Product

August 26, 2013

Strengthening Dollar has Consequences for Steel Industry

Written by Peter Wright

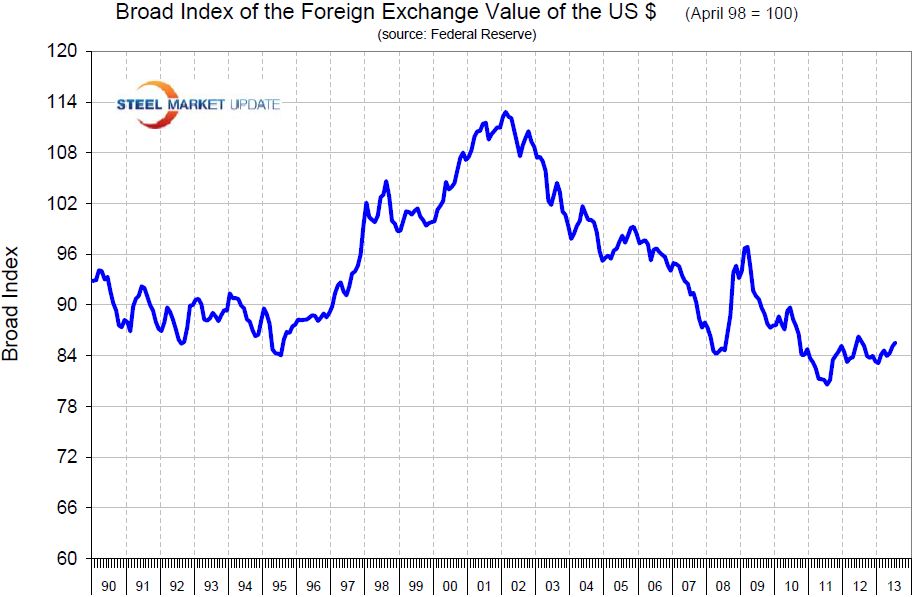

Currency update August 22nd 2013. The Federal Reserve publishes a trade weighted index of the value of the US dollar against a basket of the currencies of our major trading partners on a daily and monthly basis. This is referred to as the Broad Index.

The Broad Index appreciated strongly in the 3rd Quarter of 2011 and since then has been more stable than at any time since 1993 /1994, (Fig 1). That is not true of many of the major steel trading nations.

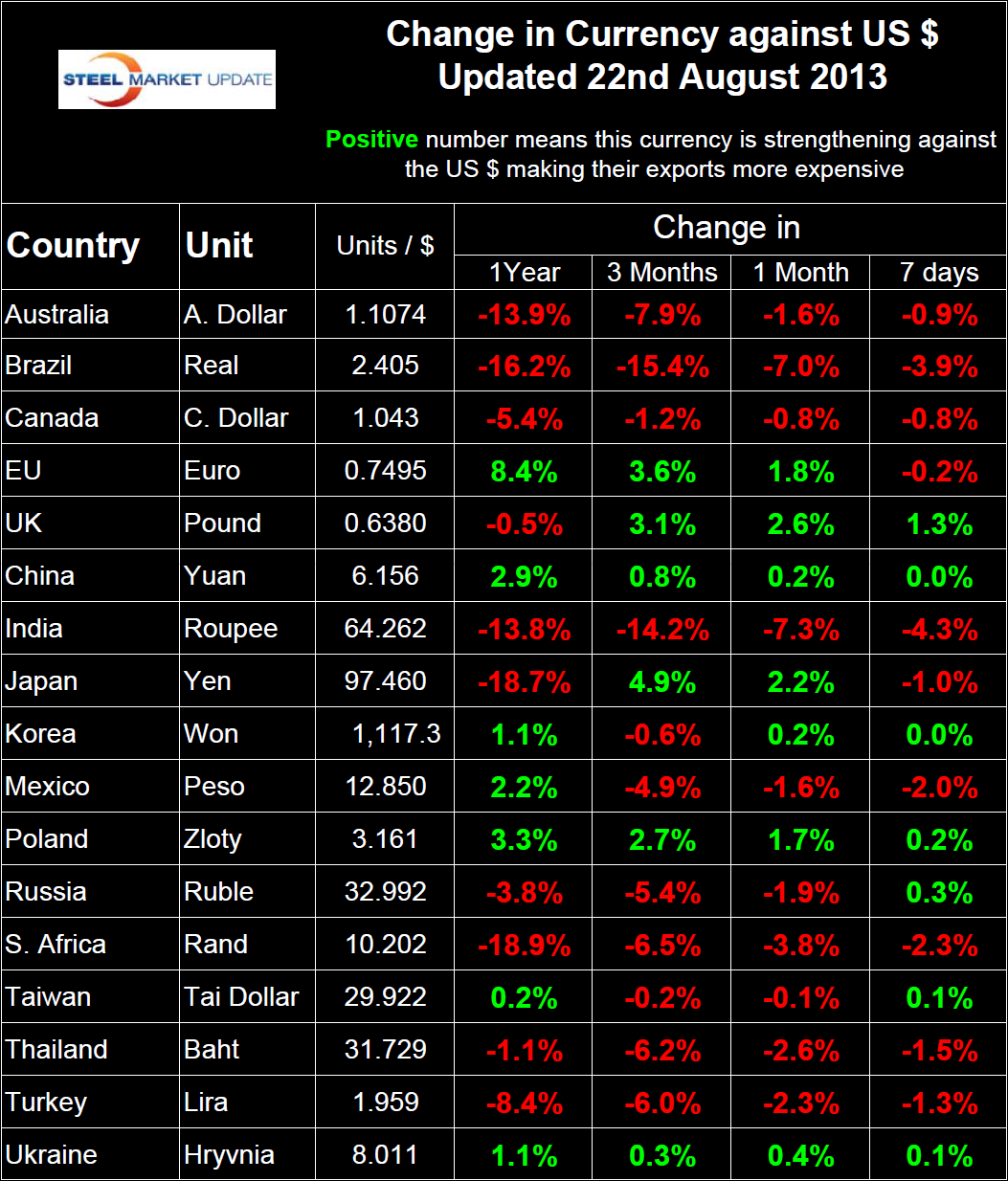

The following table shows the change in value of the individual steel trading nation’s currencies over the last year, three months, one month and seven days. Red numbers indicate that the currency is declining against the US dollar. In the last year, the currencies of Australia, Brazil, India, Japan and South Africa have all weakened by more than 13 percent against the US dollar. The most striking change this year is in the Indian Rupee which has been in free fall since May, (Fig 2). The Turkish Lira continues to be at an all time low and the Japanese Yen has stabilized at just under 100 Yen / US dollar. The Chinese Yuan continues to gradually strengthen.

The following table shows the change in value of the individual steel trading nation’s currencies over the last year, three months, one month and seven days. Red numbers indicate that the currency is declining against the US dollar. In the last year, the currencies of Australia, Brazil, India, Japan and South Africa have all weakened by more than 13 percent against the US dollar. The most striking change this year is in the Indian Rupee which has been in free fall since May, (Fig 2). The Turkish Lira continues to be at an all time low and the Japanese Yen has stabilized at just under 100 Yen / US dollar. The Chinese Yuan continues to gradually strengthen.

Implications for steel are that the depreciation of the Australian dollar and the Brazilian Real will make iron ore cheaper on the global market as measured in US Dollars. Goldman Sachs is forecasting an iron ore price of $80 / tonne for 62% Fe delivered north China in 2015. Most US steel exports are destined for our NAFTA partners; the US dollar has strengthened against both the Canadian dollar and the Mexican Peso in the last three months. The Canadian dollar is down by 5.4 percent in the last year. On the global market a US dollar that is stronger against a local currency makes the U.S. a more attractive export destination for their steel products.