Prices

September 26, 2013

Hot Rolled Futures: Fundamentals Reign

Written by Andre Marshall

When I last wrote two weeks back the SP 500 had failed to break down as expected and technicals suggested we were headed to 1775 as next long term target. Well within one week of that report the SP 500 hit 1730 from that Sep 12th 1685 area. This rally was in large part due to the, at the time, stunning report by the Fed that they would indeed NOT start to taper the bond buying program as had been claimed pretty much all year. We have since retraced back off those highs to settle 1697 area today. Technical picture is still bullish, but I expect the market to retrace further on the concerns over the government funding extension, which comes due Monday, and the ensuing debt ceiling argument, which appears to be a bit of train wreck. I see SP touching 1665 area at a minimum before finding support, if it breaches that support then we should see 1635-40 zone at least, if not lower, should the powers that not get to a resolution quickly.

In Copper, we have picked up about 10 cts/lb in these two weeks as both technical CTA traders and Macro fund traders have gotten long commodities again on the back of the weaker USD shift (linked to the Fed’s surprise announcement). We are last $3.3040/lb. in Copper. In Gold, we have had been a bit calmer market than the prior months as we are essentially flat to two weeks back at $1324/oz, but only after having risen to $1375/oz and coming off again (again USD driven). In Crude, we have tested support right here at $102.3/bbl zone today and bounced for now to $103.03/bbl last. We are at a critical juncture in Crude where if we break support here we will next head to $98.00/bbl, likely to find real support closer to $92/bbl. My guess is likely with the Middle East tensions easing.

Steel:

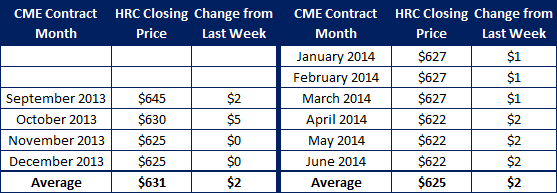

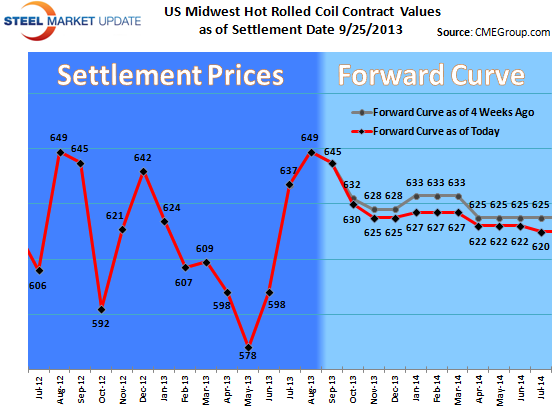

Another quiet week in futures as the market has only traded 226 lots or 4520 ST. Prices have barely moved at all with the few trades happening within a few dollars of last week’s levels. The CRU posted at $642 which was level to the prior week. It feels like the market is still waiting.

I have noted in my conversations of late that many people have been surprised by the lack of movement in the steel price, i.e. retracing back to lower levels. So I decided to check this year’s summer price history with last year’s, which was also a supply constrained rally in an “unusual” time in the cycle, to see whether, if indeed, this trajectory on price has been unusual.

You might recall that last year’s supply disruptions were due to a combination of strike threats at USS and AM, the No 14 Gary furnace down for re-line, and the exit of RG Steel, and an $80/ST price increase in scrap in August due to heavy restocking and export sales.

What I found out about the price comparison surprised me considering this year’s perception. This year’s August average of $649/ST was the exact same as last year’s. This year’s September average of $643/ST was actually about the same as last year’s of $645/ST. Last year’s price cycle drop happened all of a sudden when the mills had metal they had to place in October. Last year in October alone the market dropped $36/ST to $591/ST, the low, or an average of $9/week (October this year has 5 weeks). Sometimes it helps just to step back from the trees to see the woods. I don’t know what the price trajectory brings into this next quarter, but I do know that what we have seen thus far is pretty much in step with what we saw last year to this date.

As for the idea that this time is different and that maybe the price won’t come off, I would say that fundamentals always reign. Last time I checked we have a chronic overcapacity situation in the World, and in the US. In steel and there does not appear to be a particularly strong demand story globally, or even here, to suggest that the overhang of supply will be absorbed anytime soon.

There is a backlog of orders being worked down, more so in HR than in products, but once it is worked down, we are back to fundamentals. Inventory levels being lower than normal can be a factor in a rising price market with increasing orders, but will have no logical effect on pricing in a downward pricing market with stable to lower orders. A speculative unit is a speculative unit regardless of inventory. Can actions change the course of price discovery? Only for short periods if the fundamentals run contrary to those actions, and usually with consequences later on. For the 22 years I’ve been in commodities, my experience is that “this time” is never different, and that commodity markets always have cycles. A more permanent cycle shift higher or lower, like in 2007, can only happen when fundamentals are aligned with that shift. That is not the case today. So in this author’s opinion, no, this time is not different. With widespread reports of OEM’s booking deals end year and into next year at May ’13 type prices, and at least two mills already offering CRU less 5% index deals, I’d say the market already senses the same. Market share is still too important in an oversupplied market.

Iron Ore:

Initial reports from the China Iron Ore conference going on this week are one of confusion about the direction of their markets. With Rebar having dropped just under 4% in the month, it’s is surprising to see the mills there continue to buy and operate at such high capacity levels thus supporting the Iron Ore price. The index today came in at $133.80/MT, where it has been holding within a couple dollars for a couple weeks now. The forward curve is still backwardated suggesting the market has no confidence in Iron Ore prices increasing over the course of the next year or beyond. Many in the trade feel that it is still only a matter of time before Iron Ore prices will succumb to market fundamentals.

The ever stricter lending conditions by China’s banks are a likely culprit of that correction as it starts to pinch the production channel more firmly. So goes rebar, so goes Iron Ore, so goes world ferrous values. Unfortunately China’s production at over half the world’s capacity is just too big to ignore over time. Everyone appears to be waiting for September’s economic numbers there hoping that an upward trend may be developing to avoid such a correction.In the meantime, let’s call Oct ’13 either side of $130.50/MT, Q4 ’13 either side of $127.5/MT, Q1 ’14 either side of $124.50/MT, and Cal ’14 either side of $116.00/MT.

Scrap:

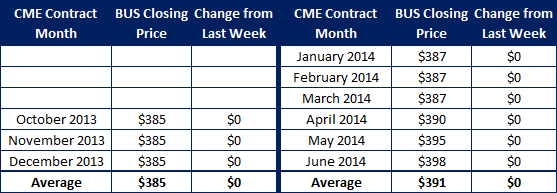

Futures have been quiet in both domestic busheling and CFR Turkey markets. Both Q4’13 periods are offered at slight discounts to spot levels with no buyers showing interest. Same holds true for Black Sea Billet.

Turkish steel demand has been weak enough that their interest in our units off East Coast have been non-existent of late. Until their demand picture improves or until the USD loses a lot more value, I am not expecting this to change. No help as yet from containerized exports to China and India which are both struggling with their own economies. SE Asian exports which had been helping a bit of late have also cooled as steel prices in SE Asia and China have all pointed downward in the last week for both longs and flats. So demand for import scrap will continue to be constrained in that environment.

For domestic scrap, spot expectations are down again for October $10-20/GT depending on who you are talking with, and whether for primes or Shred. For CFR Turkey, we have held steady at $361-361/MT zone, at least until October’s US prices are known. This will likely pull those levels down a tad.