Product

August 26, 2013

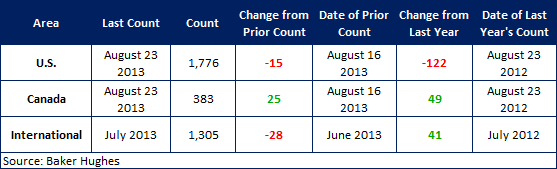

US Rig Count Down 122 and Canada Up 49 Compared to Last Year

Written by Brett Linton

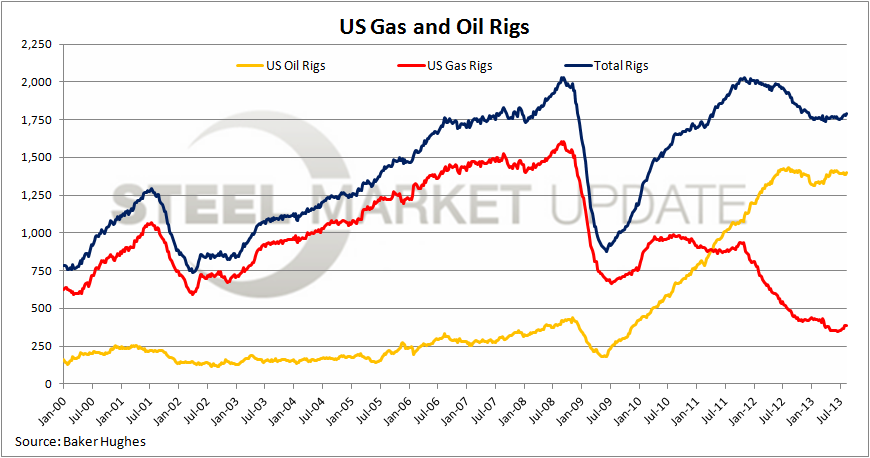

According to Baker Hughes data from August 23rd, 2013, the U.S rig count for this week is 1,776 rigs exploring for or developing oil or natural gas. This number represents a decrease of 15 rigs compared to last week, with oil rigs down 15 to 1,382 rigs, gas rigs down 1 to 387 rigs, and miscellaneous rigs up 1 to 7 rigs. Compared to last year the 1,776 count is a decrease of 122 rigs, with oil rigs down by 26, gas rigs down by 99, and miscellaneous rigs up by 3.

The Canadian rig count increased by 25 to 383 rigs this week, with oil rigs up 15 to 246 rigs, and gas rigs up 10 to 137 rigs. Compared to last year the 383 count is an increase of 49 rigs, with oil rigs down by 1 and gas rigs up by 50. International rigs decreased by 28 to 1,305 rigs last month, an increase of 41 rigs from a year ago.

The Canadian rig count increased by 25 to 383 rigs this week, with oil rigs up 15 to 246 rigs, and gas rigs up 10 to 137 rigs. Compared to last year the 383 count is an increase of 49 rigs, with oil rigs down by 1 and gas rigs up by 50. International rigs decreased by 28 to 1,305 rigs last month, an increase of 41 rigs from a year ago.