+P 500 at 1733. As I noted, we are likely headed to the 1775-1800 zone in the immediate term and possibly even further. We are in the fall, when the market typically rises, funds are underweight, and they will want to add to risk into yearend, pushing the market even higher. Don’t worry that the market has already risen 24.6% since January 1st, in this “government prints money for its own debt environment” the history shows you can pretty much just own stocks with impunity. Of course, the market will get the shakes again come January when this whole debt crisis re-appears, but until then just “buy em”;)

Copper has risen back up to the upper end of its range at $3.295/lb, but has seen little impetus in this still uncertain macro environment. Expectations are for supply to outpace demand again by mid-year of 2014, the supply disruptions will be out of the way, and so, for now in the interim, there is balance. However, risk takers are wary to bet too much on this industrial metal with those fundamental forecasts and uncertainty around the Chinese macro picture. Crude meanwhile has come off further to $100.75/bbl on the back of uncertain economic conditions in China, and the world, and a relaxation of that Middle East worry premium we had earlier in year. It needs to hold $100/bbl otherwise we are headed to $90/bbl. quickly.

Steel:

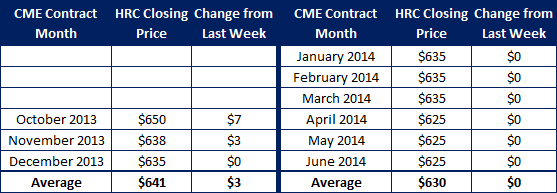

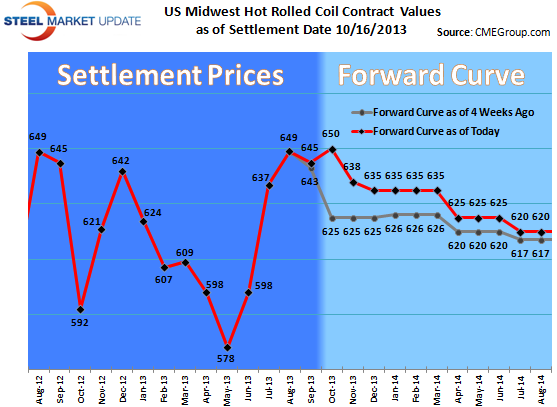

Futures have been active again. We had 2405 lots trade in the week, or 48,100 ST. HR is back to good volumes and we are on pace to have a very strong year. The uncertainty in the markets has brought greater attention to end users and producers of the inherent value in being able to secure pricing in the future outside of physical transactions. Many are now in the process of getting in a position to execute hedges. Are you one of them? Feel free to call if you need help doing so.

We have seen further short cover in the nearby months with transactions between $636 and $655 go through, on November mostly, as time creeps on and pushes any dip further out. Ca’ 14 mos still in the $635-645/ST zone depending on period. Meanwhile nothing seems to be moving in the market to change this gridlock. We all wait, except for those in the import sector, which is gaining traction on Q1 deals as the foreign differential becomes too enticing for some in a market where domestic prices are holding up for now.

Iron Ore:

Steady in this market at $134/MT zone on the index in this re-stocking period in China. Rio Tinto has further units hitting the market in the current environment and so some watching that to see if can get absorbed effectively. Market still backwardated with no discernible changes in the forward levels. Let’s call Nov. ’13 either side of $132/MT, Dec. ’13 either side of $132/MT, Q1 ’14 either side of $130/MT and Cal ’14 either side of $121/MT.

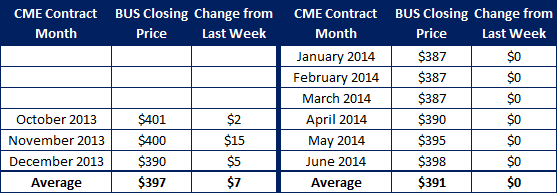

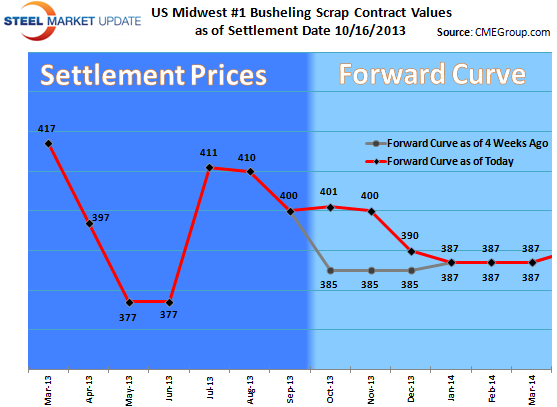

Scrap:

Futures are quiet still, but interest has circulated of late on Nov/Dec, last $400/$415. In the spot world early indications are that scrap will rise, range estimates run from $10-20/GT. We’ll know more in two weeks about where mill orders are as buyers seem to hold their ground for now. CFR Turkey has remained stable having risen to $375/GT, the uptick from $367/GT level a couple weeks back due in part to currency fluctuations and some re-stocking going on into the winter season. No fireworks expected here however as demand in the MENA region still suffering and excess units from other shores continue to pressure margins.