Prices

September 5, 2013

Iron Ore, Scrap Futures Face Uncertainties

Written by Bradley Clark

TSI Iron Ore: Prices Stay Firm, Future Is Uncertain…

After breaking through the psychological ceiling of $140/ ton a couple of weeks ago, the iron ore spot market has retreated ever so slightly to $137. While this is not necessarily an indication of a reversal in the pricing trend, it may shed light on some cracks in the markets strength to move higher in the short term.

The futures market remains backwardated with Q4 trading around $130 and calendar ’14 at $117, traders continue to price in a fall in prices. Freight rates continue strengthen which is supporting the delivered China price for ore and demand from mills seems healthy so a significant drop in iron ore prices is not a fore gone conclusion but the market today does feel a bit toppy at these levels.

Volumes on SGX remain very strong.

U.S. Midwest #1 Busheling Ferrous Scrap (AMM) Lack of Activity Prevails

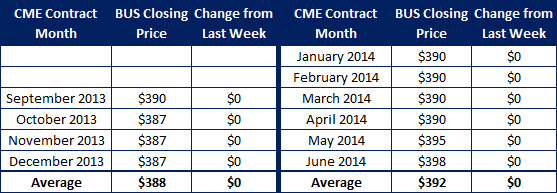

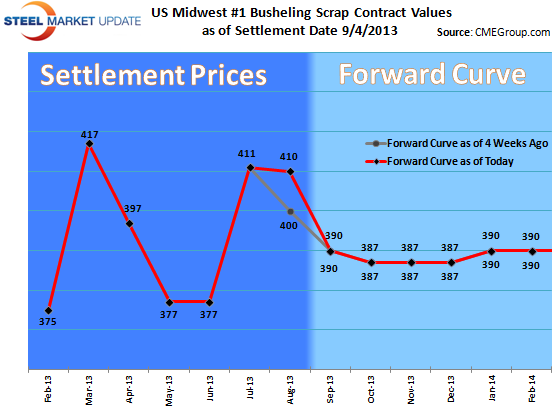

The busheling futures contract continues to struggle with liquidity as the market continues to experience low volatility. No trades have been reported the past couple of weeks and values down the curve remain unchanged with Q4 at $390, Q1 $385 and calendar Q4 $390. With the physical market looking like it will come in down $10-15 on busheling, to $395-400 the curve continues to flatten out.

It seems that the lack of volatility over the past few months has thrown cold water on the impetus for physical users to enter the futures market.

Again, there have been no reported trades this past week.