Market Data

September 26, 2013

Gross Domestic Product (GDP) Estimates 2nd Quarter at 2.46%

Written by Peter Wright

The Bureau of Economic Analysis’s third estimate of GDP growth in the second quarter was 2.46 percent q / q, little changed from the 2nd estimate and up from 1.1 percent in the first quarter. The official news release is included below. All major sub components made positive contributions except government expenditures and net exports which both had very small (-.07 percent) negative contributions. The biggest contributors to the growth improvement from Q1 to Q2 were in non residential fixed asset investment which had a 1.1 percent swing from – 0.57 percent to + 0.56 percent and the negative contribution of government expenditures shrank from – 0.82 percent in Q1.

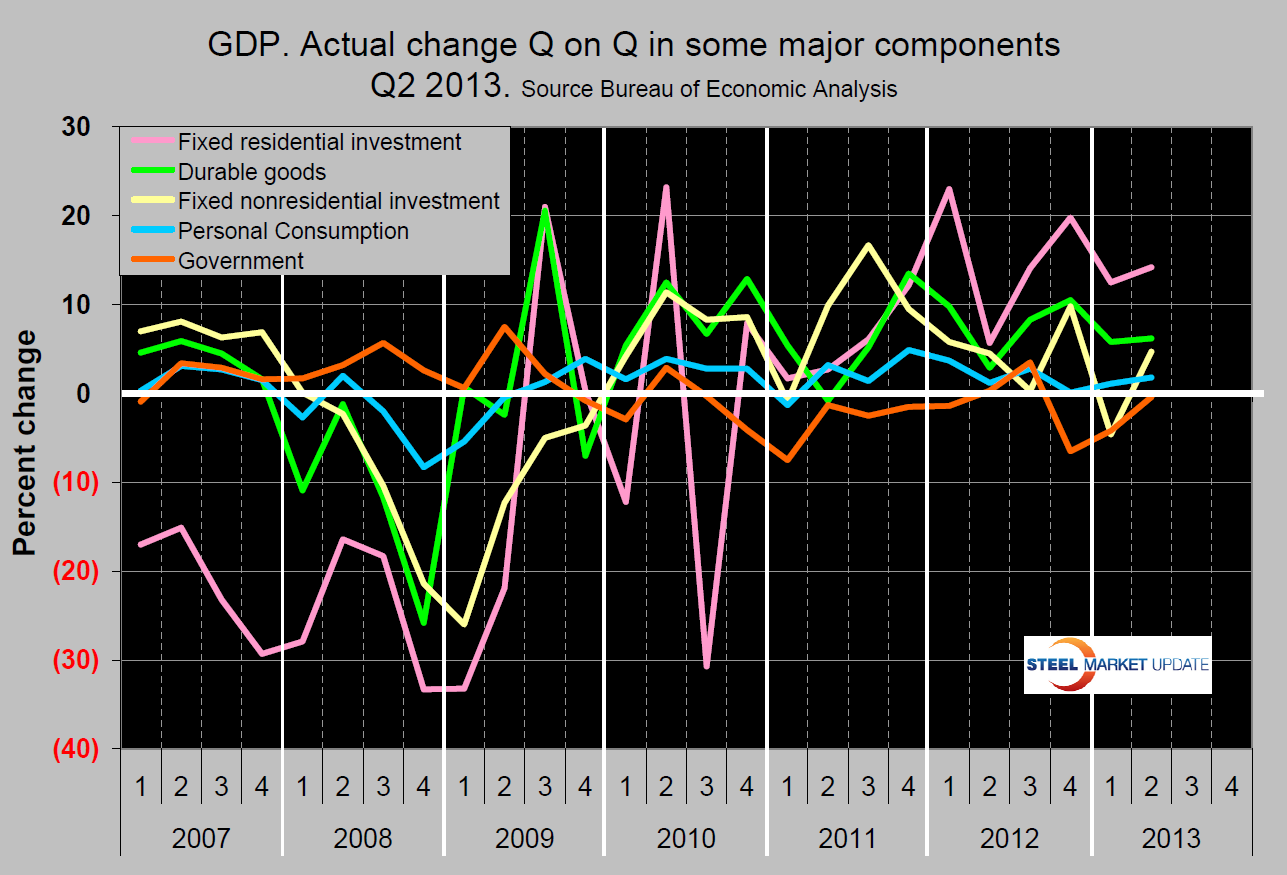

Figure 1 breaks out the individual components and measures their actual growth q / q as a single data stream. This should not to be confused with its contribution to overall GDP. This aspect is important to steel producers and consumers because it confirms the strong growth of residential construction and the Census Bureau’s report of durable goods orders.

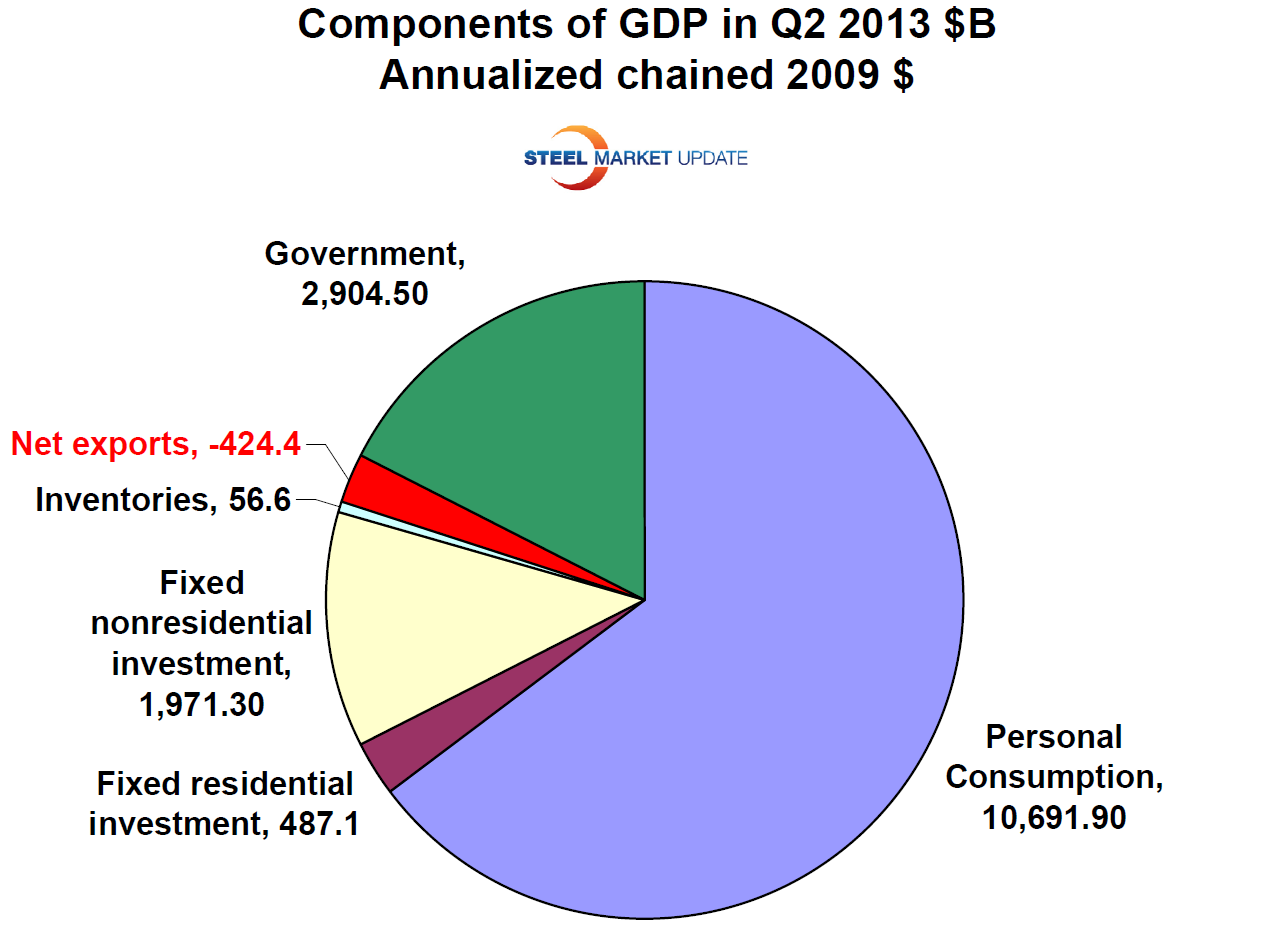

Figure 2 shows total GDP which has an annualized volume of $15.680 trillion and its sub component dollar contributions. Personal consumption currently accounts for 68.2 percent of total GDP. This not just a measure of the consumer’s performance at the cash register but is somewhat a catch all including durable goods, non durables and services.

The official news release from the BEA released this morning read as follows:

GROSS DOMESTIC PRODUCT: SECOND QUARTER 2013 (THIRD ESTIMATE)

Real gross domestic product — the output of goods and services produced by labor and property located in the United States — increased at an annual rate of 2.5 percent in the second quarter of 2013 (that is, from the first quarter to the second quarter), according to the “third” estimate released by the Bureau of Economic Analysis on September 26th. In the first quarter, real GDP increased 1.1 percent.

The GDP estimate released today is based on more complete source data than were available for the “second” estimate issued last month. In the second estimate, the increase in real GDP was also 2.5 percent. With the third estimate for the second quarter, the general picture of economic growth remains largely the same.

The increase in real GDP in the second quarter primarily reflected positive contributions from personal consumption expenditures (PCE), exports, nonresidential fixed investment, private inventory investment, and residential fixed investment that were partly offset by a negative contribution from federal government spending. Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP in the second quarter primarily reflected upturns in exports and in nonresidential fixed investment, a smaller decrease in federal government spending, and an upturn in state and local government spending that were partly offset by an acceleration in imports and decelerations in private inventory investment and in PCE.

The price index for gross domestic purchases, which measures prices paid by U.S. residents, increased 0.2 percent in the second quarter, 0.1 percentage point less than the second estimate; this index increased 1.2 percent in the first quarter. Excluding food and energy prices, the price index for gross domestic purchases increased 0.8 percent in the second quarter, compared with an increase of 1.4 percent in the first.