Prices

September 19, 2013

Iron Ore & Scrap Futures

Written by Bradley Clark

TSI Iron Ore: Prices Wobble in Signs Market is Cooling…

Iron ore prices have softened over the past couple of weeks, but are still holding the recent range above $130 per ton. Mixed news out of China regarding steel demand has cooled off buying for the time being as the market has failed to break through the recent ceiling on prices. The forward curve remains significantly backwardated with Q4 trading at $128, Q1 126 and cal 14 at $117, indicating that general market sentiment is that the question is when rather than if prices will retreat.

Volumes on SGX remain very strong.

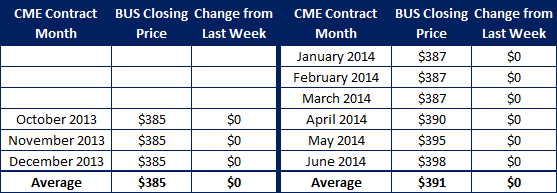

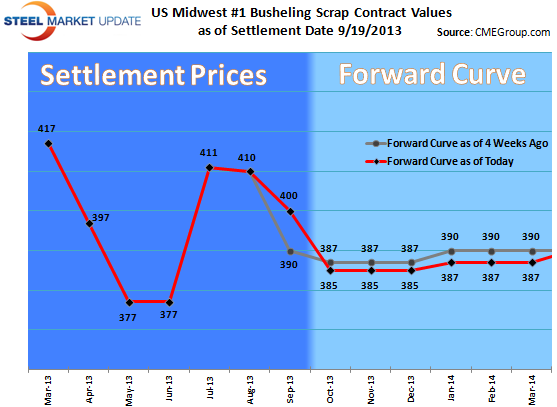

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Mid-Month Stagnation

There is very little to say about the busheling futures market as no trades have been reported and very few prices if any have been seen in the market. As has been the case over the past years, the middle of the month tends to be the quietest as the flow of information from the physical market is anemic. The initial sentiment is for prices on busheling to soften around $10 per ton in October unless a surge in demand from Turkey sucks up exports tons or domestic mills increase their purchases ahead of an expectation for an end of the year surge in production.

Again, there have been no reported trades this past week.