Prices

September 23, 2013

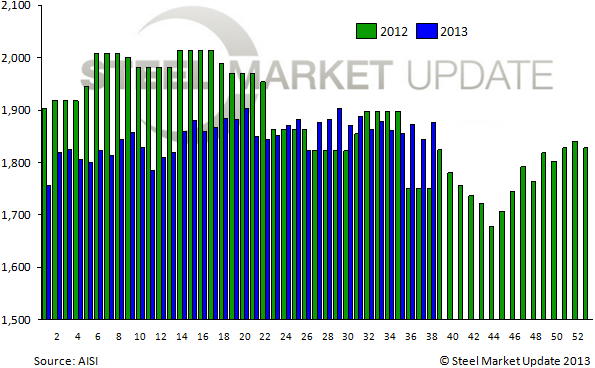

AISI Estimated Raw Steel Production & Capacity Utilization Rates

Written by Brett Linton

For the week ending September 21, 2013, the American Iron & Steel Institute (AISI) reported that the U.S. steel industry produced 1,877,000 net tons of raw steel, a 1.8 percent increase over the previous week and a 7.2 increase over the same week one year ago. The estimated capacity utilization rate is 78.3 percent, up from 76.9 percent last week and up from 70.4 percent last year.

Estimated total raw steel produced for 2013 YTD is reported to be 70,301,000 NT, down 3.6 percent from the 72,893,000 NT produced through the same period in 2012. The average capacity utilization rate for 2013 YTD is estimated to be 77.2 percent, up from 77.0 percent for 2012 YTD.

Estimated total raw steel produced for 2013 YTD is reported to be 70,301,000 NT, down 3.6 percent from the 72,893,000 NT produced through the same period in 2012. The average capacity utilization rate for 2013 YTD is estimated to be 77.2 percent, up from 77.0 percent for 2012 YTD.

Week-over-week changes per district are as follows: North East at 217,000 net tons, up 7,000 tons. Great Lakes at 654,000 NT, down 3,000 tons. Midwest at 241,000 NT, up 2,000 tons. South at 685,000 NT, up 16,000 tons. West at 80,000 NT, up 12,000 tons. Total production was 1,877,000 NT, up 34,000 tons.