Prices

October 11, 2013

Hot Rolled Futures: Wow, Look at that Volume!

Written by John Packard

Financial Markets:

Two weeks back we suspected that the SP 500 and other US equities markets would struggle with all this Government Shutdown shenanegans. Sure enough, the SP 500 dropped progressively down to a low of 1646 yesterday from the 1697 level we had two weeks ago. However, since the announcement today of the preverbial “kick-the-can” down the road not-resolution that the executive and legislative branch have agreed upon, the market has rallied a tremendous 36 points of relief. Yeah!, Really?!. So we are pretty much where we were two weeks back, 1693 area.

Market clearly has been in a raging Up mode for 5 years now, but it still has more to go. It wants all of these problems resolved so it can get back to buying. I expect we will have more volatility from here as the market is pulled between wanting to go higher, and being disappointed by our politicians who likely will continue to fail for some time to get any permanent resolution completed. Hope lies in that Obama’s legacy may be at risk. Republicans have already thrown their political future to the winds, not so sure Obama willing to do the same. Keep your fingers crossed.

Copper and Crude tell us little. They have been fairly stable and they too are simply being pulled by something else. In this case the USD, which seesaws back and forth on each latest announcements about the government crisis. Copper is down about 10 cts from two weeks back, but is still within its trading range of the last two months. We are last trading $3.2375/lb area. Crude meanwhile is about the same as two weeks back at $$102.84 today v. $103.3 then. Crude however looks like a bear flag pattern as it likely wants to work its way to a range devoid of any imminent Middle East issues. Should have pretty good support around $100/bbl., which was resistance zone on the way up.

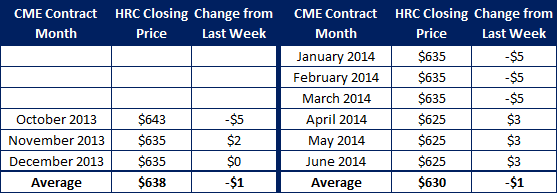

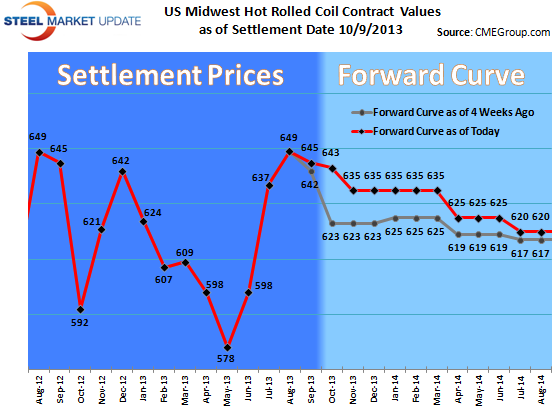

Steel:

This has been a big week in Steel futures as price increases in the spot market have brought buyers and sellers to the table on futures. We have traded 170 contracts or 35,400 ST, all traded in the months of November and December! Wow look at that volume! Yeah! That might be a record. I will have to check. The prices haven’t changed much in the week as initial volumes were triggered by buyers coming in due to the price increase announcements (some short cover and some hedging buying basis Open Interest changes) and further volumes traded mid and end week when the CRU price didn’t move up $642 despite the price increases the week prior, and sellers came in and appeared to hit standing bids in the market. The range has been pretty much $635-640/ST on the nearbys with slightly lower levels indicated for the Cal ’14 months, which was last offered $633/ST for size. Can anyone say “steel mill involvement”;

Iron Ore:

Iron Ore remains stable to slightly up after the return of Chinese from holiday and a little restocking. We are last $133/MT on the index up a dollar from earlier in week. The futures remain backwardated and many view the market with caution going into November as Chinese economic health uncertainty prevails, and the seasonal construction season passes with a whimper. Let’s call November either side of $129/MT, December either side of $126.75/MT, Q1 ’14 either side of $124.25/MT, and Cal ’14 either side of $116.25/MT.

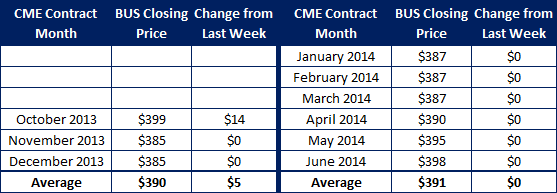

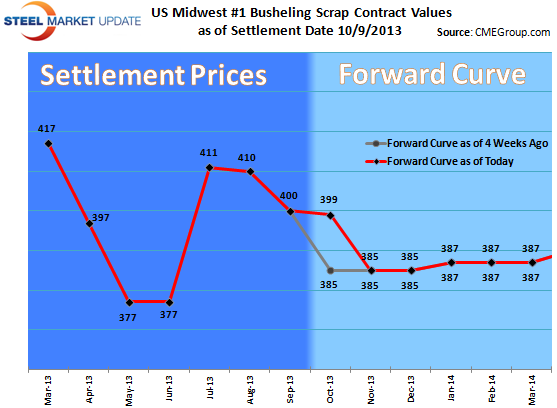

Scrap:

The market ended up not dropping and most had expected, we posted the AMM Index price today at $401.16/GT essentially flat to last month. Chatter for next month is expectation of flat to slightly up, but it’s a long way to next month. Flows have been modest coming out of a period of heavier EAF participation and expectations that the winter season is coming. Meanwhile the CFR Turkey market is also stable to slightly up, having risen a few dollars in the last couple days to $377/MT as Europe supplies are slow while Turkish mills look to replenish before their holidays. Turkish steel demand remains tepid so expectations for the extent of price increase so scrap remain muted. Futures markets in both BUS and CFR have been quiet.