Prices

September 5, 2013

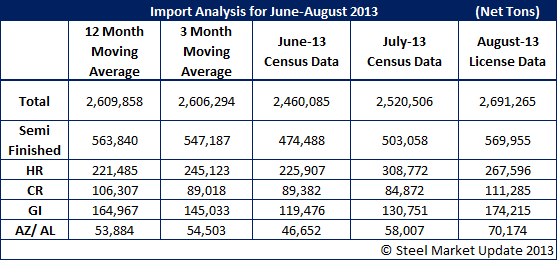

August Imports Forecast to Increase by 6.8% over July

Written by John Packard

Based on the most recent compiled license data from the U.S. Department of Commerce, total steel imports are poised to rise by 6.8 percent in August compared to the prior month. August imports are forecast to be 2,691,265 net tons which are above both the 3 month and 12 month moving averages. August imports are forecast to be up 9.5 percent compared to June imports.

When looking at semi-finished we see higher flows of slabs which we believe are due to the CSA slab mill bringing their #2 blast furnace back online and beginning to replenish the ThyssenKrupp Steel USA mill in Alabama.

Imports of all of the other flat rolled products followed by Steel Market Update on a regular basis are forecast to be higher in August than both the prior month as well as above the 3MMA and 12MMA.

What will be interesting to watch from here are the months of September and October which could be much higher on flat rolled products due to the increases in domestic steel prices which began in late May.