Product

August 20, 2013

Global Steel Production in July 2013

Written by Peter Wright

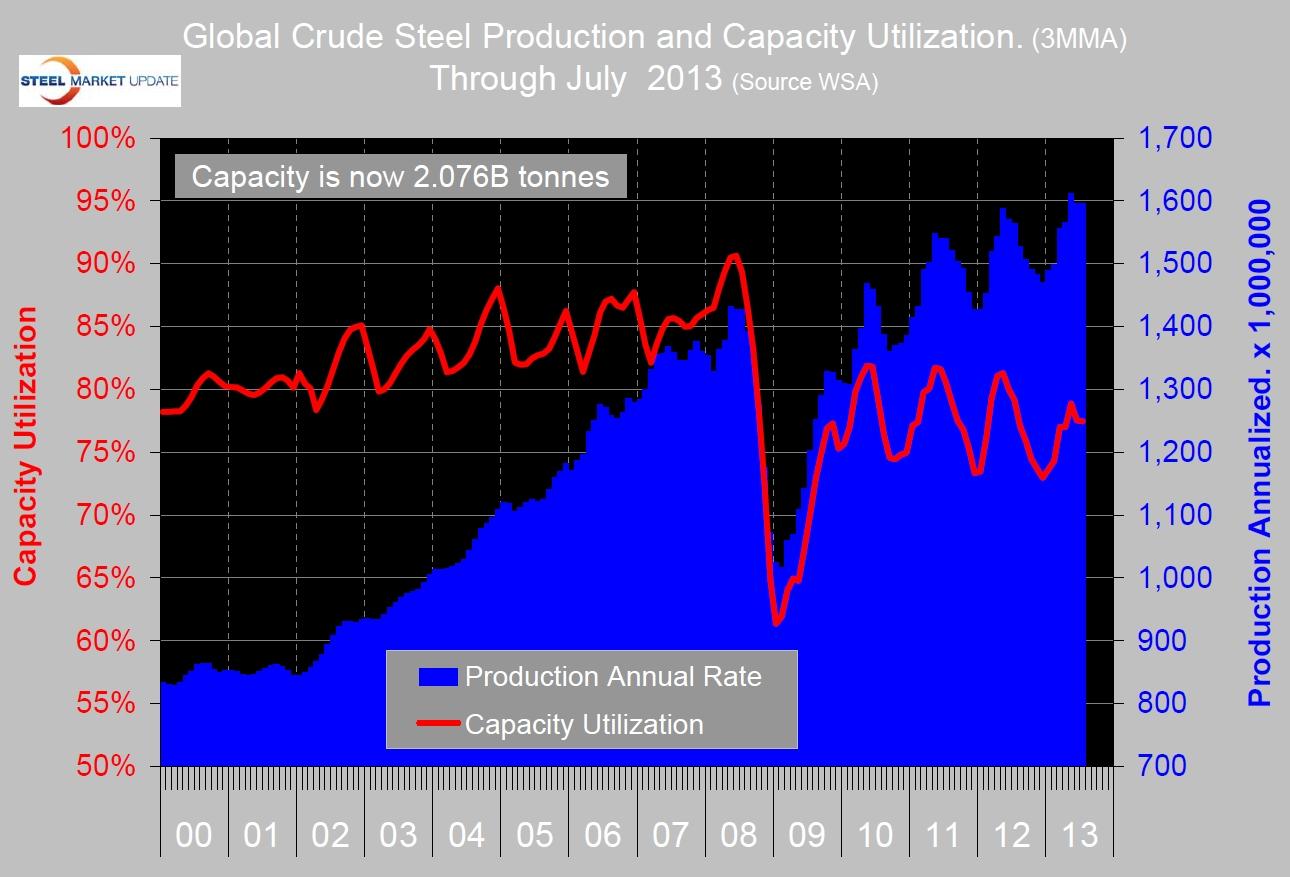

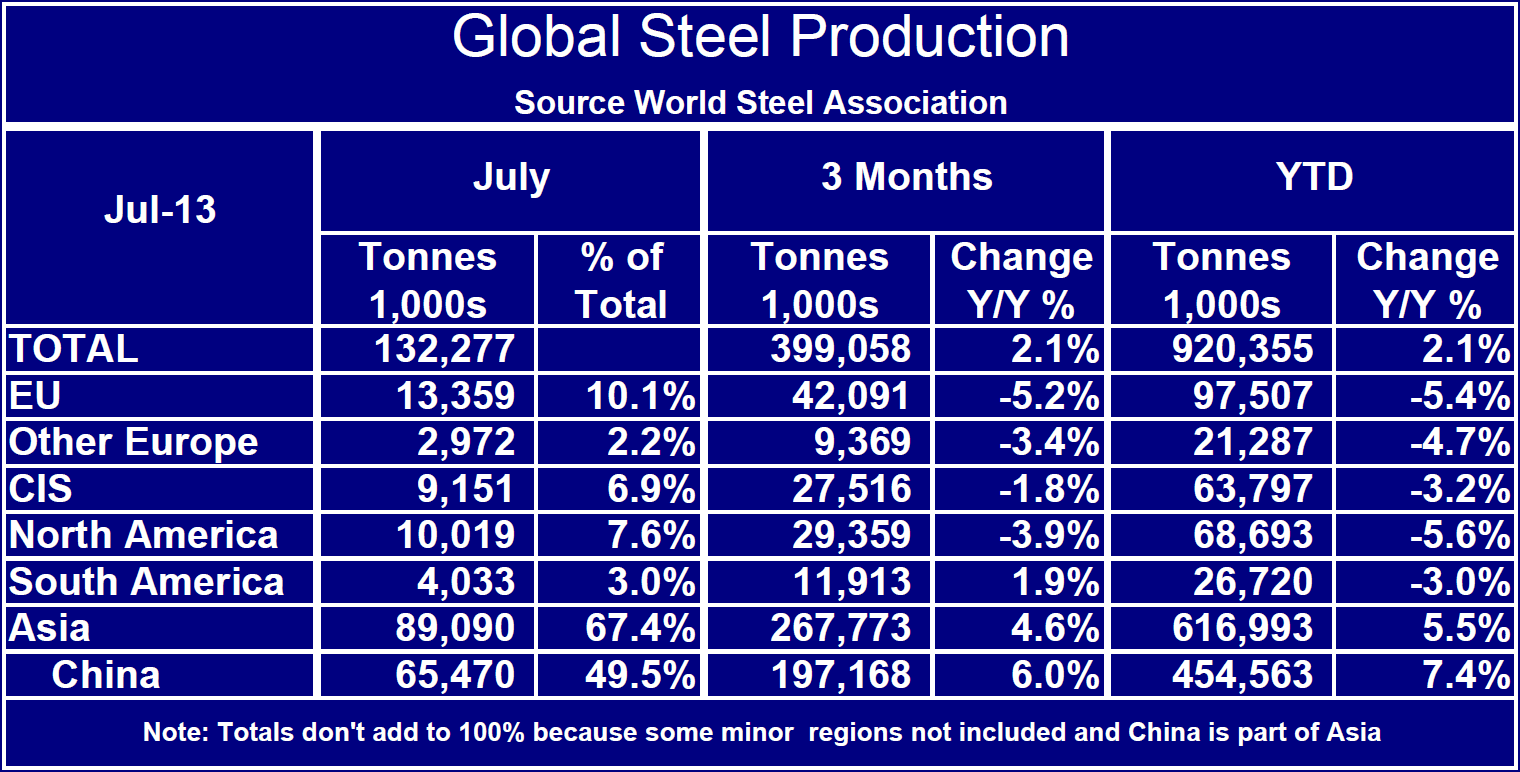

The three month moving average of global production in July was unchanged from June at an annual rate of 1.596 billion tons. Capacity utilization was 77.5 percent (Figure 1). For the July data, the World Steel Association increased the global capacity to 2.06 billion tons which reduced the capacity utilization value back to Q3 last year. Year to date global production through July was up by 2.1 percent from 2012. All regions declined except Asia which increased by 5.5 percent. All the reporting nations in Asia increased except South Korea which was down by 5.3 percent. China was up by 7.4 percent (Table 1). This is a continuation of recent trends with no surprises. China now accounts for 49.4 percent of global steel production which intuitively seems unsustainable.

George Friedman of Stratfor wrote about the unsustainability of Chan’s economic growth on July 23rd and had this to say:

The New York Times, Barons and Goldman Sachs are all both a seismograph of the conventional wisdom and the creators of the conventional wisdom. Therefore, when all three announce within a few weeks that China’s economic condition ranges from disappointing to verging on a crash, it transforms the way people think of China. Now the conversation is moving from forecasts of how quickly China will overtake the United States to considerations of what the consequences of a Chinese crash would be.

For China’s economic growth to continue at the past level, China had to maintain its wage differential indefinitely. But China had another essential policy: Beijing was terrified of unemployment and the social consequences that flow from it. This was a rational fear, but one that contradicted China’s main strength, its wage advantage. Because the Chinese feared unemployment, Chinese policy, manifested in bank lending policies, stressed preventing unemployment by keeping businesses going even when they were inefficient, (Excess steel capacity). China also used bank lending to build massive infrastructure and commercial and residential property. Over time, this policy created huge inefficiencies in the Chinese economy. Without recessions, inefficiencies compound and will eventually drag down the economy.

The obvious economic impact on the rest of the world will fall on the producers of industrial commodities such as iron ore. The extravagant expectations for Chinese growth will not be met, and therefore expectations for commodity prices won’t be met. Since the Chinese economic failure has been underway for quite awhile, the degradation in prices has already happened. Australia in particular has been badly hit by the Chinese situation, just as it was by the Japanese situation a generation ago.

The SMU perspective on this is that we inescapably live in a global economy and the US steel industry is at the mercy of those nations that manipulate their currency and support excess and/or inefficient production. This is why we track and report trade and currency values continuously to enable our subscribers to be proactive in managing their businesses.