Product

August 22, 2013

Hot Rolled Futures: Now Where To?

Written by Andre Marshall

Financial Markets:

When I last wrote, I mentioned that the SP 500 was likely headed to 1720 before a retracement and then an eventual rally up the 1775 zone. Well the SP 500 reached 1709 on August 2nd from which we have since retraced to 1640 yesterday. We settled today at 1657. In this retracement , it looks like we are headed to test the 1550 support zone before we can climb again in earnest. I’m sure you have all heard that the 10 yr treasury has been coming off in the last few weeks in anticipation of Bernanke’s easing of the purchasing program – that schedule for easing was reiterated yesterday by the FOMC notes, where it reflected full support from all members. This is the root cause of the uncertainty in the stock market. So when we reach 1550 don’t think by any means that that support is not susceptible to being broken, particularly if the bond market erodes further. The 10 year treasury yield was at 2.587% at the time of the last Fed meeting at the end of July, we have since reached a 3.10% high to settle last at 2.90% today. A quarter point increase in the yield doesn’t seem like a lot unless it’s just enough to stop that buyer from taking that mortgage or that new car. It is certainly going to have an effect on buyer behavior. Results from Costco and Walmart and the like may well already be reflecting that waning appetite in this higher interest rate, higher tax , sequester environment.

Copper and Crude have rallied in the last few weeks as money has flowed further into US denominated assets on that back of serious weakening of emerging market currencies, eg. Indonesia, Turkey just to name a couple. This despite a Euro rally that is seen as a retracement move on the back of somewhat encouraging growth data out of France and Germany. Most feel that bear trend is still intact there as Europe will continue to struggle with zero growth. In these few weeks Copper and Crude have both moved up approximately 10.75% and 13.25% respectively since June 24th. Clearly Egypt’s turmoil has caused some of the concern in crude, but as you can see in Copper there is an underlying interest in USD denominated currencies. China has helped, proving to be better in the July period for economic growth, but not as yet determined to be a trend. The commodity markets, ferrous included, are waiting to see if China economic activity really is improving, or if we have simply seen some inventory replenishment on the back of future economic hopes. Iron Ore beware. Concern persists in this area as despite the increase in some finished metal purchases in China there does not seem to be any real appetite for scrap (ferrous or or non-ferrous), and that would not compute with a legitimately growing economy there.

Steel:

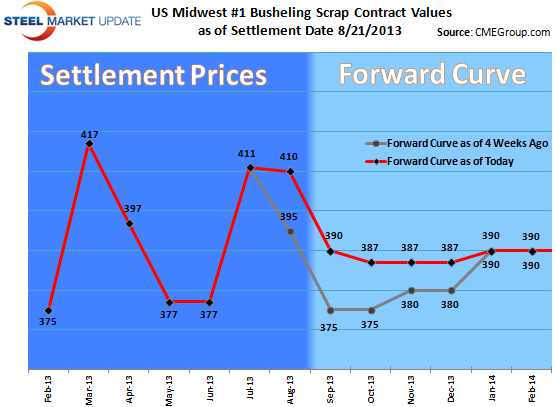

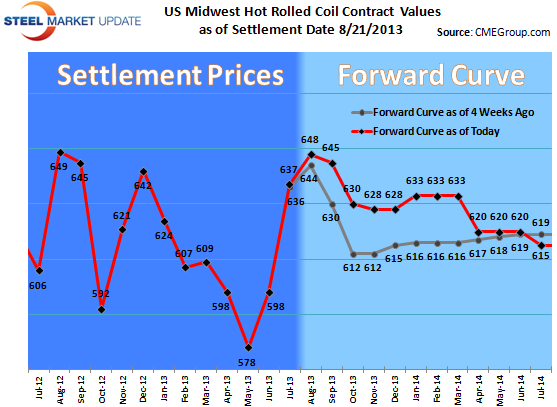

We have had a quiet week in futures in steel with 665 lots or 13,300 ST trading. The prices have not changed a whole a lot in a week as of yesterday’s close except for a $3/ST increase in Q1 and slightly higher levels in August through October, up by $2-3/ST. Interest is coming in on the forwards albeit light. I think the fact that the forwards are below the spot price has some buyers deciding to look at layering in a little bit. The CRU printed $651/ST which is essentially sideways from last the last two prints at $647/ST and $649/ST. Anecdotal info. from the field suggest some mills are offering lower, $630-640/ST and even more interesting levels on finished products. Interesting as finished products have had historically the longer lead times of late, that might be changing due to the various BoF issues at various mills which has kept HR prices firmer than expected. Similar story again of some with good orders while others now looking to fill holes. Demand appears to continue to be consistently tepid while supply is ramping back up. We are now 13weeks into this upward cycle with $85/ST plus of increases, not a bad run.

p=

Scrap:

CFR Turkey finally traded Q4 $370/MT in the last week plus. Market is offered slightly above. The spot index has stabilized at $379/MT with expectations that Turkish demand steel should improve a bit, but not clear if enough to keep scrap prices where they are, particularly as the Lira has continued to appreciate. Exports have been quiet in the last week. The appreciating currency may be in part to blame. The last cargoes went off our East coast between $377-383/MT cfr. More than likely that next buys will be lower when they show up.

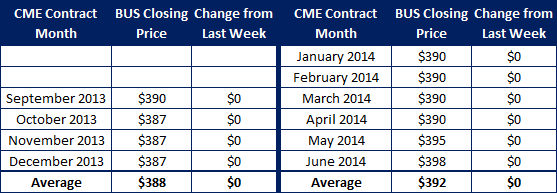

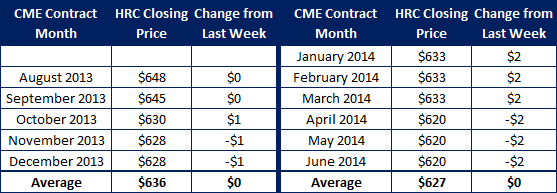

In BUS, we are tradeless this week, but we continue to get inquiries from both buyers and sellers on the curve. On the spot, consensus seems to be calling for down $5-15/T for shred and maybe almost as much on Bush where dealers will miss out on sales to shred if insist on the premium spread with Mini’s. In August the Bush contract settled $409+ while Shred settled $368+ or a hefty $41/GT differential. In the coming month, if Shred is indeed down $10/GT then we should see Bush get pulled down a bit harder to narrow that spread or at least maintain it. Mid West has been lower than the Ohio valley for some months now for primes, it will be interesting to see if that trend continues now that supply disruption issues and Republic steel’s entry are now complete.

Iron Ore:

The Chinese restocking of Ore has proved impressive in price discovery with Iron Ore reaching $142/MT. We have since retraced to $137/MT area. Depending on the view, some think the price will either be stable for a few more weeks or start to retrace sooner as the mills restocking comes to fruition. Steel capacity continues to run at historically high levels and everyone continues to marvel at the objective here of such production in an an environment of what must be somewhat reduced demand. For now the inventory re-stocking has provided a significant price move, and direction form here is clearly concerning as questions continue about the real health of China’s economy. The market remains in a healthy backwardation with Aug ’13 either side of $136/MT, Sep ’13 either side of $133/MT, Q4 either side of $129/MT, Q1 ’14 either side of $126/MT and Cal ’14 either side of $117/MT.